Three short to medium term opportunities

Published February 14, 2019

The market showed a small loss Wednesday, and Nifty 50 (NIFTY) ended the day at 10794 points, which is a decline of 0.35 percent. The index has now closed down for the fourth day in a row.

Like we had suggested last time to stay with caution when Nifty had given a breakout from a rectangle formation, we hold our comment and suggest the same this time again. Why? Because there is still resistance at 11060 points which the index has not been able to defeat.

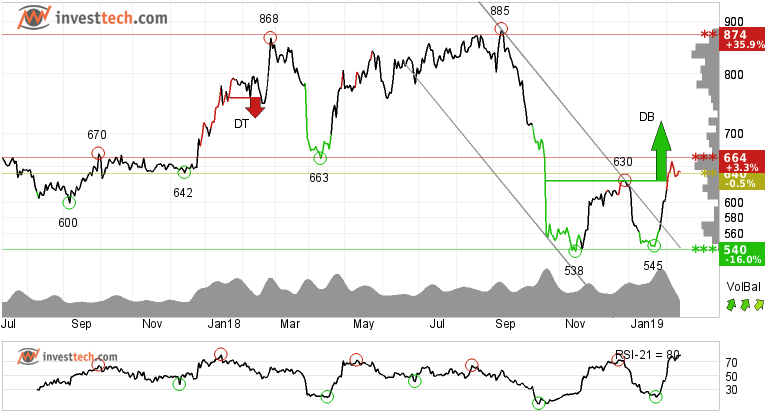

Persistent Systems Lim (PERSISTENT.NS) Close: 642.90

Persistent Systems Limited has broken through the ceiling of a falling trend channel in the medium term. This indicates a slower falling rate initially, or the start of a more horizontal development. The stock has given positive signal from double bottom formation by a break up through the resistance at 630. Further rise to 720 or more is signaled.

Positive volume balance and strong momentum supports the rally. The stock has risen sharply after bottoming out around 545 levels and under resistance at 664. One must maintain proper stop-loss.

Recommendation one to six months: Buy

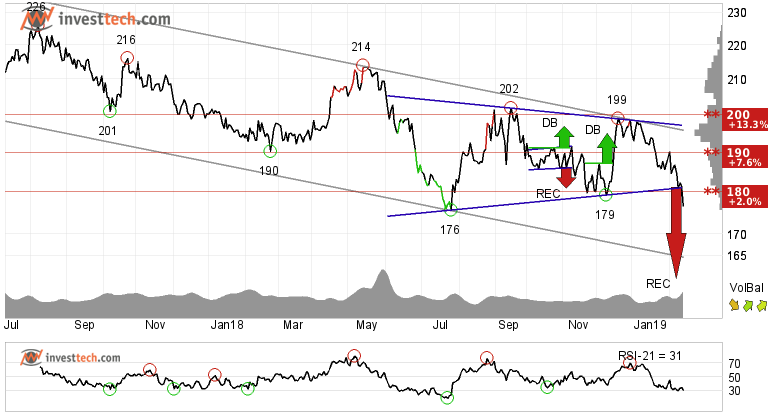

Power Grid Corporation (POWERGRID.NS) Close: 176.55

Power Grid Corporation of India Limited is inside a falling trend channel in all time frames, short, medium and long term. Falling trends indicate that the company experiences negative development and declining buy interest among investors. The stock has broken a rectangle formation and may fall further down to 160 rupees or lower.

The stock has resistance between 180 and 190. The stock is overall assessed as technically negative for the medium term.

Recommendation one to six months: Sell

Lupin Limited (LUPIN.NS) Close: 791.40

Lupin Limited has broken the falling trend channel down in the medium term. It also gave a negative signal from a rectangle formation at the break down through the support at 813. Target from the formation is around 755, however, the stock can fall further. The stock has support at 735. A fall below that level may lead to fresh selling. There is resistance around 810-820 rupees.

RSI below 30 shows that the momentum of the stock is strongly negative in the short term. Investors have steadily gone down on price to sell the stock, which indicates increasing pessimism and continued falling prices. The stock is overall assessed as technically negative for the short to medium term.

Recommendation one to six months: Sell

The analyses are based on closing price as per February 13, 2019. Maintaining proper stop loss is always recommended.

Skrevet af

Analytiker

i Investtech

Archive:

08 February: One buy and one sell in stocks while index suggests caution

06 February: One buy and one sell, short to medium term opportunities

01 February: Upside breakout from price formations

30 January: Buying opportunity: Reversing from trend channel support

9 January: One positive and one to stay away from

2 January: A good investment opportunity

2018

21 December: Good buying opportunities

14 December: Positive on these three stocks

11 December: One buy and one sell signal

07 December: Sell Signals in Three Big Stocks

04 December: Highest scorer of our Top 50 list

30 November: Positive stocks with 5-11 per cent upside potential

28 November: Buy signal on high volume

27 November: One Buy and One Sell Signal

23 November: Fear dominates these stocks

21 November: Sell signal, time to stay away

20 November: Early opportunity from short term buy signal?

16 November: Two Buy Signals and One Sell Signal

15 November: Buy signal in this one

13 November: Big auto stocks comparison

09 November: What to wait for?

06 November: Banking stocks look positive

02 November: Positive on this one

01 November: TECHM, NIFTY50 and Hausse

31 October: What are investors thinking?

30 October: Bullish on these three stocks

26 October: Three potential candidates to ride on

24 October: Three big Metal stocks, Seasonal variation

22 October: Among top performers on our Top 50 list

18 October: Three stocks investors should stay away from

17 October: Flowing against the tide

16 October: Positive on these 2 stocks

11 October: Over 45 per cent rise

9 October: The Indian banking space

5 October: Nifty closes at a crucial level

2 October: Price formations in the long-term charts

28 September: Positive on Biocon Limited

"Investtech analyserer psykologien i markedet og giver dig konkrete tradingforslag hver dag."

Partner & Senior Advisor - Investtech

Investeringsanbefalinge(r)n(e) er udarbejdet af Investtech.com AS ("Investtech"). Investtech garanterer ikke for fuldstændigheden eller rigtigheden af analysen. Eventuel eksponering i forhold til de råd / signaler, som fremkommer i analyserne, står helt og holdent for investors regning og risiko. Investtech er hverken direkte eller indirekte ansvarlig for tab, der opstår som følge af brug af Investtechs analyser. Oplysninger om eventuelle interessekonflikter vil altid fremgå af investeringsanbefalingen. Yderligere information om Investtechs analyser findes på infosiden.

Investeringsanbefalinge(r)n(e) er udarbejdet af Investtech.com AS ("Investtech"). Investtech garanterer ikke for fuldstændigheden eller rigtigheden af analysen. Eventuel eksponering i forhold til de råd / signaler, som fremkommer i analyserne, står helt og holdent for investors regning og risiko. Investtech er hverken direkte eller indirekte ansvarlig for tab, der opstår som følge af brug af Investtechs analyser. Oplysninger om eventuelle interessekonflikter vil altid fremgå af investeringsanbefalingen. Yderligere information om Investtechs analyser findes på infosiden.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices