Today's Case Germany - results 2003-2013

Published 2014-01-17

Investtech has analysed the German market since year 2000. Since May 2003, our computers have selected Today's Case from among the Dax30 companies and also the broader CDax, and presented the selected stocks to our subscribers.

We have now calculated statistics for this past decade, looking at how the recommendations have performed.

The Data Set

Overall Investtech presented 1,969 positive candidates as the Daily Case on the Dax30 and 2,620 on the CDax in the time period May 2003 to December 2013. The Dax30 Cases are big companies, where 99 percent had an average daily turnover of ten million euros or more. The CDax Cases are more evenly distributed among liquidity classes, with 52 percent above ten million euros, 25 percent between two and ten million euros and 23 percent below two million euros.

About Today's Case from Investtech

Today's Case in Germany is selected entirely automatically by Investtech’s mathematical algorithms. The criteria used are highest possible technical score, based on trend, price formation, volume development and other technical indicators, in addition to satisfactory liquidity. Time horizon for the recommendations is medium term, i.e. one to three months.

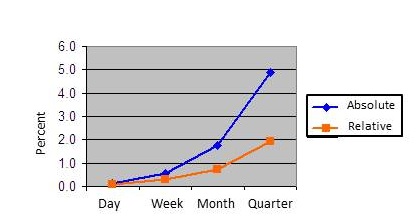

Results Dax30

The Dax30 Cases increased by an average of 1.8 percent the first month, which equals 0.7 percent excess return compared to reference index. The Daily Case stocks increased by 4.9 percent the first quarter, which is 1.9 percentage points better than index.

| Number | Day | Week | Month | Quarter | |

| Absolute return | 1,969 | 0.1 | 0.6 | 1.8 | 4.9 |

| Relative to index | 1,969 | 0.1 | 0.3 | 0.7 | 1.9 |

The table shows absolute and relative return from stocks published as the Daily Case to Investtech’s subscribers in Germany from May 5, 2003, to December 30, 2013. For the newer Cases where prices up to a quarter after publication date are not available, we have estimated the missing prices to equal the last known closing price.

The system also selects negative case candidates, which are the most negative stocks. However, these have not been made available to our subscribers. The negative cases followed the stock exchange relative to index for the first month, but quarterly they fell 0.2 percentage points compared to index.

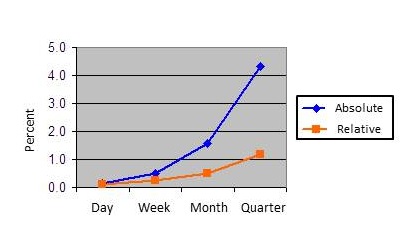

Results CDax

The CDax Cases increased on average by 1.6 percent the first month, which is 0.5 percentage points more than the reference index. The CDax Case stocks increased by 4.3 percent in the first quarter, which is 1.2 percentage points better than index.

| Number | Day | Week | Month | Quarter | |

| Absolute return | 2,620 | 0.1 | 0.5 | 1.6 | 4.3 |

| Relative to index | 2,620 | 0.1 | 0.3 | 0.5 | 1.2 |

The table shows absolute and relative return from stocks published as the Daily Case to Investtech’s subscribers in Germany from May 5, 2003, to December 30, 2013. For the newer Cases where prices up to a quarter after publication date are not available, we have estimated the missing prices to equal the last known closing price.

The system also selected negative case candidates for the CDax. The negative cases fell by 0.4 percentage points relative to index the first month and by 0.4 percentage points quarterly.

Keywords: CDax,daily case,Germany,return,statistics.

Written by

Head of Research and Analysis

at Investtech

Where do I find Today's Case from Investtech?

To access Investtech's Daily Case, you must be a subscriber. Log in and select Today's Case from the left hand menu or click the Today's Case teaser on the start page.

On the Today's Case page, the previous ten Daily Cases are listed on the right hand side. Access Today's Case (subscription required).

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices