Bullish on these three stocks in the medium term

Published October 30, 2018

Webinar October 31

Join our free online webinar on October 31. Analyst Kiran Shroff and Country Manager Jan Marius van Leeuwen will give an introduction to Investtech's analyses and present stock picking tools & strategies.

It was party for the Nifty 50 index on Monday as the index rose more than 2 per cent to close at 10250.85 points.

The broader market index may have reversed from being very close to its support of 10000 mark, but still not out of danger unless it manages to close above its short term resistance of 10600 points. Until then our outlook on Nifty 50 would be Watch.

Among stocks, there are a few that have performed very well in the recent past, some managed to hold despite market downturn, while a few are eager to fly. We found three stocks today, one from each category.

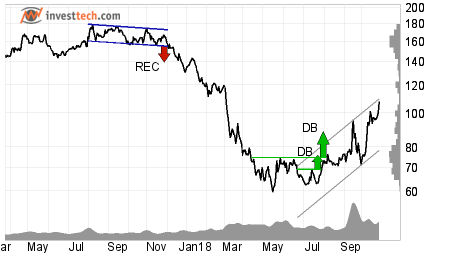

Balrampur Chini Mills (BALRAMCHIN.NS) Close: 107.90

Investors have paid higher prices over time to buy Balrampur Chini Mills Limited and the stock is in a rising trend channel in the medium term. Rising trends indicate that the company experiences positive development and that buy interest among investors is increasing.

Investors have paid higher prices over time to buy Balrampur Chini Mills Limited and the stock is in a rising trend channel in the medium term. Rising trends indicate that the company experiences positive development and that buy interest among investors is increasing.

The stock gave a positive breakout through double bottom formations both in the medium and long term charts and has been rising since establishing a bottom at 62.00 rupees.

Next level of resistance is around 176.00 rupees, so huge potential on the upside. On the downside, there is support at 96.00 in the short term and at 85 in the long term chart.

Positive volume balance and rising momentum, as indicated by the RSI curve, are strong and positive. This provides additional support to the rising share prices of Balrampur Chini Mills.

The stock is overall assessed as technically positive for the short to medium term.

Investtech's outlook (one to six months): Positive

Power Finance Corporat (PFC.NS) Close: 91.70

Power Finance Corporation Limited has broken up through the ceiling of a falling trend channel both in the medium and long term charts. The stock has also broken out from its resistance of 88.00 rupees and has established an inverted-head-and-shoulders formation. The price may rise to 115.00 levels, which is the target from the formation.

Power Finance Corporation Limited has broken up through the ceiling of a falling trend channel both in the medium and long term charts. The stock has also broken out from its resistance of 88.00 rupees and has established an inverted-head-and-shoulders formation. The price may rise to 115.00 levels, which is the target from the formation.

In the recent past, volume has been rising on days with rising price and falling on days with any price correction. This is a positive sign.

The RSI curve is rising its head up that indicates positive momentum.

In case of price corrections, there is support between 87.20 and 80.00 in the short term.

The stock is overall assessed as technically positive for the medium term.

Investtech's outlook (one to six months): Weak Positive

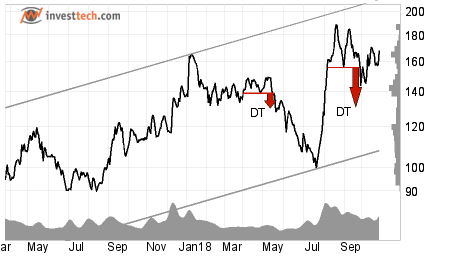

JK Paper Limited (JKPAPER.NS) Close: 168.10

JK Paper Limited is inside a rising trend channel in the medium term. After giving a sell signal from a double top formation, the stock price have recovered and is now above its resistance of 166.00 rupees. Next resistance is at 190.00. On the downside there is support around 144.00-132.00 levels.

JK Paper Limited is inside a rising trend channel in the medium term. After giving a sell signal from a double top formation, the stock price have recovered and is now above its resistance of 166.00 rupees. Next resistance is at 190.00. On the downside there is support around 144.00-132.00 levels.

Volume has previously been high at price tops and low at price bottoms. Volume balance is thus positive, which strengthens the trend. The stock is overall assessed as technically positive for the medium term.

Investtech's outlook (one to six months): Positive

The analyses are based on closing price as per October 29, 2018. Maintaining proper stop loss is always recommended.

Skrevet af

Analytiker

i Investtech

Archive:

26 October: Three potential candidates to ride on

24 October: Three big Metal stocks, Seasonal variation: Special feature

22 October: Among top performers on our Top 50 list

18 October: Three stocks investors should stay away from

17 October: Flowing against the tide

16 October: Positive on these 2 stocks

11 October: Over 45 per cent rise

9 October: The Indian banking space

5 October: Nifty closes at a crucial level

2 October: Price formations in the long-term charts

28 September: Positive on Biocon Limited

"Investtech analyserer psykologien i markedet og giver dig konkrete tradingforslag hver dag."

Partner & Senior Advisor - Investtech

Investeringsanbefalinge(r)n(e) er udarbejdet af Investtech.com AS ("Investtech"). Investtech garanterer ikke for fuldstændigheden eller rigtigheden af analysen. Eventuel eksponering i forhold til de råd / signaler, som fremkommer i analyserne, står helt og holdent for investors regning og risiko. Investtech er hverken direkte eller indirekte ansvarlig for tab, der opstår som følge af brug af Investtechs analyser. Oplysninger om eventuelle interessekonflikter vil altid fremgå af investeringsanbefalingen. Yderligere information om Investtechs analyser findes på infosiden.

Investeringsanbefalinge(r)n(e) er udarbejdet af Investtech.com AS ("Investtech"). Investtech garanterer ikke for fuldstændigheden eller rigtigheden af analysen. Eventuel eksponering i forhold til de råd / signaler, som fremkommer i analyserne, står helt og holdent for investors regning og risiko. Investtech er hverken direkte eller indirekte ansvarlig for tab, der opstår som følge af brug af Investtechs analyser. Oplysninger om eventuelle interessekonflikter vil altid fremgå af investeringsanbefalingen. Yderligere information om Investtechs analyser findes på infosiden.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices