Nasdaq Combined Compos (COMPX.US)

Bas risk

Analyse générale

Nasdaq Combined Composite Index est techniquement négatif pour les court et long termes, et positif pour le moyen terme.Recommendation one to six months: Conclusion légèrement négative (Score: -28)

Court terme

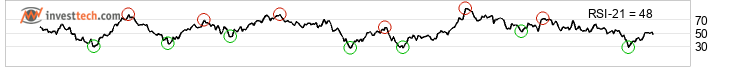

Nasdaq Combined Composite Index a débordé du canal haussier à la baisse. Cela indique dans un premier temps, un taux de croissance plus faible ou le début d'un développement plus horizontal. La valeur a subi une baisse importante après le signal de vente de la formation rectangulaire et le franchissement à la baisse du support à 16080. L'objectif de 15731 est maintenant atteint, mais la formation indique une poursuite du développement dans la même direction. L'indice a marginalement franchi le support à environ 15630 points. Un franchissement établi et persistant peut indiquer une poursuite de la baisse. La courbe RSI montre une tendance baissière, ce qui pourrait être le signal précursuer d'une nouvelle tendance baissière. L'indice est généralement considéré comme negatif technique pour court terme.Recommendation one to six weeks: Négatif (Score: -62)

Moyen terme

Nasdaq Combined Composite Index progresse fortement dans un canal haussier. Pour la suite, la progression reste bien orientée et il y a du support en bas du canal haussier. Cependant la valeur a franchi un niveau de support sur le court terme et la stratégie de trading range court terme a donné un signal de vente. L'indice rencontre du support à environ 14300 points et de la résistance à environ 16400 points. La courbe RSI montre une tendance baissière, ce qui est le signal précurseur d'un éventuel changement de tendance. L'indice est généralement considéré comme positif technique pour moyen long terme.Recommendation one to six months: Positif (Score: 54)

Long terme

Nasdaq Combined Composite Index progresse fortement dans un canal haussier. Pour la suite, la progression reste bien orientée et il y a du support en bas du canal haussier. L'indice a franchi le support à environ 16000 points et une poursuite de la baisse est annoncée. L'indice est considéré comme légèrement negatif technique pour long terme.Recommendation one to six quarters: Conclusion légèrement négative (Score: -41)

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices