Global stocks: Two buy and one sell among US consumer packaged goods

Published March 06, 2019

More and more people are moving towards packaged goods. Consumption is high and customers use up and replace items such as food, beverages, cosmetics and cleaning products very quickly and easily. It does not take much time for consumers to decide on one brand over another. Hence competition is not easy, especially when there are so many substitutes present in the market.

In the consumer packaged goods (CPG) space, we choose to write about three well known brands that have been in the market for a very long time now and are tough competitors, or you can say the one's loss is the other's gain.

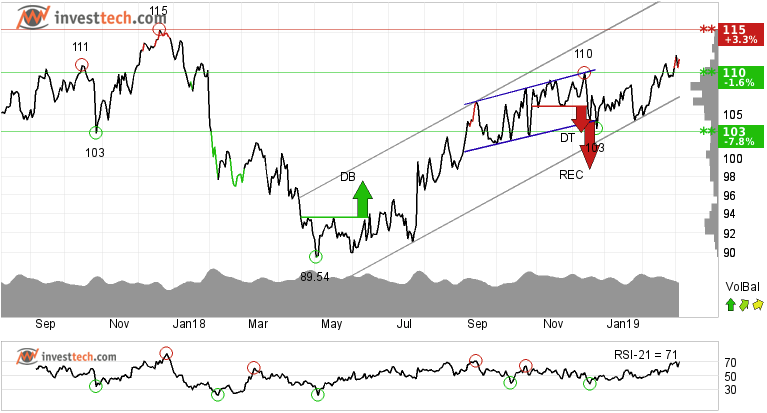

Hershey Foods Corp (HSY.US500) Close: 111.75

Hershey Foods Corp shows strong development within a rising trend channel in the short, medium and long term charts. This signals increasing optimism among investors and indicates continued rise.

The stock had given a false break down from a rectangle and a double top formation and reversed back from 103 dollars which is now established as support. It managed to break above the 110 level on high volume in the past few days. Also the momentum is rising with RSI above 70. These positive indicators add up to the positive development in the stock. However, there is resistance around 115 dollars both in the medium and longer term chart. Hence one must be conscious, but if the stock price manages to close and stay above that level, it will explore a new territory and may go higher. The stock is overall assessed as technically positive for the medium term.

Investtech's outlook (one to six months): Buy

Mondelez International (MDLZ.US500) Close: 46.93

Mondelez International Inc. Cl A has broken up from an approximate horizontal trend channel both in the medium term and for the first time in four years in the long term. This shows that investors have faith in the stock and expect the price to go up even more.

A buy signal was triggered when the stock broke out from a rectangle formation through the resistance both in the medium and longer term chart. A target of 53.00 - 55.75 is given, however, the stock can go even higher. On the downside there is support around 43.90 and 39.50 dollars if one wants to take more risk. The stock is overall assessed as technically positive for the medium to long term.

Investtech's outlook (one to six months): Buy

Kellogg Company (K.US500) Close: 54.77

Unlike the other two companies mentioned above, Kellogg Company stock is trading at its multi-year low. The stock is inside a falling trend channel and has now broken under its support of 56.80 dollars. Further fall is anticipated.

Negative volume balance shows that volume is higher on days with falling prices than days with rising prices. It suggests that sellers have been in charge lately and are constantly selling the stock at a lower price.

There is no clear support visible in the stock on the medium and long term charts, so the downfall can be huge. But if the stock manages to revert back, there is resistance around 56.80-58.40 dollars in the short term. A change in trend can only be visible if the stock turns around and manages to close and trade above 61.50 dollars.

Investtech's outlook (one to six months): Sell

The analyses are based on closing price as per March 6, 2019

Note: These instruments are traded in currency based on the exchange or country they are listed on.

Written by

Analyst - Investtech

"Investtech analyses the psychology of the market and gives concrete trading suggestions every day."

Partner & Senior Advisor - Investtech

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices