Big US investment and financial services stocks and their current health

Published March 27, 2019

The broader US index S&P 500 gained 0.72 per cent on Tuesday to a close at 2818 points. The broader index does not show any clear trend on Investtech's medium term graph, but is inside a rising trend channel in the long term, which is one to six quarters.

Since establishing a bottom at 2351 points just before Christmas, the index has risen by almost 20 per cent as of date and is just a little shy of its all time high of 2930 points on closing basis, which does not seem too far and only four per cent away from Tuesday's close. Keeping our fingers crossed, if we can say that.

On the charts, the stock price of some of the big Financial Services stocks are doing really well, like Visa Inc., PayPal Inc. and Mastercard Inc.. They are currently trading at their peaks. However, the other big commercial and banking services, investment and asset management stocks like Citigroup, JP Morgan Chase, Morgan Stanley and Blackrock, to name a few, are not moving in tandem.

As per theory, the stock price cashes in all the available market information and reflects a company's health almost six months in advance. A stock price is nothing but a negotiation between demand and supply that the market players agree to pay for each share traded in the secondary market. So what does the price of a few of these stocks suggest?

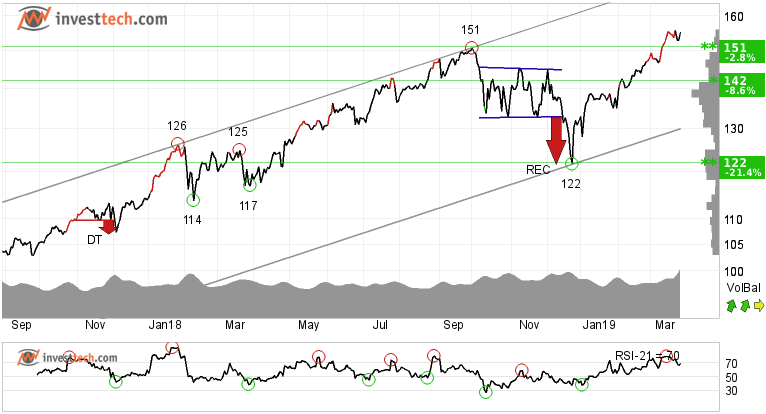

Visa Inc (V.US500) Close: 155.30

Visa Inc shows strong development within a rising trend channel in the medium to long term. Rising trends indicate that the company experiences positive development and that buy interest among investors is increasing. The stock has broken up through resistance at 151. This predicts a further rise. In case of negative reactions, there will now be support at 151 and 142 dollars.

Positive volume balance indicates that volume is high on days with rising prices and low on days with falling prices, which strengthens the stock. The stock is overall assessed as technically positive for the medium term.

Investtech's outlook (one to six months): Positive

PayPal Holdings Inc (PYPL.US) Close: 103.15

PayPal Holdings Inc has broken up through the ceiling of the rising trend channel in the medium term. Based on the research that we have done in the Scandinavian markets, this kind of breakout signals an even stronger rising rate. This may or may not apply to US stocks.

The price has risen strongly since positive signals from two rectangle formations in the last 15 months. The objective at 98.43 dollars from the last rectangle is now met, but the formation still gives a signal in the same direction. The stock is in all time high, hence it can rise further. However, in case of a downward reaction, there is support between 99 and 90 dollars in the short term. The stock is overall assessed as technically positive for the medium long term.

The positive development, however, may give rise to short term corrections down from today's level. Hence one must maintain proper stoploss as per your preferred time frame.

Investtech's outlook (one to six months): Positive

Morgan Stanley (MS.US500) Close: 41.88

The Morgan Stanley stock is inside a falling trend channel both in the medium and long term. The stock fell more than 37 per cent in 2018 before making a low in December. In the last three months, the stock has attempted to cross the resistance at 44 dollars, but so far has not been able to sustain above it. To achieve a change in trend, the stock has to make higher tops and higher bottoms and close above the 46.80 mark. Until then it is in a weak zone.

The volume balance indicator is negative, suggesting that sellers are more aggressive with falling prices, while buyers are more passive when the price corrects upwards. There is support around 40 dollars and below that all the way to 37 dollars, which was also the stock's last major low.

Investtech's outlook (one to six months): Weak Negative

Citigroup Inc (C.US500) Close: 61.22

Citigroup Inc is inside a falling trend channel in the medium term, but unlike Morgan Stanley it is inside an upward trend channel in the long term. Falling trends indicate that the company experiences negative development and falling buy interest among investors.

The stock corrected sharply after making a low of 49.26 dollars, but failed an attempt to move beyond 66 dollars. It has also given a breakdown from a small rectangle formation in the short term. Further downside is anticipated.

The stock is closer to its long term support around 60 dollars. If the price breaks below that, then the support is around 56 and 49 levels. Resistance at 65.60 and 72.50 dollars respectively.

Investtech's outlook (one to six months): Weak Negative

We see that there is mixed behaviour among banking and financial services, investment and asset management stocks. You can study charts and auto-analysis of all such stocks for the short, medium and long term time frames on our website at www.investtech.com

The analyses are based on closing price as per March 26, 2019

Note: These instruments are traded in currency based on the exchange or country they are listed on.

Geschreven door

Analist

in Investtech

"Investtech analyseert de psychologie in de markt en geeft u iedere dag concrete trading-voorstellen."

Partner & Senior Advisor - Investtech

Investeringsaanbevelingen worden gedaan door Investtech.com AS ("Investtech"). Investtech garandeert geen volledigheid of juistheid van de analyses. Eventuele fouten in de aanbevelingen, koop- en verkoopsignalen en mogelijke negatieve gevolgen hiervan zijn geheel het risico van de belegger. Investtech neemt geen enkele verantwoordelijkheid voor verlies, direct of indirect, als gevolg van het gebruik van Investtechs analyses. Meer informatie omtrent Investtechs analyses kunt u vinden op disclaimer.

Investeringsaanbevelingen worden gedaan door Investtech.com AS ("Investtech"). Investtech garandeert geen volledigheid of juistheid van de analyses. Eventuele fouten in de aanbevelingen, koop- en verkoopsignalen en mogelijke negatieve gevolgen hiervan zijn geheel het risico van de belegger. Investtech neemt geen enkele verantwoordelijkheid voor verlies, direct of indirect, als gevolg van het gebruik van Investtechs analyses. Meer informatie omtrent Investtechs analyses kunt u vinden op disclaimer.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices