Banking stocks look positive

Published November 6, 2018

Webinar November 14

Join our free online webinar on November 14 . Analyst Kiran Shroff and Country Manager Jan Marius van Leeuwen will give an introduction to Investtech's analyses and present stock picking tools & strategies.

The market showed a small loss Monday, and Nifty 50 (NIFTY) ended the day at 10524 points, which is a decline of 0.27 per cent.

713 shares were up and 782 were down, while 59 remained unchanged. There was no trading in 251 shares.

The total value of the trading volume for shares and primary capital certificates Monday was approximately 292.4 billion.

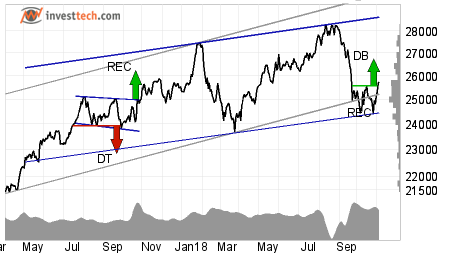

Nifty Bank (BANKNIFTY.NS) Close: 25 732.00

Bank Nifty was the star performer among all the indices on NSE with Nifty PSU Bank index rising around 2.90 per cent on Monday.

Bank Nifty was the star performer among all the indices on NSE with Nifty PSU Bank index rising around 2.90 per cent on Monday.

The index is still inside an uptrend channel, unlike Nifty 50. It marginally broke above its resistance at 25700 points and also gave a breakout from a small double double bottom formation. This is a positive sign. However, there is still a long way to go as the next level of resistance is shown at 27500 points or a little less than 7 per cent from yesterday's close. Support is around 24400 points in BankNifty.

Investtech's outlook (one to six months): Positive

Axis Bank Limited (AXISBANK.NS) Close: 624.40

Since our last published analysis of AXISBANK on the 17th of October, the stock has gained over 12 per cent.

Since our last published analysis of AXISBANK on the 17th of October, the stock has gained over 12 per cent.

AXISBANK rose over two per cent on Monday on very high volumes.

The stock is looking strong in a rising trend channel in the medium term. It broke through its earlier resistance of 620.00 rupees to close at 624.40 rupees. Next resistance is nowhere before 660.00 which is its last pivot point. On the downside there is support around 590.00 levels.

The volume balance indicator is positive and suggests that more investors are buying in the the stock at steadily higher prices while sellers are not willing to sell at lower prices. The momentum indicator RSI is also positive and rising, which supports the price rise.

Investtech's outlook (one to six months): Positive

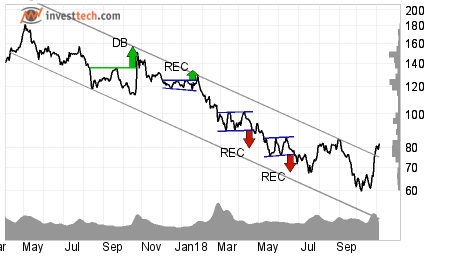

Oriental Bank of Comme (ORIENTBANK.NS) Close: 82.05

Another interesting-looking banking stock is Orient Bank of Commerce. The stock is out of its downward trend channel and is just 3.6 % shy of giving a buy signal. It is trading under its resistance of 85.00 rupees. A close above this level may initiate a buy signal in the stock.

Another interesting-looking banking stock is Orient Bank of Commerce. The stock is out of its downward trend channel and is just 3.6 % shy of giving a buy signal. It is trading under its resistance of 85.00 rupees. A close above this level may initiate a buy signal in the stock.

Volume balance is positive as indicated by green up arrows on the bottom right corner of the chart, indicating that buyers are getting aggressive while sellers are passive. This is a sign of strength. RSI above 70 shows that the stock has strong positive momentum in the short term.

The stock has short term support around 76.70.

Investtech's outlook (one to six months): Watch

Other interesting-looking banking stocks that are very close to their short term resistance levels and have very positive volume balance, and thus can turn out to be good bets in the near term if they manage to close above their resistance levels, are SOUTHBANK, UNIONBANK, FEDERALBANK and SYNDIBANK.

The analyses are based on closing price as per November 5, 2018. Maintaining proper stop loss is always recommended.

Skrevet af

Analytiker

i Investtech

Archive:

02 November: Positive on this one

01 November: TECHM, NIFTY50 and Hausse

31 October: What are investors thinking?

30 October: Bullish on these three stocks

26 October: Three potential candidates to ride on

24 October: Three big Metal stocks, Seasonal variation

22 October: Among top performers on our Top 50 list

18 October: Three stocks investors should stay away from

17 October: Flowing against the tide

16 October: Positive on these 2 stocks

11 October: Over 45 per cent rise

9 October: The Indian banking space

5 October: Nifty closes at a crucial level

2 October: Price formations in the long-term charts

28 September: Positive on Biocon Limited

"Investtech analyserer psykologien i markedet og giver dig konkrete tradingforslag hver dag."

Partner & Senior Advisor - Investtech

Investeringsanbefalinge(r)n(e) er udarbejdet af Investtech.com AS ("Investtech"). Investtech garanterer ikke for fuldstændigheden eller rigtigheden af analysen. Eventuel eksponering i forhold til de råd / signaler, som fremkommer i analyserne, står helt og holdent for investors regning og risiko. Investtech er hverken direkte eller indirekte ansvarlig for tab, der opstår som følge af brug af Investtechs analyser. Oplysninger om eventuelle interessekonflikter vil altid fremgå af investeringsanbefalingen. Yderligere information om Investtechs analyser findes på infosiden.

Investeringsanbefalinge(r)n(e) er udarbejdet af Investtech.com AS ("Investtech"). Investtech garanterer ikke for fuldstændigheden eller rigtigheden af analysen. Eventuel eksponering i forhold til de råd / signaler, som fremkommer i analyserne, står helt og holdent for investors regning og risiko. Investtech er hverken direkte eller indirekte ansvarlig for tab, der opstår som følge af brug af Investtechs analyser. Oplysninger om eventuelle interessekonflikter vil altid fremgå af investeringsanbefalingen. Yderligere information om Investtechs analyser findes på infosiden.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices