Head and shoulders formations have low predictive power in the short term

Published 14 November 2017

Inverse/ head and shoulders formations in Investtech's short term charts have low predictive power. This is shown in a research report from Investtech based on 19 years of data from the Oslo Stock Exchange in Norway.

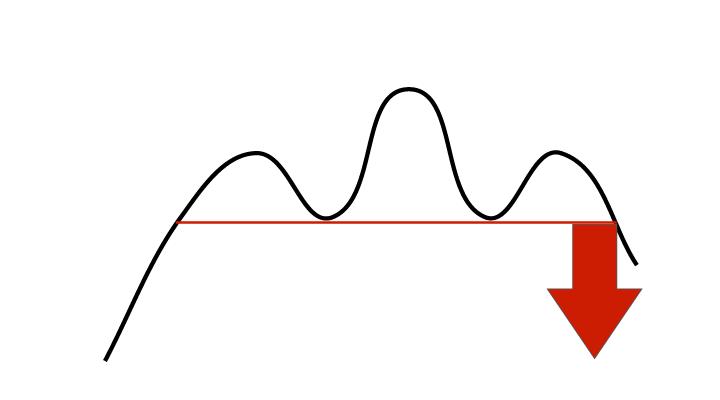

A head and shoulders formation is a top formation which marks the end of a rising period. The formation consists of a left shoulder, a head and a right shoulder, connected by a neckline, see figure 1. The creation of a head and shoulders formation indicates increasing pessimism among investors and the start of a falling trend. Such formations are considered among the most reliable signals in technical analysis. They are primarily used to predict reversals in long term market trends, but can also be used in the shorter term.

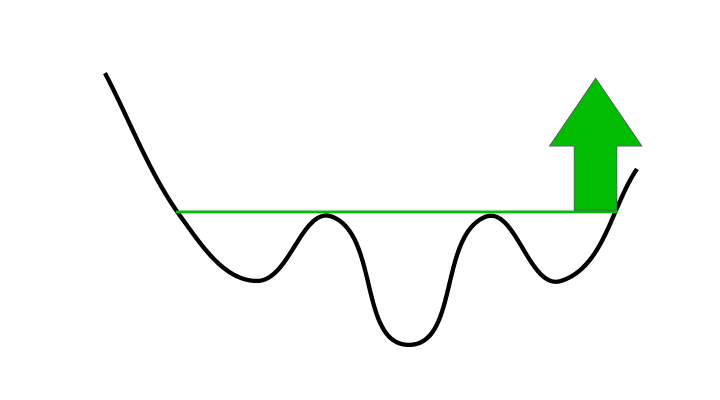

This formation also exists in the opposite direction, as an inverse head and shoulders formation, see figure 2. This is a bottom formation which marks the end of a falling period. An inverse head and shoulders formation signals increasing optimism among investors and the start of a rising trend.

Figure 1: Sell signal from head and shoulders formation.

Figure 2: Buy signal from inverse head and shoulders formation.

In technical analysis terminology we say that a break downwards through the neckline of a head and shoulders formation triggers a sell signal. Similarly a break up from an inverse head and shoulders formation triggers a buy signal.

We have studied the price movements following buy and sell signals from such formations on the Oslo Stock Exchange in Norway.

Investtech's computers identified a total of 659 buy signals and 777 sell signals in the period 1996 - 2014.

Figure 3: Price development after buy and sell signals from inverse/ head and shoulders formations on the Oslo Stock Exchange identified by Investtech’s automatic algorithms in short term price charts. Click the image for bigger version.

The chart shows average price development following short term buy and sell signals from inverse/ head and shoulders formations. The signals are triggered on day 0. Only days when the exchange is open are included, so 66 days equal approximately three months. Buy signals are the blue line and sell signals are the red one. The shaded areas are the standard deviation of the calculations. Benchmark index is the black line.

Figure 3 shows that stocks with buy signals and stocks with sell signals both have an average development in line with average benchmark for the first 30 days following the signal. Deviations from benchmark until day 66 following the signals were so small that they are not significant based on statistical t-value.

More details and results are available in the research report here >>.

Keywords: Buy signal,Head and shoulders formation,Inverse head and shoulders formation,Oslo Stock Exchange,Sell signal,short term,statistics.

Written by

Head of Research and Analysis

at Investtech

"Investtech analyses the psychology of the market and gives concrete trading suggestions every day."

Partner & Senior Advisor - Investtech

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices