Investtech Research: Price formations - Overview

Published 27 January 2020

Geometric price formations, like rectangles, double bottoms and head and shoulders formations, are used in technical stock analysis to predict future price development. These patterns can be explained by human behaviour and psychological conditions, but also based on the economic development in the companies, and many investors use this as an important part of their decision making process when buying or selling stocks.

We have studied the price movements that have followed buy and sell signals from formations in Investtech's price charts for the Norwegian, Swedish, Danish and Finnish Stock Exchanges over a period of 23 years, from 1996 to 2018. Many of the results confirm the theory, but in one case the stocks have developed contrary to established theory.

This is an overview of results and key conclusions. Details are available in a separate article for each of these six buy and sell signals, which are based on nine different research reports.

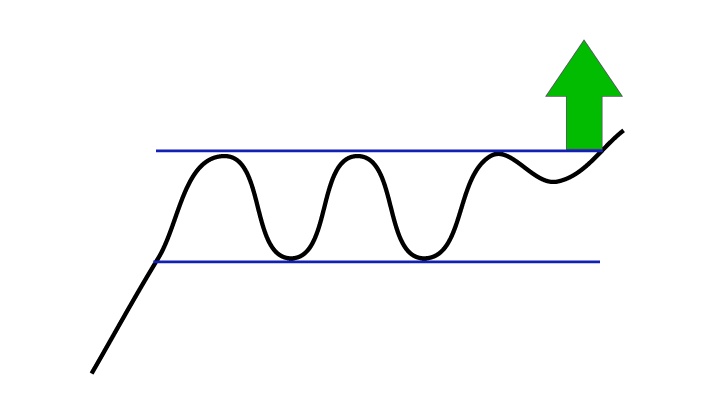

Buy signal: Rectangle formation

Theory: A buy signal from a rectangle formation signals increasing optimism among investors and signals that the stock continues or enters a rising trend.

Theory: A buy signal from a rectangle formation signals increasing optimism among investors and signals that the stock continues or enters a rising trend.

A stock that has triggered a buy signal from a rectangle formation is indicated to rise further. This is especially the case when the stock price is already in a rising trend channel. Investors have experienced a positive surprise which has triggered the signal, and optimism is on the increase.

Research results:

The Nordic markets 1996-2018, a total of 4,314 buy signals.

Stocks with buy signals from rectangle formations have on average outperformed market in the coming months. Annualised return has been 9.8 percentage points better than benchmark.

Read the research article here>>

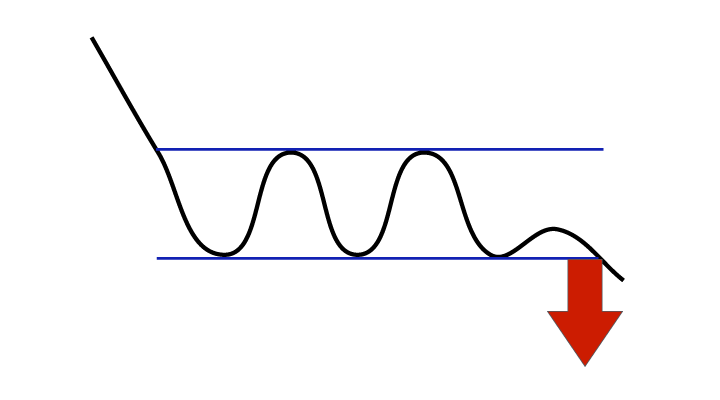

Sell signal: Rectangle formations

Theory: A sell signal from a rectangle formation signals increasing pessimism among investors and signals that the stock continues or enters a falling trend.

Theory: A sell signal from a rectangle formation signals increasing pessimism among investors and signals that the stock continues or enters a falling trend.

A stock that has triggered a sell signal from a rectangle formation is indicated to fall further. This is especially the case when the stock price is already in a falling trend channel. Investors have experienced a negative surprise which has triggered the signal, and the level of fear is increasing.

Research results:

The Nordic markets 1996-2018, a total of 3,109 signals.

Stocks with sell signals from rectangle formations have on average underperformed compared to benchmark in the coming months. Annualised return has been 4.9 percentage points weaker than benchmark.

Read the research article here>>

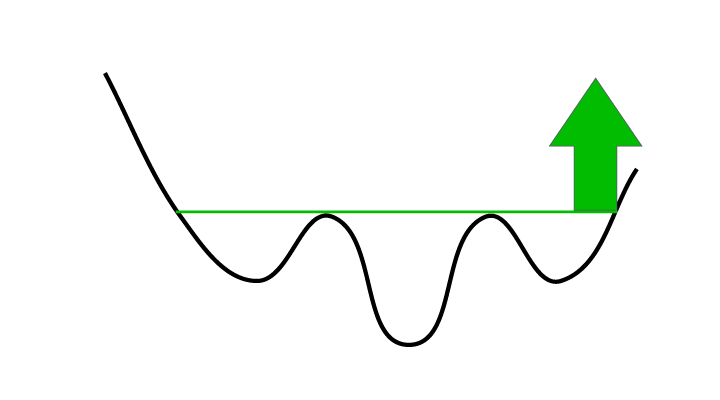

Buy signal: Inverse head and shoulders formation

Theory: A buy signal from an inverse head and shoulders formation signals increasing optimism among investors and the beginning of a rising trend. Formations like this are considered some of the most reliable formations in technical analysis. An inverse head and shoulders formation is a bottom formation which marks the end of a falling trend. The formation consists of a left shoulder, a head and a right shoulder, connected by a neckline. The buy signal is triggered when the price breaks upwards through the neckline heading up from the right shoulder.

Theory: A buy signal from an inverse head and shoulders formation signals increasing optimism among investors and the beginning of a rising trend. Formations like this are considered some of the most reliable formations in technical analysis. An inverse head and shoulders formation is a bottom formation which marks the end of a falling trend. The formation consists of a left shoulder, a head and a right shoulder, connected by a neckline. The buy signal is triggered when the price breaks upwards through the neckline heading up from the right shoulder.

Research results:

The Nordic markets 1996-2018, a total of 1,443 buy signals.

Stocks with buy signals from inverse head and shoulders formations have on average outperformed benchmark in the coming months. Annualised return has been 5.2 percentage points better than benchmark.

Read the research article here>>

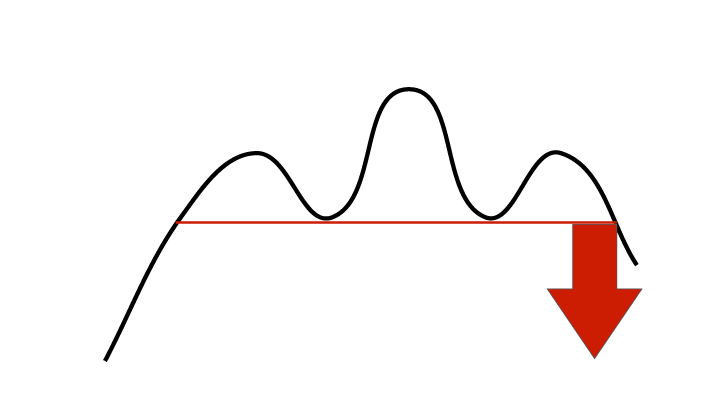

Sell signal: Head and shoulders formation

Theory: A sell signal from a head and shoulders formation signals increasing pessimism among investors and the start of a falling trend. Formations like this are considered some of the most reliable formations in technical analysis. A head and shoulders formation is a top formation which marks the end of a rising period. The formation consists of a left shoulder, a head and a right shoulder, connected by a neckline. The sell signal is triggered when the price breaks downwards through the neckline heading down from the right shoulder.

Theory: A sell signal from a head and shoulders formation signals increasing pessimism among investors and the start of a falling trend. Formations like this are considered some of the most reliable formations in technical analysis. A head and shoulders formation is a top formation which marks the end of a rising period. The formation consists of a left shoulder, a head and a right shoulder, connected by a neckline. The sell signal is triggered when the price breaks downwards through the neckline heading down from the right shoulder.

Research results:

The Nordic markets 1996-2018, a total of 1,830 sell signals.

Stocks with sell signals from head and shoulders formations have on average performed a little weaker than benchmark in the coming months. Annualised return has been 1.3 percentage points weaker than benchmark.

Read the research article here>>

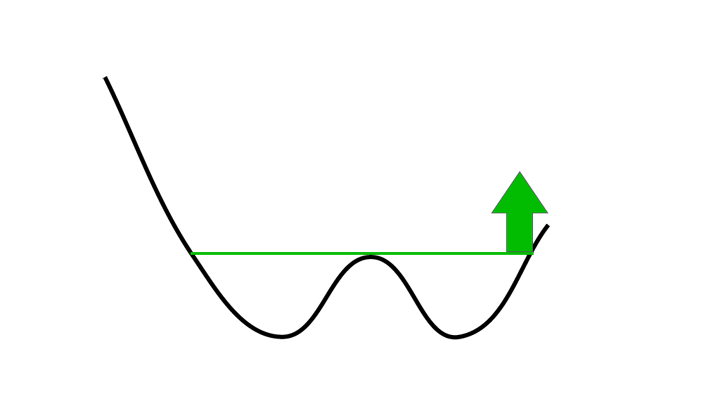

Buy signal: Double bottom formation

Theory: A buy signal from a double bottom formation signals increasing optimism among investors and the beginning of a rising trend. A double bottom formation is a bottom formation which marks the end of a falling period. The formation consists of two bottoms of about the same depth. The buy signal is triggered when the price breaks upwards above the bottoms.

Theory: A buy signal from a double bottom formation signals increasing optimism among investors and the beginning of a rising trend. A double bottom formation is a bottom formation which marks the end of a falling period. The formation consists of two bottoms of about the same depth. The buy signal is triggered when the price breaks upwards above the bottoms.

Research results:

The Nordic markets 1996-2018, a total of 2,607 buy signals.

Stocks with buy signals from double bottom formations have on average performed in line with benchmark in the coming months. Annualised return has been 0.2 percentage points weaker than benchmark. These are statistics for Investtech's medium term price charts. Short and long term formations have given quite different results.

Read the research article here>>

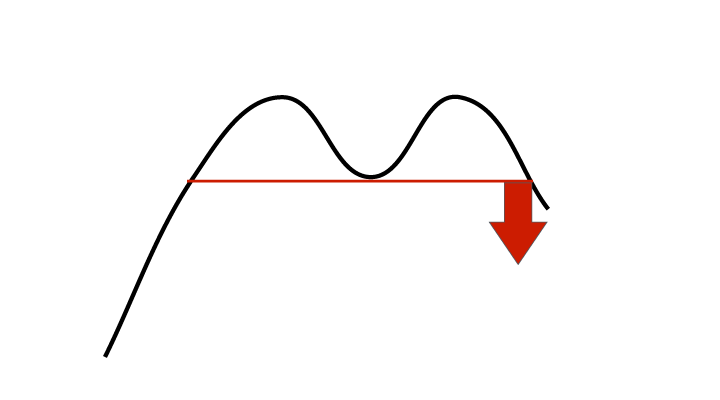

Sell signal: Double top formations

Theory: A sell signal from a double top formation signals increasing pessimism among investors and the beginning of a falling trend. A double top formation is a top formation which marks the end of a rising trend. The formation consists of two tops of about the same height. The sell signal is triggered when the price breaks down below the tops.

Theory: A sell signal from a double top formation signals increasing pessimism among investors and the beginning of a falling trend. A double top formation is a top formation which marks the end of a rising trend. The formation consists of two tops of about the same height. The sell signal is triggered when the price breaks down below the tops.

Research results:

The Nordic markets 1996-2018, a total of 3,481 sell signals.

Stocks with sell signals from double top formations have on average done a little better than benchmark in the coming months. These results are contrary to theory. Annualised return has been 1.3 percentage points better than benchmark. These statistics are for formations in Investtech's medium term price charts. Short and long term formations have given quite different results.

Read the research article here>>

Conclusions

Based on the results above, we come to the following conclusions:

Conclusion - Rectangle formations

Stocks that have triggered buy signals from rectangle formations in Investtech's price charts have continued to rise, and they have risen more than the stock exchange in general. Stocks that have triggered sell signals from rectangle formations have continued to underperform. Such signals can be valuable input into a buy or sell decision about a stock. The period following a buy signal from a rectangle formation will be a statistically good time to buy. This is in line with classic technical analysis theory.

Conclusion - Inverse/head and shoulders formations

Stocks that have triggered buy signals from inverse head and shoulders formations in Investtech's price charts have continued to rise, and they have risen more than the stock exchange in general. Stocks that have triggered sell signals from head and shoulders formations have continued to underperform. Such signals can be valuable input into a buy or sell decision about a stock. Statistically the signals are stronger for long term than for short term formations, and the price movement is stronger in the first month following the signal.

Conclusion - Double bottom/top formations

Stocks that have triggered signals from double top/bottom formations in Investtech's medium term price charts have developed the same as other stocks in the coming months. In the short term, such stocks have given a small price movement in the opposite direction of what the theory predicts. The formations are small and subject to short term noise, and the results indicate that such formations can be ignored in a technical analysis of a stock. Long term formations have given price movement in the signal direction and are considered more reliable.

The results were quite similar across all four countries we studied. In the case of inverse/head and shoulders formations and double top/bottom formations, signal effect differed between Investtech's short, medium and long term price charts. The data sets were too small to conclude with any difference between bigger and smaller companies and between different parts of the time period studied.

The time period for the study is fairly long, the quality of the data is considered to be good and the algorithms used are entirely automatic and deemed to identify only actual formations. We had a medium size data set and the conclusions are considered quite robust.

Read more in the research report here.

Keywords: h_PatGeneral.

Geschreven door

Hoofd research en analyse

in Investtech

Research articles:

Strong excess return following buy signals from rectangle formations

Good sell signals from rectangle formations

Excess return following buy signals from inverse head and shoulders formations

Variable predictive power in sell signals from head and shoulders formations

Sell signals from double top formations have little signal power

"Investtech analyseert de psychologie in de markt en geeft u iedere dag concrete trading-voorstellen."

Partner & Senior Advisor - Investtech

Investeringsaanbevelingen worden gedaan door Investtech.com AS ("Investtech"). Investtech garandeert geen volledigheid of juistheid van de analyses. Eventuele fouten in de aanbevelingen, koop- en verkoopsignalen en mogelijke negatieve gevolgen hiervan zijn geheel het risico van de belegger. Investtech neemt geen enkele verantwoordelijkheid voor verlies, direct of indirect, als gevolg van het gebruik van Investtechs analyses. Meer informatie omtrent Investtechs analyses kunt u vinden op disclaimer.

Investeringsaanbevelingen worden gedaan door Investtech.com AS ("Investtech"). Investtech garandeert geen volledigheid of juistheid van de analyses. Eventuele fouten in de aanbevelingen, koop- en verkoopsignalen en mogelijke negatieve gevolgen hiervan zijn geheel het risico van de belegger. Investtech neemt geen enkele verantwoordelijkheid voor verlies, direct of indirect, als gevolg van het gebruik van Investtechs analyses. Meer informatie omtrent Investtechs analyses kunt u vinden op disclaimer.

Oslo B°rs

Oslo B°rs Stockholmsb÷rsen

Stockholmsb÷rsen K°benhavns Fondsb°rs

K°benhavns Fondsb°rs Helsingin p÷rssi

Helsingin p÷rssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices