Global stocks: Bitcoin and Gold

Published July 10, 2019

After lot of surfing through different markets we thought to review our analysis on Bitcoin and Gold. We had published a weak positive and then a positive recommendation on Bitcoin on two different occassions since April this year. On April 3, Bitcoin was at 4957.52 and right after 40 days on May 13 it was at 7112.33 dollars. Since our first recommendation it has gained enormously, up by 161%. As I write this article, Bitcoin is up 3.47 percent trading at 12956.50 points (1120 hrs CET).

On the other hand since our Watch recommendation in Gold, it has gone up by a whopping 17 percent and trading at 1394.13 on Wednesday at 1120 hrs CET.

Please note that there is no interdependence or proven correlation between these two instruments.

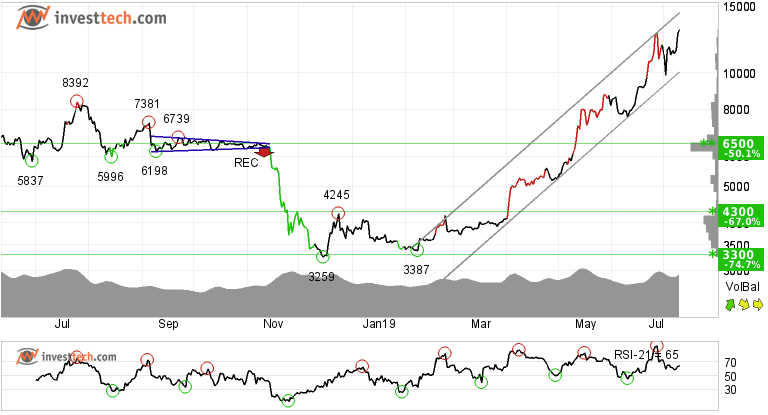

Bitcoin (BTC.CPT) Close: 13027.00

Bitcoin is inside a rising trend channel in both short and medium term charts. In April the cryptocurrency broke above its resistance of 4300 dollars and has gained remarkably by 200 percent since then.

Now the price of the crypto giant is in the same territory as it was seventeen months back. There is no considerable resistance visible on the mediun or long term charts before its previous high of 19345 dollars. In case of any reaction there is support around 10000 and 7700 dolalrs respectively.

Both volume balance and momentum indicators are positive and support the underlying rise in price. The stock is overall assessed as technically positive in the medium to long term.

Investtech's outlook (one to six months): Positive

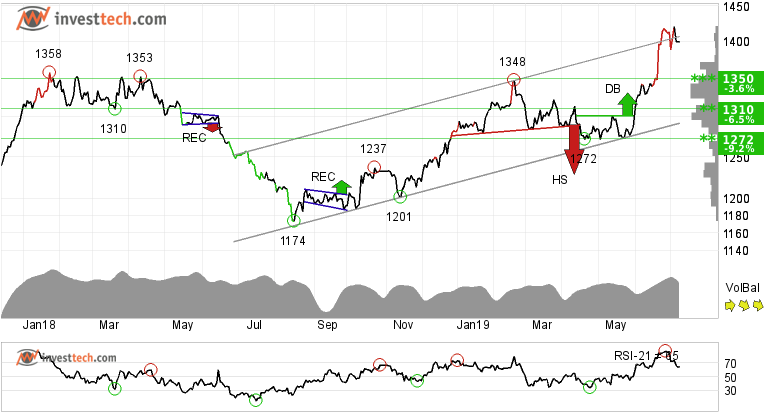

Gold (GC.FUT) Close: 1400.50

Investors have paid higher prices over time to buy in Gold and the commodity price is in a rising trend channel in the medium term. This signals increasing optimism among investors and indicates continued rise.

Gold prices broke above its earlier resistance of 1350 dollars and is now latching itself to the ceiling of the uptrending channel. The commodity has little resistance as shown in the medium term chart. There is support around 1350 dollars. The short term momentum is positive and further increase is indicated.

Investtech's outlook (one to six months): Positive

The analyses are based on closing price as per July 09, 2019

Note: These instruments are traded in currency based on the Exchange or country they are listed on.

Geschreven door

Analist

in Investtech

"Investtech analyseert de psychologie in de markt en geeft u iedere dag concrete trading-voorstellen."

Partner & Senior Advisor - Investtech

Investeringsaanbevelingen worden gedaan door Investtech.com AS ("Investtech"). Investtech garandeert geen volledigheid of juistheid van de analyses. Eventuele fouten in de aanbevelingen, koop- en verkoopsignalen en mogelijke negatieve gevolgen hiervan zijn geheel het risico van de belegger. Investtech neemt geen enkele verantwoordelijkheid voor verlies, direct of indirect, als gevolg van het gebruik van Investtechs analyses. Meer informatie omtrent Investtechs analyses kunt u vinden op disclaimer.

Investeringsaanbevelingen worden gedaan door Investtech.com AS ("Investtech"). Investtech garandeert geen volledigheid of juistheid van de analyses. Eventuele fouten in de aanbevelingen, koop- en verkoopsignalen en mogelijke negatieve gevolgen hiervan zijn geheel het risico van de belegger. Investtech neemt geen enkele verantwoordelijkheid voor verlies, direct of indirect, als gevolg van het gebruik van Investtechs analyses. Meer informatie omtrent Investtechs analyses kunt u vinden op disclaimer.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices