Global stocks: Two buy candidates from Top 50 list of Nasdaq 100

Published December 11, 2019

We have analysed two stocks from the Top 50 list of Nasdaq 100 available on Investtech's website. The stocks making it to the Top 50 list are ones that have scored highest on technical parameters.

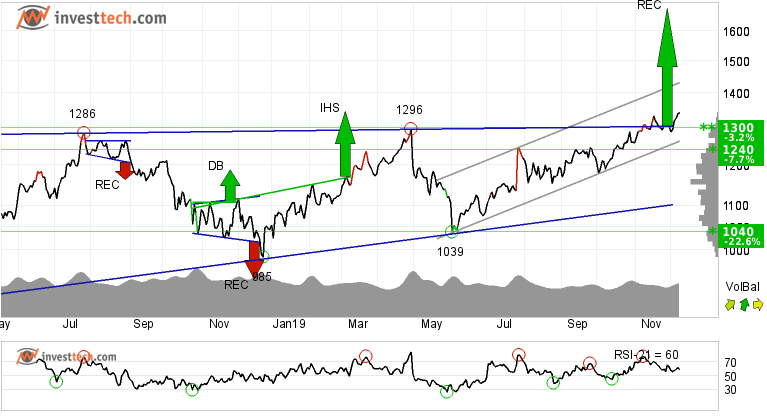

Alphabet Inc (GOOGL.NAS100) Close: 1342.99

A sideways price movement, that stretched for almost two years, is finally broken. Alphabet Inc. has given a buy signal from a rectangle formation both in the medium and long term charts. This indicates that the long term sluggish perspective of the investors has now taken a heads up and more and more people are now interested in buying the stock. Further rise to 1678 dollars or more is signalled.

The stock has also broken up through resistance at 1300 dollars and further rise in the stock is expected. There is no resistance in the price chart whatsoever and further rise is indicated. In case of a negative reaction, the stock has support at the same level.

The current movement is positive with an overweight of optimists over pessimists. Further rise in stock price is expected.

We last analysed the stock on October 30, when the price had closed at 1262.62 dollars, and gave a weak positive recommendation. We now upgrade our recommendation to positive for Alphabet Inc.

Investtech's outlook (one to six months): Positive

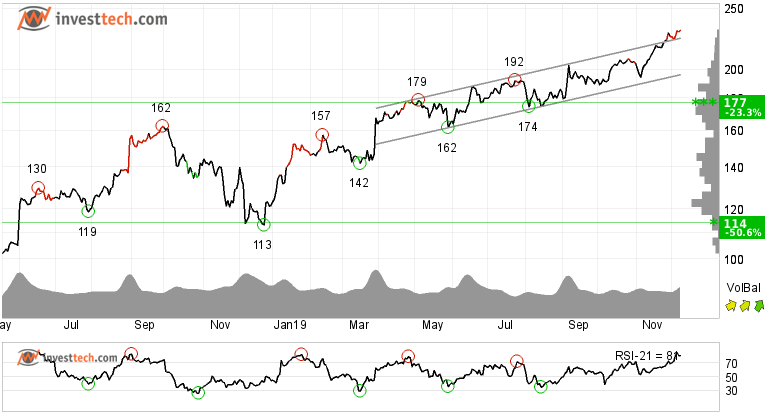

Lululemon Athletica inc (LULU.NAS100) Close: 230.88

Investors have paid higher prices over time to buy Lululemon Athletica inc. and the stock has broken the rising trend up in the medium long term, which indicates an even stronger rising rate. Investtech had done a lot of research in the area regarding position of price with respect to the trend channel, support and resistance and the average return for stocks with respect to the broader index in the Scandinavian markets. More about the research can be studied here.

The athletic giant is trading near its all time high. Hence no significant resistance is visible in the charts. In case of any downward reaction, there is support around 217 dollars in the short term.

Positive volume balance shows that volume is higher on days with rising prices than days with falling prices. This indicates increasing optimism among investors. RSI is above 70 after a good price increase the past weeks. The stock has strong positive momentum and further increase is indicated.

Investtech's outlook (one to six months): Positive

The analyses are based on closing price as per December 9, 2019.

These instruments are traded in currency based on the Exchange or country they are listed on.

Geschreven door

Analist

in Investtech

"Investtech analyseert de psychologie in de markt en geeft u iedere dag concrete trading-voorstellen."

Partner & Senior Advisor - Investtech

Investeringsaanbevelingen worden gedaan door Investtech.com AS ("Investtech"). Investtech garandeert geen volledigheid of juistheid van de analyses. Eventuele fouten in de aanbevelingen, koop- en verkoopsignalen en mogelijke negatieve gevolgen hiervan zijn geheel het risico van de belegger. Investtech neemt geen enkele verantwoordelijkheid voor verlies, direct of indirect, als gevolg van het gebruik van Investtechs analyses. Meer informatie omtrent Investtechs analyses kunt u vinden op disclaimer.

Investeringsaanbevelingen worden gedaan door Investtech.com AS ("Investtech"). Investtech garandeert geen volledigheid of juistheid van de analyses. Eventuele fouten in de aanbevelingen, koop- en verkoopsignalen en mogelijke negatieve gevolgen hiervan zijn geheel het risico van de belegger. Investtech neemt geen enkele verantwoordelijkheid voor verlies, direct of indirect, als gevolg van het gebruik van Investtechs analyses. Meer informatie omtrent Investtechs analyses kunt u vinden op disclaimer.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices