Global stocks: Optimism rules, three solid buy candidates

Published February 06, 2018

Since their bottom in late December, many global indices have recovered by 8 to 16 per cent on closing basis. S&P 500 gained around 16 % and FTSE 100 and Oslo Stock Exchange are up by 8 per cent, to name a few.

In the meantime, many stocks have gained good momentum and a few of them have given breakouts from trading ranges or achieved new highs. We analyse three of the well known companies among them here.

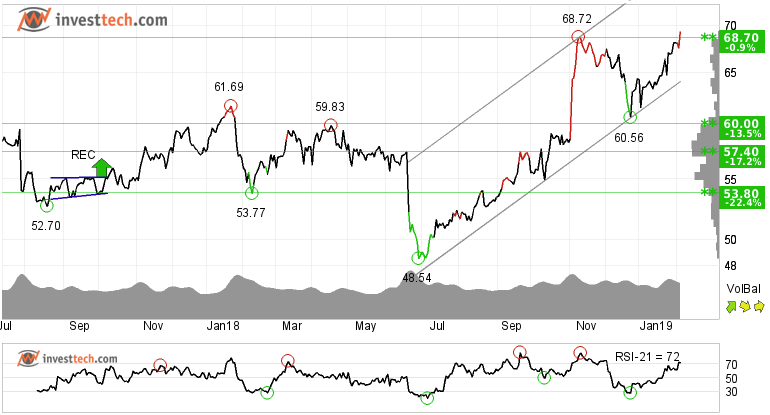

Starbucks Corp (SBUX.US) Close: 69.34

Starbucks Corp shows strong development within a rising trend channel in the medium long term. This signals increasing optimism among investors and indicates continued rise. The stock has broken up through its earlier resistance at dollar 68.70 which is over 13 per cent higher than its December low. The stock is closed yesterday at all time high.

The stock has support at 64.40 dollars. The short term momentum of the stock is strongly positive, with RSI above 70. This indicates increasing optimism among investors and further price increase for Starbucks Corp. However, particularly for big stocks, high RSI may be a sign that the stock is overbought and that there is a chance of a reaction downwards.

The stock is overall assessed as technically positive for the medium term.

Investtech's outlook (one to six months): Buy

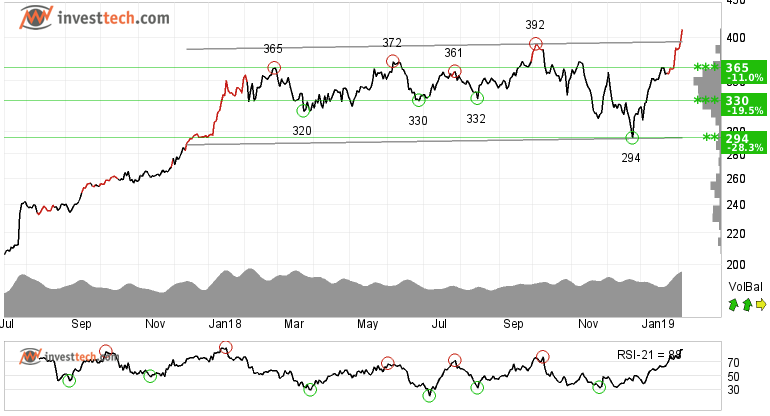

Boeing Company (BA.US) Close: 410.18

Boeing Company has broken up from an approximate horizontal trend channel in the medium term after investors have paid ever more to buy into the stock. The price has broken resistance at 395 dollars and a positive signal has been triggered. Further increase for the stock is indicated.

Positive volume balance indicates that buyers are aggressive while sellers are passive, and strengthens the stock. RSI above 70 shows that the stock has strong positive momentum in the short term.

Like the Starbucks stock, the Boeing Company stock price is at all time high, so there is no visible resistance. However, in case of any correction there is support around 365-360 levels.

The stock is overall assessed as technically positive for the medium term.

Investtech's outlook (one to six months): Buy

UNITED UTILITIES GROUP (UU.L) Close: 832.80

A very interesting chart we have is this of the FTSE 100 listed stock United Utilities Group. After trading within a range bound area for almost a year, the stock has given a buy signal from an inverted head and shoulders formation both in the medium and long term plus a double bottom formation in the longer term chart. A target of 865 and eventually 970 pence is given for the medium and long term respectively. There is support around 815 and 790 pence.

Positive volume balance and rising momentum with RSI over 70 indicates rising optimism among investors.

The stock is overall assessed as technically positive for the medium term.

Investtech's outlook (one to six months): Buy

The analyses are based on closing price as per February 05, 2018.

Note: These instruments are traded in currency based on the exchange or country they are listed on.

Skrevet af

Analytiker

i Investtech

"Investtech analyserer psykologien i markedet og giver dig konkrete tradingforslag hver dag."

Partner & Senior Advisor - Investtech

Investeringsanbefalinge(r)n(e) er udarbejdet af Investtech.com AS ("Investtech"). Investtech garanterer ikke for fuldstændigheden eller rigtigheden af analysen. Eventuel eksponering i forhold til de råd / signaler, som fremkommer i analyserne, står helt og holdent for investors regning og risiko. Investtech er hverken direkte eller indirekte ansvarlig for tab, der opstår som følge af brug af Investtechs analyser. Oplysninger om eventuelle interessekonflikter vil altid fremgå af investeringsanbefalingen. Yderligere information om Investtechs analyser findes på infosiden.

Investeringsanbefalinge(r)n(e) er udarbejdet af Investtech.com AS ("Investtech"). Investtech garanterer ikke for fuldstændigheden eller rigtigheden af analysen. Eventuel eksponering i forhold til de råd / signaler, som fremkommer i analyserne, står helt og holdent for investors regning og risiko. Investtech er hverken direkte eller indirekte ansvarlig for tab, der opstår som følge af brug af Investtechs analyser. Oplysninger om eventuelle interessekonflikter vil altid fremgå af investeringsanbefalingen. Yderligere information om Investtechs analyser findes på infosiden.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices