Momentum and RSI

RSI is an often used indicator in technical analysis. RSI means Relative Strength Index, and it measures how well a stock has performed compared to itself. The figure is calculated by looking at the strength of days with rising prices compared to strength of days with falling prices over a certain period of time and it gets a value between 0 and 100.

A stock that has risen a lot compared to reactions back during this time, will have high RSI. Similarly a stock that has fallen a lot compared to reactions back, will have low RSI. RSI is used as an indicator of whether a stock is oversold or overbought, and if it has positive momentum or negative momentum.

RSI can indicate that:

- This stock has risen a lot in a short time. Optimism is increasing and further rise is indicated.

- This stock has fallen a lot in a short time. The investors are becoming more pessimistic and will continue to reduce prices to get out of the stock.

Many investors also think that RSI indicates whether a stock has risen or fallen too much and will react back. Investtech’s research shows that this overbought and oversold interpretation is statistically not true.

Read the research report on RSI here.

RSI as overbought/oversold indicator

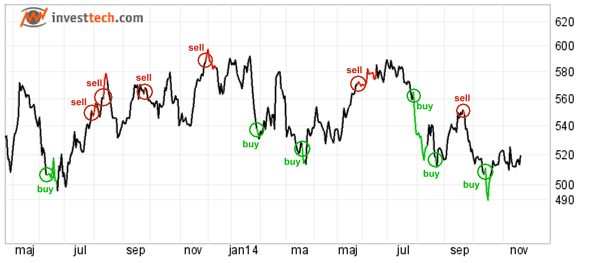

A stock is overbought when it has risen a lot in a short time, without any significant reactions back during the time period. The idea is that it has risen too much and will have a reaction back soon, indicating that it is time to sell the stock. Similarly a stock is oversold when it has fallen a lot in a short time. This may indicate that it will have a reaction up soon and should be bought before then. See example below.

Figure 1: RSI21 in Carlsberg B. Green areas show oversold RSI (below 30) and red areas overbought RSI (above 70).

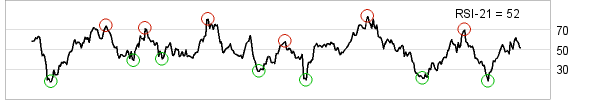

RSI as momentum indicator

RSI is also used as a momentum indicator. The idea is that major price movements indicate that the investors as a group are in motion. It is thought necessary to join the early movements, as even more investors will join later and drive the price further in the same direction. See example below.

Figure 2: RSI21 in D/S Norden. Red areas show high momentum and positive (RSI above 70) and green areas show high momentum and negative (RSI below 30).

High positive momentum and overbought

RSI above 70 shows strong positive momentum in the stock. The stock has risen in the short term, with few reactions downwards. Investors have continued to pay more to buy stocks. This indicates that more buyers are entering the stock and that the price will continue to rise.

RSI above 70 shows strong positive momentum in the stock. The stock has risen in the short term, with few reactions downwards. Investors have continued to pay more to buy stocks. This indicates that more buyers are entering the stock and that the price will continue to rise.

RSI above 70 used to be considered a sign of danger. These stocks were said to be overbought and it was assumed they would soon see a reaction down. However, Investtech’s research shows that these stocks have continued to rise, in fact more so than the market.

The following applies to high RSI:

- Indicates short term strength

- Indicates that investors are positive and that the price will continue to rise

- Many investors think this is a negative signal, but our research shows it is clearly positive

In general we want high RSI, i.e. strong short term momentum, for stocks we own or are going to buy. It can be a psychological challenge to buy such stocks, since they have already risen quite a bit and may seem expensive. However, high RSI indicates that more investors are buying and that the rise will continue.

Investtech Research: High positive momentum and overbought

Stocks with these positive signals have on average outperformed the market in the following months. Annualised excess return has been 7.4 percentage points (pp). This is significantly better than benchmark.

| Annualised return (based on 66-day figures) | |

| Positive signals medium term | 17.1% |

| Reference index | 9.7% |

| Excess return | 7.4pp |

The research results are based on 35864 signals from Nordic stocks in the period 2008-2020.

Read more

- Research Report: RSI - Relative Strength Index – signal statistics for the Nordic markets, 1996 to 2018 (Required access level: PRO)

- Research Article: RSI is a good momentum indicator

- Research Article: Buy signals: Strong positive momentum: Research results 2021-2023

- Research Report: Investtech-forskning: RSI - Relative Strength Index - signalstatistikk nordiske markeder 2019 og 2020 (Required access level: PRO)

- Research Article: Investtech-forskning: Høy RSI var et godt kjøpssignal under koronapandemien

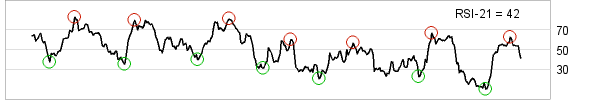

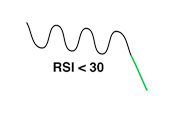

High negative momentum and oversold

RSI below 30 shows strong negative momentum in the stock. The stock has fallen a lot in a short time, without significant reactions upwards. Investors keep reducing the price to sell their stocks. This indicates that investors are leaving the stock, pessimism is increasing and the price will continue to fall.

RSI below 30 shows strong negative momentum in the stock. The stock has fallen a lot in a short time, without significant reactions upwards. Investors keep reducing the price to sell their stocks. This indicates that investors are leaving the stock, pessimism is increasing and the price will continue to fall.

RSI below 30 used to be considered a good buy opportunity. These stocks were oversold, having fallen a lot in a short time. The theory said they would soon see a reaction upwards. However, Investtech’s research shows that these stocks have clearly underperformed compared to the market.

The following applies to low RSI:

- Indicates short term weakness

- Indicates negative investors and that prices will continue to fall

- Many investors think it is a positive signal, but our research shows it is clearly negative

Stocks with low RSI have negative momentum and our research shows you should stay away from such stocks. It may be tempting to buy such stocks, because they have fallen a lot and seem cheap. However, low RSI indicates increasing pessimism and that the price will continue to fall.

Investtech Research: High negative momentum and oversold

Stocks with these negative signal have on average underperformed compared to benchmark in the following months. Annualised negative excess return has been 5.7 percentage points (pp). This is significantly weaker than benchmark.

| Annualised return (based on 66-day figures) | |

| Negative signal medium term | 6.1% |

| Reference index | 11.7% |

| Excess return | -5.7pp |

The research results are based on 24920 signals from Nordic stocks in the period 2008-2020.

Read more

- Research Report: RSI - Relative Strength Index – signal statistics for the Nordic markets, 1996 to 2018 (Required access level: PRO)

- Research Article: RSI is a good momentum indicator

- Research Article: Sell signals: Strong negative momentum. Research results 2021-2023

- Research Report: Investtech-forskning: RSI - Relative Strength Index - signalstatistikk nordiske markeder 2019 og 2020 (Required access level: PRO)

- Research Article: Investtech-forskning: Høy RSI var et godt kjøpssignal under koronapandemien

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices