Important indices show that optimism prevails

Published 2014-09-04

Analyses of leading indices show that long-term optimism dominates the big stock exchanges.

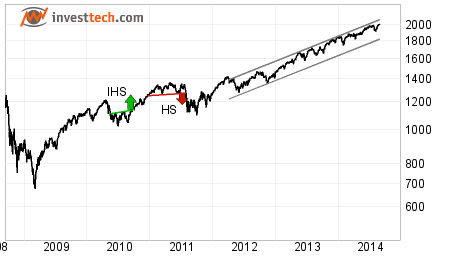

The S&P 500 with 500 of the biggest companies on the NYSE and NASDAQ exchanges is in a long-term rising trend. The index has reached an all-time high, and broke upwards through the psychologically important 2,000 points last week. This opens for further rise within the trend, which has an annual rate of increase of 17 percent.

The S&P 500 with 500 of the biggest companies on the NYSE and NASDAQ exchanges is in a long-term rising trend. The index has reached an all-time high, and broke upwards through the psychologically important 2,000 points last week. This opens for further rise within the trend, which has an annual rate of increase of 17 percent.

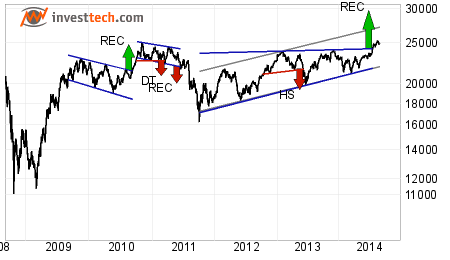

The Hang Seng in Hong Kong is in a long-term rising trend. A buy signal was recently triggered when the index broke upwards through resistance at 24,000 points. The buy signal has a formation target of 30,000 points by the end of 2017.

The Hang Seng in Hong Kong is in a long-term rising trend. A buy signal was recently triggered when the index broke upwards through resistance at 24,000 points. The buy signal has a formation target of 30,000 points by the end of 2017.

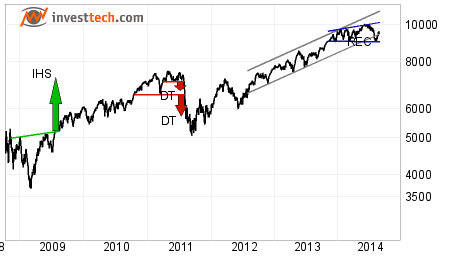

The DAX consists of the 30 biggest companies on the stock exchange in Frankfurt. The index has risen comfortably in the past few years and is in a rising trend. However there is resistance at approx. 10,000 points which has restricted further rise this year. A rectangle formation is developing with support around 9,000 points and resistance around 10,000 points. If the index breaks upwards through 10,000 points, it will trigger a buy signal. If it instead experiences a reversal and breaks downwards below 9,000 points, a weaker market outlook in Germany will be indicated.

The DAX consists of the 30 biggest companies on the stock exchange in Frankfurt. The index has risen comfortably in the past few years and is in a rising trend. However there is resistance at approx. 10,000 points which has restricted further rise this year. A rectangle formation is developing with support around 9,000 points and resistance around 10,000 points. If the index breaks upwards through 10,000 points, it will trigger a buy signal. If it instead experiences a reversal and breaks downwards below 9,000 points, a weaker market outlook in Germany will be indicated.

The FTSE is comprised of the 100 biggest companies on the London stock exchange. The index triggered a buy signal from a large rectangle formation when it broke upwards through resistance at 6,000 points in January 2013. The buy signal has a formation target of more than 7,200 points. So far this year, the index has had a more sideways development, and has established solid resistance around 6,800 points. The rising trend has marginally broken downwards, which indicates a more neutral market. Established trading above resistance at 6,800 – 7,000 points will indicate new optimism on the British stock exchange and signal further rise.

The FTSE is comprised of the 100 biggest companies on the London stock exchange. The index triggered a buy signal from a large rectangle formation when it broke upwards through resistance at 6,000 points in January 2013. The buy signal has a formation target of more than 7,200 points. So far this year, the index has had a more sideways development, and has established solid resistance around 6,800 points. The rising trend has marginally broken downwards, which indicates a more neutral market. Established trading above resistance at 6,800 – 7,000 points will indicate new optimism on the British stock exchange and signal further rise.

The analyses were written for publication in the Norwegian newspaper Dagens Næringsliv on 2 Sept 2014.

Geschreven door

Analist

in Investtech

"Investtech analyseert de psychologie in de markt en geeft u iedere dag concrete trading-voorstellen."

Partner & Senior Advisor - Investtech

Investeringsaanbevelingen worden gedaan door Investtech.com AS ("Investtech"). Investtech garandeert geen volledigheid of juistheid van de analyses. Eventuele fouten in de aanbevelingen, koop- en verkoopsignalen en mogelijke negatieve gevolgen hiervan zijn geheel het risico van de belegger. Investtech neemt geen enkele verantwoordelijkheid voor verlies, direct of indirect, als gevolg van het gebruik van Investtechs analyses. Meer informatie omtrent Investtechs analyses kunt u vinden op disclaimer.

Investeringsaanbevelingen worden gedaan door Investtech.com AS ("Investtech"). Investtech garandeert geen volledigheid of juistheid van de analyses. Eventuele fouten in de aanbevelingen, koop- en verkoopsignalen en mogelijke negatieve gevolgen hiervan zijn geheel het risico van de belegger. Investtech neemt geen enkele verantwoordelijkheid voor verlies, direct of indirect, als gevolg van het gebruik van Investtechs analyses. Meer informatie omtrent Investtechs analyses kunt u vinden op disclaimer.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices