Two stocks that have stood the test of time

Published June 12, 2019

The market showed a small gain Tuesday, and Nifty 50 (NIFTY) ended the day at 11966 points, which is an increase of 0.36 percent.

We are writing about two stocks that have stood the test of time, seen the ups and downs of the market in the past ten months and still holding strong, none the less making new highs. Axis Bank Limited and Titan Company Limited

Titan Company Limited (TITAN.NS) Close: 1284.95

Investors have paid higher prices over time to buy Titan Company Limited and the index is in a rising trend channel in the short, medium and long term. This shows that investors over time have bought the stock at higher prices and indicates good development for the company. The stock is up by over 70 percent which is huge for a Nifty 50 stock. The stock has support around 1240 rupees, while there is no resistance in the stock since it close at its all time high on Tuesday.

RSI above 70 shows that the stock has strong positive momentum in the short term. Investors have steadily paid more to buy the stock, which indicates increasing optimism and that the price may continue to rise. The stock is overall assessed as technically slightly positive for the medium to long term.

Recommendation one to six months: Positive

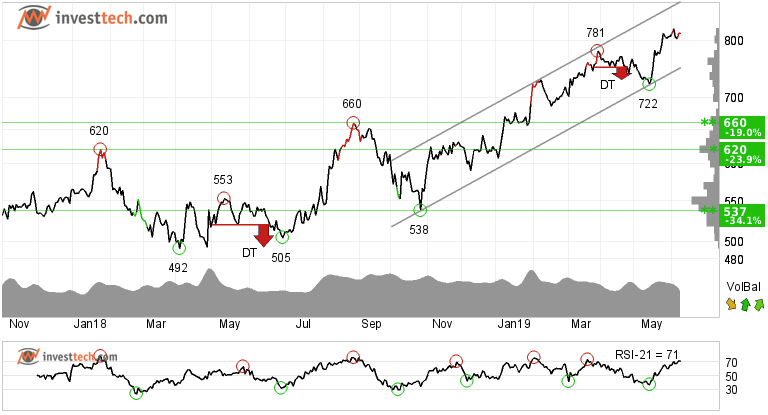

Axis Bank Limited (AXISBANK.NS) Close: 814.80

Axis Bank Limited has risen by 51 percent since its bottom in late October. The stock shows strong development within a rising trend channel in the medium term. Rising trends indicate that the company experiences positive development and that buy interest among investors is increasing. In the longer term chart the stock has broken above the upper trend channel line which indicates even stronger rate of rise for the stock.

Volume balance is positive. Volume tops and volume bottoms correspond well with tops and bottoms in the price. This strengthens the trend. RSI is above 70 after a good price increase the past weeks. The stock has strong positive momentum and further increase is indicated.

There is little resistance around 822.80 rupees so the upside can be big, while there is support around 768 rupees.

Recommendation one to six months: Positive

The analyses are based on closing price as per June 11, 2019. Maintaining proper stop loss is always recommended.

Skrevet af

Analytiker

i Investtech

Archive:

5 June: How to stay invested in a market like this?

29 May: Three buy signals, strong momentum and positive volume balance

21 May: Two buy and one interesting to watch

6 May: This banking stock has gone up by 20% in the last six months

2 May: Three exciting buy opportunities - Price breakouts

24 April: Exclusive research report: Rectangles and return from breakouts

17 April: Stock with 20 per cent upside potential

11 April: Three buy opportunities, price-volume breakout

29 March: Two stocks to stay from

27 March: Recent breakouts in three stocks, short term opportunity

21 March: Three buy and one sell

12 March: Cement stocks are posing good opportunity

08 March: Clear breakout and reversal from intermediate downtrend

07 March: Deepak Nitrite Limited looks promising to enter into a trade

06 March: Three buy candidates for medium to long term

28 February: Breakout in these three stocks invites for early opportunity

26 February: Two buy opportunities for the near term future

21 February: Stocks with RSI above 70, based on our research

19 February: Close to selling point, time to be cautious

15 February: These two sugar stocks look promising

14 February: Three short to medium term opportunities

08 February: One buy and one sell in stocks while index suggests caution

06 February: One buy and one sell, short to medium term opportunities

01 February: Upside breakout from price formations

30 January: Buying opportunity: Reversing from trend channel support

9 January: One positive and one to stay away from

2 January: A good investment opportunity

2018

21 December: Good buying opportunities

14 December: Positive on these three stocks

11 December: One buy and one sell signal

07 December: Sell Signals in Three Big Stocks

04 December: Highest scorer of our Top 50 list

30 November: Positive stocks with 5-11 per cent upside potential

28 November: Buy signal on high volume

27 November: One Buy and One Sell Signal

23 November: Fear dominates these stocks

21 November: Sell signal, time to stay away

20 November: Early opportunity from short term buy signal

16 November: Two Buy Signals and One Sell Signal

15 November: Buy signal in this one

13 November: Big auto stocks comparison

09 November: What to wait for?

06 November: Banking stocks look positive

02 November: Positive on this one

01 November: TECHM, NIFTY50 and Hausse

31 October: What are investors thinking?

30 October: Bullish on these three stocks

26 October: Three potential candidates to ride on

24 October: Three big Metal stocks, Seasonal variation

22 October: Among top performers on our Top 50 list

18 October: Three stocks investors should stay away from

17 October: Flowing against the tide

16 October: Positive on these 2 stocks

11 October: Over 45 per cent rise

9 October: The Indian banking space

5 October: Nifty closes at a crucial level

2 October: Price formations in the long-term charts

28 September: Positive on Biocon Limited

"Investtech analyserer psykologien i markedet og giver dig konkrete tradingforslag hver dag."

Partner & Senior Advisor - Investtech

Investeringsanbefalinge(r)n(e) er udarbejdet af Investtech.com AS ("Investtech"). Investtech garanterer ikke for fuldstændigheden eller rigtigheden af analysen. Eventuel eksponering i forhold til de råd / signaler, som fremkommer i analyserne, står helt og holdent for investors regning og risiko. Investtech er hverken direkte eller indirekte ansvarlig for tab, der opstår som følge af brug af Investtechs analyser. Oplysninger om eventuelle interessekonflikter vil altid fremgå af investeringsanbefalingen. Yderligere information om Investtechs analyser findes på infosiden.

Investeringsanbefalinge(r)n(e) er udarbejdet af Investtech.com AS ("Investtech"). Investtech garanterer ikke for fuldstændigheden eller rigtigheden af analysen. Eventuel eksponering i forhold til de råd / signaler, som fremkommer i analyserne, står helt og holdent for investors regning og risiko. Investtech er hverken direkte eller indirekte ansvarlig for tab, der opstår som følge af brug af Investtechs analyser. Oplysninger om eventuelle interessekonflikter vil altid fremgå af investeringsanbefalingen. Yderligere information om Investtechs analyser findes på infosiden.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices