Return following signals from short term rectangle formations - Oslo Stock Exchange 1996-2014

Research results from Investtech, 14 June 2017

Published in Norwegian on 25 April 2017. Norwegian original here >>

About the author

Geir Linløkken is the Head of Analysis and Research at Investtech, and is responsible for portfolios and money management. He founded Investtech in 1997, to provide independent technical analyses based on science and investor psychology. Mr. Linløkken has an MSc. in Computer Science, specializing in Mathematical Modeling, at the University of Oslo. He is the author of the book “Technical Stock Analysis”. His daily work includes analysing stocks and developing quantitative methods for stock market investments.

Keywords: rectangle formation, buy signal, sell signal, Oslo stock exchange, technical analysis, statistics

Abstract:

Geometric price patterns, like rectangles, are used in technical analysis to predict future price development. Many investors use this as an important part of their decision making process when buying or selling stocks. We have looked at the price movements that followed short term buy and sell signals from rectangle formations on the Oslo Stock Exchange in a period of 19 years, from 1996 to 2014. Stocks with buy signals on average rose twice as much as benchmark index for the first month following the signal, increasing by 2.2 per cent, and continued to give excess return for the following two months as well. Stocks with sell signals clearly underperformed compared to index, both in the first month and in the first three months.

Research into technical price formations

This research report is part of a bigger research project conducted by Investtech into price development following technical formations in stock prices. This report studies short term rectangle formations on the Oslo Stock Exchange in Norway.

| Short term | Medium term | Long term | |

| Rectangle | Present | Report | Report |

| Inverse/ head and shoulders | Report | Report | Report |

| Double top, double bottom | Report | Report | Report |

Rectangle formations

Identification of geometric price patterns in stock prices is an important area of technical analysis. The idea is that these patterns describe the investors’ mental state, i.e. whether they will want to sell or buy stocks in the time ahead, and they thereby indicate the future direction of the stock price. Rectangle formations are one type of such patterns.

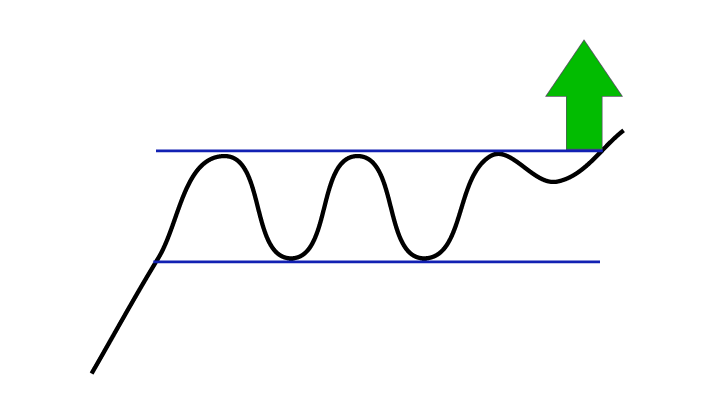

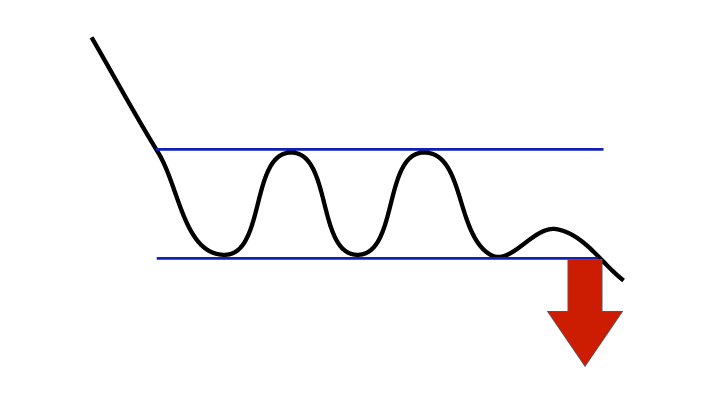

The development of a rectangle formation indicates that the investors are unsure about the future direction of the stock. The price moves sideways between a support level and a resistance level. A break upwards mirrors the investors’ increasing optimism. According to technical analysis theory, the price will then rise by at least as much as the height of the rectangle, see figure 1.

Figure 1: A stock develops a rectangle formation when the price moves sideways between a support line and a resistance line. If the price breaks up from the rectangle, it triggers a buy signal, and according to technical analysis theory the stock price will rise at least as much as the height of the formation. If the price breaks downwards, it triggers a sell signal, and the stock price will fall accordingly.

Figure 2: Buy signal from rectangle formation.

Figure 3: Sell signal from rectangle formation.

In technical analysis terminology we say that a break upwards triggers a buy signal. Similarly a break downwards from a rectangle formation triggers a sell signal. We have investigated the price movements following short term buy and sell signals from rectangle formations on Norway’s Oslo Stock Exchange.

Identification

Identification of rectangle formations in stock prices is no simple task. The figure above shows that the price moves sideways between a clearly defined support level and a similar resistance level. However, stock prices are rarely as even as those in the illustration. Often there are rectangle-like figures where the support and resistance lines may be a little crooked or otherwise diverge.

Many investors identify rectangle formations by looking at price charts and drawing support and resistance lines by hand. This method has many weaknesses, most of all that it is subjective, allowing you to see the formations you want to see, and it is very time consuming. Therefore we need an automatic algorithm whereby computers identify the formations and the signals they trigger.

Investtech has studied technical and quantitative analysis since 1997. We have developed mathematical algorithms for automatic identification of rectangle formations in stock prices. The formations are entered into the technical analysis charts, shows in signal lists and presented updated daily to Investtech’s subscribers.

In this report we have looked at the price movements that follow short term buy and sell signals from rectangle formations on the Oslo Stock Exchange. The statistics are based on rectangle formations automatically recognized by Investtech’s computer programs. No parameter optimization or changes to algorithms have been made during this study. This is an analysis based on the existing historical material.

The Base Data

We have used stock prices from 1.1.1996 to 10.10.2014 as the basis for the statistics. In this period, the main index on the Oslo Exchange rose from 106.9 to 573.6 points, which is 437 % or approximately 9.3 % a year. Compared to the risk free interest rate in this period, this is approximately what can be expected for similar periods of time.

In eight of these 19 years, the exchange rose by over 30 %, while it fell by more than 10 % in five of the years, and varied between minus 10 % to plus 30 % in five of the years. We have had both good and bad periods, and several sideways periods as well, and consider this representative for a normal period of time on the exchange.

All stocks that have been listed in the period are included. Stocks that have been delisted due to for instance mergers, takeovers and bankruptcy are included. However, we only have data for these companies for as long as they were listed. A company which went bankrupt will then have a final trading price which is not zero, which is a weakness in this study. However, this is only the case for a small number of companies. Most companies also fall a lot before they are delisted, so the difference between the price fall from when they were listed and a price fall down to zero will be small.

It is also very rare that new buy signals are generated from rectangle formations when a company’s stock price is falling. Therefore it matters very little to the statistics for buy signals. Return from sell signals would however have been a little weaker had we corrected for bankruptcies. Combined it is our opinion that these conditions have minimal impact on the results of this study.

All prices are adjusted for splits, dividend payments, reverse splits, and other corporate capital changes, in order to reflect the actual value development of the stocks.

715 time series are included, of which 597 are stocks with at least 66 days of trading. At the end of the period, approximately 220 stocks were listed on the exchange.

The stock’s daily closing price is used. We have only used prices and turnover figures from the stock’s primary market place. Alternative markets like Chi-X, Bats and Burgundy are excluded.

The Data Set

We have used Investtech’s algorithms for automatic identification of rectangle formations. The algorithms were run on short term charts made up of 65 business days, approximately 5 calendar months. We consider the algorithms good at identifying actual rectangle formations, and they do not classify indistinct rectangles as actual rectangles.

At identification of signals, only data up to the date the signal was triggered were used. The later data were hidden from the algorithm.

Basically all signals identified from rectangle formations are used. Normally each formation only triggers one signal. However, in rare cases they may trigger several signals. This happens if the price following the break reacts back into the formation, creates a modified formation and then breaks out again.

Sometimes one stock can also trigger several signals on the same day. This happens if the algorithms have recognized several formations of different length and height which are broken out from at the same time.

In order to have the data set as representative for the Oslo Stock Exchange as possible, we remove certain signals from the data set:

- Duplicate signals are removed. This will be the case when there have been mergers and ticker changes, where Investtech has two editions of the same historical time series. For instance, we remove a buy signal from DNB if we already have it for DNBNOR.

- Signals that are very close in time to a previous signal are removed. It is a requirement that there have been at least seven calendar days since the previous signal from the same stock in order for a new signal to be counted.

- Formations that are less than 2 % in height are discarded. These are small and considered to have low signal value.

- Signals from stocks with poor liquidity are discarded. This is because it is difficult for investors to make actual trades in such stocks, and also because the price is often uneven and with big leaps, making pricing uncertain and subject to noise.

We discard signals where daily average turnover on the Oslo Exchange in the past ten days including the signal day was lower than half a million Norwegian krone (NOK) or where the stock was traded on less than half the days. This also removed all signals from the exchange indices, leaving us with signals from stocks and equity certificates only, and a few traded funds. The actual turnover of stocks that gave signals may have been above this limit, as trade in other markets than the Oslo Exchange, like Chi-X, Bats and Burgundy, are not included. - Signals with less than 66 days' price history following the signals are removed. This gives complete price history for the first 66 days following the signals.

Our data set now consists of 1383 identified buy signals and 1072 sell signals from short term rectangle formations in stocks and equity certificates on the Oslo Stock Exchange in the period 1996 to 2014.

Results

The chart below shows average price development following buy and sell signals from rectangle formations. The signals are triggered on day 0. Only days when the exchange is open are included, so 66 days equal approximately three months. Buy signals are the blue line and sell signals are the red one. The shaded areas are the standard deviation of the calculations. Benchmark index is the black line.

Figure 4: Price development following buy and sell signals from rectangle formations on the Oslo Stock Exchange identified by Investtech’s automatic algorithms in short term charts. Click the image for bigger version.

Buy signals

| Buy signal | Day 1 | 10 | 22 | 66 |

| Absolute | 100.26 | 101.25 | 102.15 | 104.74 |

| Benchmark | 100.05 | 100.48 | 101.06 | 103.31 |

| Relative | 0.21 | 0.78 | 1.09 | 1.43 |

| T-value | 2.34 | 3.17 | 2.83 | 2.01 |

Buy signals from rectangle formations identified in Investtech's short term charts have historically given good price increase the following months. On average the stocks with buy signals have risen by 4.7 per cent in the next three months. This is significantly better than benchmark, which rose 3.3 per cent in the same period. In 22 days the stocks rose by 2.2 per cent and benchmark by 1.1 per cent.

The price increase is stronger in the first days after the signal, but the stocks continue upwards both in absolute terms and relative to benchmark for the whole period. In the first 22 days, approximately for the first month, the signal stocks rise by 0.10 per cent on average per day. The next 44 days they rise by 0.06 per cent on average per day.

The average figures are calculated based on 1,386 observations. This is a fairly high number, which means the significance of the estimates is relatively high. The blue shaded area shows the standard deviation of the estimates. Assuming normal distribution, the average price development following buy signals from short term rectangle formations has a 68 % probability of falling within this interval.

After 10 days the return is t=3.2 standard deviations above benchmark and after 22 days it is t=2.8 standard deviations above. Assuming we have independent samples with normal distribution, this is a significant deviation from a null hypothesis.

After 66 days the return is t=2.0 standard deviations above benchmark. Although the chart and percentages show clear average excess return from buy signals from short term rectangle formations, even on such relatively long term as three months, this is at the lower limit of being classified as a statistically significant deviation from a null hypothesis. Especially so because we know that stocks to some extent see covariance and that the samples therefore are not statistically independent.

Sell signals

| Sell signal | Day 1 | 10 | 22 | 66 |

| Absolute | 100.30 | 100.21 | 100.41 | 101.88 |

| Benchmark | 100.05 | 100.48 | 101.06 | 103.31 |

| Relative | 0.25 | -0.27 | -0.66 | -1.44 |

| T-value | 2.19 | -0.85 | -1.47 | -1.74 |

Sell signals from rectangle formations identified in Investtech’s long term price charts have historically increased by an average of 1.9 per cent the following three months. Even though they have risen, they have developed clearly weaker than average benchmark, with a negative excess return of 1.4 percentage points. In 22 days the stocks had increased by 0.4 per cent, a negative excess return of 0.7 percentage points.

In relative terms the development is weaker in the first 22 days following the sell signals, but the stocks have developed weaker than average benchmark also for the next 44 days.

The average figures are calculated based on 1,072 obersvations over 19 years. In 10, 22 and 66 days, return is respectively t=0.9, t=1.5 and t=1.7 standard deviations below benchmark. Although the chart and percentages show clear average negative excess return from sell signals from short term rectangle formations, this is at the lower limit of being classified as a statistically significant deviation from a null hypothesis.

The Stockholm Stock Exchange in Sweden

Figure 5. Price development following signals from short term rectangle formations on the Stockholm Stock Exchange 2003-2014

We have conducted the same study on the Stockholm Stock Exchange in Sweden, for the period 1 April 2003 to 10 October 2014. Investtech’s computers identified 1,887 buy signals and 1,425 sell signals in this period.

Return one and three months after buy signals from short term rectangle formations was on average 2.4 and 5.9 per cent respectively, and excess return was 1.2 and 2.1 percentage points relative to benchmark. The excess return is t=4.0 standard deviations above benchmark.

Price development following sell signals from short term rectangle formations in Stockholm was on average on par with benchmark.

Summary

We have studied return from stocks on the Oslo Stock Exchange with signals from technical rectangle formations over a period of 19 years, from 1996 to 2014. Investtech’s automatic algorithms identified a total of 1,383 buy signals and 1,072 sell signals from such formations in short term price charts

The buy signals gave an average return of 4.7 per cent the next three months, while the sell signals have a return of 1.9 per cent. Relative to average benchmark development, buy signals gave an excess return of 1.4 percentage points and sell signals a negative excess return of 1.4 percentage points. Statistical t-values were 2.0 and 1.7 for buy and sell signals respectively.

Short term, a month after signal, which is the most relevant for signals from short term price charts, average return after buy signals was 2.2 %, while the sell signals gave a return of 0.4 %. Relative to average benchmark development, buy signals gave an excess return of 1.1 percentage points and sell signals negative excess return of 0.7 percentage points. Statistical t-values were 2.8 and 1.5 for buy and sell signals respectively.

The same study for the stocks in Stockholm showed good excess return after buy signals, with statistical t-values up to 4.0, while stocks with sell signals developed in line with average stock exchange development.

The time period for the study is fairly long, the quality of the data is considered to be good and the algorithms used are entirely automatic and deemed to identify only actual rectangle formations. Statistical measures suggest a high degree of significance for positive price development following buy signals. If we assume that conditions that influence pricing in the stock market remain steady over time, we believe that buy signals from rectangle formations will give similar results in the future and can be a good indicator for future price increase. The results are in agreement with classical technical analysis theory about rectangle formations.

The Oslo sell signals were followed by falling prices compared to benchmark, while the Swedish ones showed neutral development. Combined the results show weak negative development after sell signals from short term rectangle formations, but the figures are not statisically significant. We may want to study such formations over a longer period of time or from other stock exchanges to get a bigger data set.

Technical analysis theory on rectangle formations says that the formations have stronger predictive power when triggering signals in the same direction as the trend. This is a possible topic for a future research project.

Literature

- Investtech, help pages. Price formations. Link

- Investtech, help pages. Buy signal from rectangle formation. Link

- Investtech, help pages. Sell signal from rectangle formation. Link

- Geir Linløkken. Buy signals from rectangle formations - how often are they successful? Investtech.com, 2005. Link

- Geir Linløkken and Steffen Frölich. Technical StockAnalysis - for reduced risks and increased returns. Investtech.com, 2001.

- John J. Murphy. Technical Analysis of the Financial Markets. New York Institute of Finance, 1999.

Skrevet af

Forsknings- og analysechef

i Investtech

"Investtech analyserer psykologien i markedet og giver dig konkrete tradingforslag hver dag."

Partner & Senior Advisor - Investtech

Investeringsanbefalinge(r)n(e) er udarbejdet af Investtech.com AS ("Investtech"). Investtech garanterer ikke for fuldstændigheden eller rigtigheden af analysen. Eventuel eksponering i forhold til de råd / signaler, som fremkommer i analyserne, står helt og holdent for investors regning og risiko. Investtech er hverken direkte eller indirekte ansvarlig for tab, der opstår som følge af brug af Investtechs analyser. Oplysninger om eventuelle interessekonflikter vil altid fremgå af investeringsanbefalingen. Yderligere information om Investtechs analyser findes på infosiden.

Investeringsanbefalinge(r)n(e) er udarbejdet af Investtech.com AS ("Investtech"). Investtech garanterer ikke for fuldstændigheden eller rigtigheden af analysen. Eventuel eksponering i forhold til de råd / signaler, som fremkommer i analyserne, står helt og holdent for investors regning og risiko. Investtech er hverken direkte eller indirekte ansvarlig for tab, der opstår som følge af brug af Investtechs analyser. Oplysninger om eventuelle interessekonflikter vil altid fremgå af investeringsanbefalingen. Yderligere information om Investtechs analyser findes på infosiden.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices