Global stocks: Three positive opportunities, consumer defensives and cyclical stocks

Published June 12, 2019

Consumer Defensive are stocks that deal with staples. As the name suggests, they provide a cushion against market volatility, pay good periodic dividends, and are less susceptible to market pullbacks. In times where the economic policies and trade decisions of the Trump administration scare the markets, not only locally but internationally, keeping consumer defensive stocks in your basket can be a good option as they provide diversification to the portfolio.

Going through our database and filters, we found 30 such stocks listed on S&P 500, but we choose to write about two. I take the liberty to jump to another sector, Consumer Cyclical, because the third stock that I have chosen to write about looked equally promising.

Cyclicals follow a different set of rules. They rely heavily on the state of economy and business cycle, and include industries such as automotive, housing, entertainment, and retail. These can further be divided into durables and non-durables. Given the expected healthy state of the US economy so far, and the not so bad development of the index in general, we can include one stock from consumer cyclicals.

Walmart Inc (WMT.US) Close: 107.94

Walmart Inc is inside a rising trend channel in short, medium and long term charts. Recently the stock broke out from a large rectangle formation that stretches back more than eighteen months. The price has also moved beyond the resistance of 105 and further rise to 131 or more is signalled.

There is now support around 105 and 99 dollars. However, in the longer term chart, the stock is nearing its earlier resistance of 110 dollars. This may pose some hindrance, but a close above that level will take the price into new territory and would signal further rise in price.

Both volume balance and momentum indicators are positive and support the underlying rise in price. The stock is overall assessed as technically positive in the medium to long term.

Investtech's outlook (one to six months): Positive

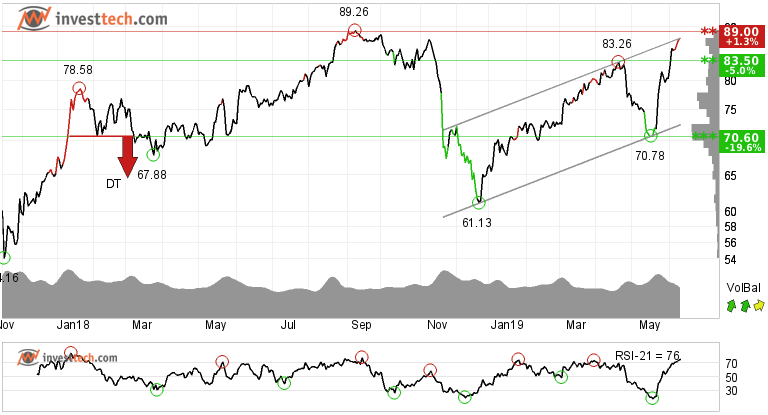

Target Corp (TGT.US) Close: 87.85

Investors have paid higher prices over time to buy Target Corp and the stock is in a rising trend channel in the medium term. Rising trends indicate that the company experiences positive development and that buy interest among investors is increasing. The stock is testing the resistance at 89.00. A close above this level may initiate new buy and the stock may rise further. There is support around 83.50 dollars.

Positive volume balance indicates that buyers are aggressive while sellers are passive, and strengthens the stock. RSI is above 70 after a good price increase the past weeks. The stock has strong positive momentum and further increase is indicated.

Investtech's outlook (one to six months): Positive

Under Armour Inc (UAA.US) Close: 26.18

Under Armour Inc has broken the rising trend upwards in the medium term. This signals an even stronger rate of growth. The price has risen strongly since the positive signal from a rectangle formation, and has broken through the resistance at 23.16. The objective at 25.65 is now met, but the formation still gives a signal in the same direction. The stock has support at dollar 24.00 - 22.85 dollars.

Volume balance is positive and strengthens the stock both in the short and medium term. RSI above 70 shows that the stock has strong positive momentum and indicates increasing optimism among investors and that the price may continue to rise.

Investtech's outlook (one to six months): Positive

The analyses are based on closing price as per June 11, 2019

Note: These instruments are traded in currency based on the Exchange or country they are listed on.

Geschreven door

Analist

in Investtech

"Investtech analyseert de psychologie in de markt en geeft u iedere dag concrete trading-voorstellen."

Partner & Senior Advisor - Investtech

Investeringsaanbevelingen worden gedaan door Investtech.com AS ("Investtech"). Investtech garandeert geen volledigheid of juistheid van de analyses. Eventuele fouten in de aanbevelingen, koop- en verkoopsignalen en mogelijke negatieve gevolgen hiervan zijn geheel het risico van de belegger. Investtech neemt geen enkele verantwoordelijkheid voor verlies, direct of indirect, als gevolg van het gebruik van Investtechs analyses. Meer informatie omtrent Investtechs analyses kunt u vinden op disclaimer.

Investeringsaanbevelingen worden gedaan door Investtech.com AS ("Investtech"). Investtech garandeert geen volledigheid of juistheid van de analyses. Eventuele fouten in de aanbevelingen, koop- en verkoopsignalen en mogelijke negatieve gevolgen hiervan zijn geheel het risico van de belegger. Investtech neemt geen enkele verantwoordelijkheid voor verlies, direct of indirect, als gevolg van het gebruik van Investtechs analyses. Meer informatie omtrent Investtechs analyses kunt u vinden op disclaimer.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices