Global stocks: Defensive stocks - 2 buy and 1 sell

Published November 14, 2018

Webinar today

Join our free online webinar today . Analyst Kiran Shroff and Country Manager Jan Marius van Leeuwen will give an introduction to Investtech's analyses and present stock picking tools & strategies.

The last couple of weeks have been choppy for most of the international stock markets, with UK FTSE 100 swinging between 7140 and 6940 points, US index S&P 500 shuffling between 2815 and 2640 points and India based Nifty 50 index trading between 10600 and 10000 points.

Consequently, in the shorter term, it is not easy to determine which direction world indices may go, but most of them have broken below their uptrend channels in the medium term charts and are waiting for the next course of action which will eventually be first reflected in the short term chart.

To bring down uncertainty in the market, companies like FMCG, Pharma and Logistics help tide over market volatility. They are considered defensives, as traders and investors use them as a hedge to safeguard their portfolios from major downside. But company internals are equally important. If a company is not doing very well from inside, it may turn out to be a poor investment irrespective of market direction.

We look at three international stocks today, two FMCG and one Pharma and Health Care.

Astrazeneca Plc (AZN.US) Close: 41.49

Headquartered in UK, listed on both US and UK stock exchanges, the Anglo–Swedish multinational pharmaceutical company ASTRAZENECA PLC is inside a rising trend channel in the medium term. This signals increasing optimism among investors and that the company's prospects continue to be promising in the coming future.

Headquartered in UK, listed on both US and UK stock exchanges, the Anglo–Swedish multinational pharmaceutical company ASTRAZENECA PLC is inside a rising trend channel in the medium term. This signals increasing optimism among investors and that the company's prospects continue to be promising in the coming future.

The stock price has given a new buy signal from a rectangle formation and a break up through the resistance at 40.39 dollars. Further rise to 43.45 dollars or more is signaled. The stock has support at 39.70 and 37 dollars respectively.

Investtech's outlook (one to six months): Buy

Procter & Gamble Compa (PG.US) Close: 93.47

Procter & Gamble Company has broken up through the ceiling of the rising trend channel in the medium term. According to Investtech's research analysis done in four Scandinavian markets, average price development for shares with breakouts from the rising medium-term trend has yielded a weighted average of 3.3 % excess return compared to index on an annual basis. It indicates a strong further price development in that stock.

Procter & Gamble Company has broken up through the ceiling of the rising trend channel in the medium term. According to Investtech's research analysis done in four Scandinavian markets, average price development for shares with breakouts from the rising medium-term trend has yielded a weighted average of 3.3 % excess return compared to index on an annual basis. It indicates a strong further price development in that stock.

This recent price move of this world renowned FMCG company has been supported by high volume, which suggests that buyers have been aggressive while sellers were passive. Also the momentum indicator RSI is above 70 and is at a multi-month high. It indicates rising optimism among investors and further rise in stock price.

Procter & Gamble Company may have some resistance around 94.40 dollars, which is its earlier top. A close above that level will be a new buy signal and the stock would continue to rise. There is support between 92.40 and 86.00 dollars.

Investtech's outlook (one to six months): Buy

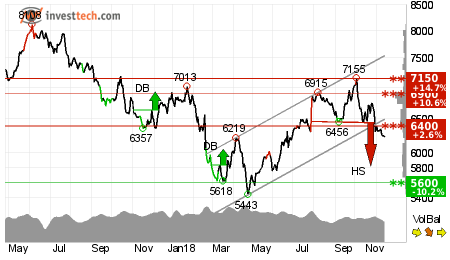

RECKITT BENCKISER GROU (RB.L) Close: 6236.00

RECKITT BENCKISER GROUP PLC has broken the floor of the rising trend channel in the medium term, which indicates a weaker initial rising rate. It also gave a negative signal from a head and shoulders formation and broke the support at 6400. Further fall to 5815 or lower is signaled. The Consumer Defensive stock chart shows that the next support is around 5600 pence.

RECKITT BENCKISER GROUP PLC has broken the floor of the rising trend channel in the medium term, which indicates a weaker initial rising rate. It also gave a negative signal from a head and shoulders formation and broke the support at 6400. Further fall to 5815 or lower is signaled. The Consumer Defensive stock chart shows that the next support is around 5600 pence.

RSI below 30 shows that the momentum of the stock is strongly negative in the short term. It suggests that investors has pressed down the price to be quit of their holdings. This indicates increasing pessimism and continued falling prices.

The stock has resistance at 6400 levels.

Investtech's outlook (one to six months): Sell

The analyses are based on closing price as per November 13, 2018.

Note: These instruments are traded in currency based on the exchange or country they are listed on.

Written by

Analyst - Investtech

"Investtech analyses the psychology of the market and gives concrete trading suggestions every day."

Partner & Senior Advisor - Investtech

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices