Support and Resistance: Research results cause doubt about buy signals

Published 10 October 2019

New research results from Investtech show that stocks which have reacted downwards and are testing support have developed in line with benchmark in the following period. Such signals give little information about future price development and can be dropped from a technical analysis of a stock. These results cause doubt about an important element of technical analysis theory.

According to technical analysis theory, support and resistance are among the most central concepts in technical analysis and can in theory be used to find good buy and sell levels.

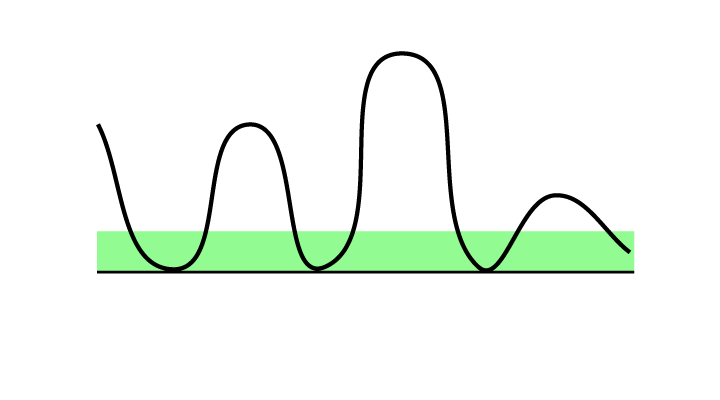

Figure 1: Price is near support. The stock has reversed here before. Many investors now find it to be cheap and may wish to buy again. In theory, a stock which is near support is therefore expected to rise. The definition of support says that more and more buyers are active the closer the price gets to the support level. It can be favourable to set a buy order a little above the support level when wanting to buy such stocks. Please note that a break downwards through support will trigger a sell signal. The price can potentially fall very much in a short time. It can be risky to buy on support especially if volume development is negative or the stock is in a falling trend.

Figure 1: Price is near support. The stock has reversed here before. Many investors now find it to be cheap and may wish to buy again. In theory, a stock which is near support is therefore expected to rise. The definition of support says that more and more buyers are active the closer the price gets to the support level. It can be favourable to set a buy order a little above the support level when wanting to buy such stocks. Please note that a break downwards through support will trigger a sell signal. The price can potentially fall very much in a short time. It can be risky to buy on support especially if volume development is negative or the stock is in a falling trend.

Research results

We have studied return from Norwegian, Swedish, Danish and Finnish stocks following signals triggered by stocks' movements in relation to support and resistance levels in technical price charts. We used support and resistance levels automatically identified in Investtech’s medium term price charts. We had 23 years of data, from 1996 to 2018.

The chart below shows average price development following buy signals from stocks reacting downwards towards support identified in Investtech’s medium term price charts. The signals are triggered on day 0. Only days when the exchange is open are included, so 66 days equal approximately three months. The thick blue line shows the development of buy signal stocks. The shaded areas are the standard deviation of the calculations. The thin blue line shows benchmark development in the same period as the buy signal stocks.

Figure 2: Return following buy signals from stocks with reaction downwards to support identified in Investtech’s medium term price charts. Thick blue line is buy signals, thin blue line is benchmark, the Nordic markets, 1996-2018.

| Annualised return (based on 66-day figures) | Norway | Sweden | Denmark | Finland | Weighted average |

| Buy signal | 8.7 % | 12.9 % | 6.0 % | 6.8 % | 10.3 % |

| Benchmark in same period | 10.2 % | 12.2 % | 7.9 % | 5.5 % | 10.4 % |

| Excess return buy signal | -1.5 pp | 0.7 pp | -1.8 pp | 1.2 pp | -0.2 pp |

pp = percentage points

Stocks with buy signals from reactions downwards to support have risen in the following period. In the first two weeks, the stocks on average did just barely better than benchmark in the same period, and in the next two and a half months, they did the same as or a little weaker than benchmark.

In absolute figures these stocks have risen and the signals have worked well as buy signals. But benchmark has also risen, and on average signal stocks have followed benchmark closely.

The difference vs benchmark is at most 0.1 percentage points in the three-month period. T-values are low, especially at the end of the period, suggesting weak statistical significance. Either way the deviation is much too small for these signals to be suited to active trading.

Article on sell signals:

Support and Resistance: Profitable to buy stocks that are near resistance

Read the research report here.

Keywords: h_SupClose.

Kirjoittaja

Perustaja ja tutkimustyön johtaja

Investtech

Research articles:

Support and Resistance: Research results cause doubt about buy signals

Support and Resistance: Profitable to buy stocks that are near resistance

Support and Resistance: Break upwards through resistance is a buy signal

Support and Resistance: Break downwards through support is a sell signal

Support and Resistance: Buy signal when stock is above support and lacks resistance

Support and Resistance: Good sell signals from stocks that are far below resistance and lack support

Please note:

Changes to Support and Resistance algorithms

Insight & Skills:

"Investtech analysoi markkinoiden psykologiaa ja antaa konkreettisia kaupankäyntisuosituksia päivittäin."

Partner & Senior Advisor - Investtech

Investtech ei takaa analyysien tarkkuutta tai kattavuutta. Kaikkien analyysien tuottamien neuvojen ja signaalien käyttäminen on täysin käyttäjän vastuulla. Investtech ei vastaa mistään tappioista, jotka saattavat syntyä Investtechin analyysien käytön seurauksena. Mahdollisten eturistiriitojen yksityiskohdat mainitaan aina sijoitusneuvon yhteydessä. Lisätietoja Investtechin analyyseistä löytyy täältä disclaimer.

Investtech ei takaa analyysien tarkkuutta tai kattavuutta. Kaikkien analyysien tuottamien neuvojen ja signaalien käyttäminen on täysin käyttäjän vastuulla. Investtech ei vastaa mistään tappioista, jotka saattavat syntyä Investtechin analyysien käytön seurauksena. Mahdollisten eturistiriitojen yksityiskohdat mainitaan aina sijoitusneuvon yhteydessä. Lisätietoja Investtechin analyyseistä löytyy täältä disclaimer.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices