Candlestick analysis

Candlestick analysis is the best tool for doing a detailed short term volume analysis. Candlesticks help identify signals before they appear in the price chart, as well as assist with short term timing and setting limits. Candlesticks also strengthen or weaken more long term trend signals.

The Candlestick graphs

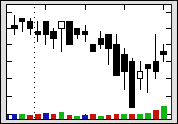

You switch the candlestick graphs on and off by clicking the ![]() button. The graphs show short term details in the price chart. Opening price, low and high prices are stated in addition to closing price. You can also study volume details and the connection between volume and price changes.

button. The graphs show short term details in the price chart. Opening price, low and high prices are stated in addition to closing price. You can also study volume details and the connection between volume and price changes.

About Candle formation

The rectangle section of the candle line is called the Real body. Thin lines above and below the real body are called Shadows. These shadows represent the session’s price extremes. The shadow above the real body is called the upper shadow, and the shadow below is called the lower shadow. Accordingly, the peak is the high of the trading session and the bottom is the low.

When the closing price is higher than the opening, we get a white real body.

When the price closes below the open, we get a black real body.

Volume is plotted with one column per day. The column is green if the closing price was higher than the day before. It is red if the closing price fell, and blue if there was no change.

Volume is plotted with one column per day. The column is green if the closing price was higher than the day before. It is red if the closing price fell, and blue if there was no change.

Volume analysis with Investtech’s candlesticks

In short term volume analysis we study what volume is like on days when the price rises and on days when the price falls. Investtech’s candlesticks are very good tools for this analysis, especially due to the colour coded volume columns.

The main rules are:

- Tall green volume columns and low red ones indicate rising prices.

- Tall red volume columns and low green ones indicate falling prices.

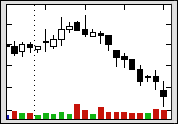

Positive

Positive

High volume on rising prices indicates that optimism is increasing and many investors pay more to acquire stocks. Low volume on falling prices indicates that few investors will reduce the price in order to sell, and that they are comfortable keeping the stock. This is positive and indicates further rise.

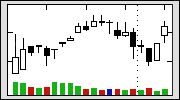

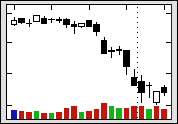

Negative

Negative

High volume on falling prices indicates that uncertainty is on the increase and that many investors will reduce the price in order to get rid of their stocks. Low volume on rising prices indicates that few investors will pay more to be able to acquire the stock, and that they are not very interested or they assume they will be able to get the stocks more cheaply later. This is negative and indicates further fall.

Please note the tall red volume columns in the chart on the left, combined with the low green columns. This is evident already in the first half of the chart. Volume balance was negative and gave a good warning of the falling prices to come.

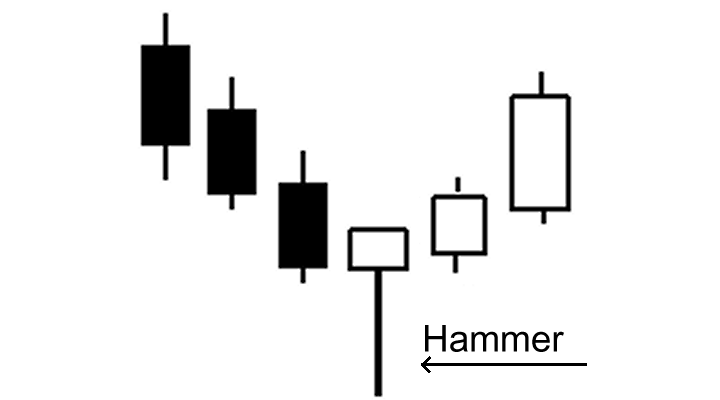

Find buy opportunities with candlestick patterns

Traditionally, candlestick analysis is used to identify short-term purchase and sale signals. By identifying candle patterns, one can understand something about the change in optimism or pessimism among investors. Thus, one can also predict whether stock prices are going to go up or down for the next few days. Such signals provide good opportunities to enter in or get out of the market at favorable times.

Read more about Candlestick patterns here.

Read more about Candlestick patterns here.

At what time of day should trading be done?

Sometimes buyers and sellers of a stock are active at different times of day.

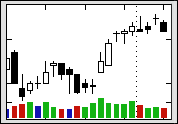

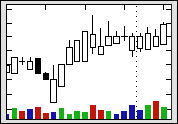

Price rises throughout the day

Price rises throughout the day

The figure shows a stock that sees few buyers in the morning, but many sellers. Such stocks open low and rise during the day. The candlestick graph shows this in a glance, as almost all the price columns are white.

- A stock with a large majority of white candlesticks should be bought in the morning and sold in the evening.

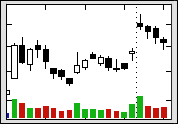

Price falls throughout the day

Price falls throughout the day

The figure shows a stock that sees few buyers in the evening, but many sellers. Such stocks fall during the day and close low. The candlestick graph shows this in a glance, as almost all the price columns are black.

- A stock with a large majority of black candlesticks should be bought in the evening and sold in the morning.

Die Anlageempfehlungen werden von Investtech.com AS ("Investtech") ausgearbeitet. Investtech übernimmt keine Haftung für die Vollständigkeit oder Richtigkeit der jeweiligen Analyse. Ein etwaiges Engagement aufgrund der aus den Analysen resultierenden Empfehlungen/Signale erfolgt zur Gänze für Rechnung und Risiko des Anlegers. Investtech haftet nicht für Verluste, die sich direkt oder indirekt infolge der Nutzung von Investtechs Analysen ergeben. Angaben zu etwaigen Interessenkonflikten gehen stets aus der Anlageempfehlung hervor. Weitere Informationen zu Investtechs Analysen finden Sie unter disclaimer.

Die Anlageempfehlungen werden von Investtech.com AS ("Investtech") ausgearbeitet. Investtech übernimmt keine Haftung für die Vollständigkeit oder Richtigkeit der jeweiligen Analyse. Ein etwaiges Engagement aufgrund der aus den Analysen resultierenden Empfehlungen/Signale erfolgt zur Gänze für Rechnung und Risiko des Anlegers. Investtech haftet nicht für Verluste, die sich direkt oder indirekt infolge der Nutzung von Investtechs Analysen ergeben. Angaben zu etwaigen Interessenkonflikten gehen stets aus der Anlageempfehlung hervor. Weitere Informationen zu Investtechs Analysen finden Sie unter disclaimer.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices