Support and resistance

Support and resistance are two of the most central concepts in technical analysis. Studying support and resistance may answer the following questions:

- Where is the price reversal most likely to happen?

- Where are sell and buy signals triggered?

Support and resistance are thus used to find good buy and sell levels.

Main principles

Support levels indicate where there will be a surplus of buyers. This may be because many have seen that the stock has turned upwards from these levels earlier, or that the stock at this level has a low fundamental price.

Resistance levels indicate where there will be a surplus of sellers. This may be because the stock has turned downwards from this level before, or that many think it is fundamentally expensive.

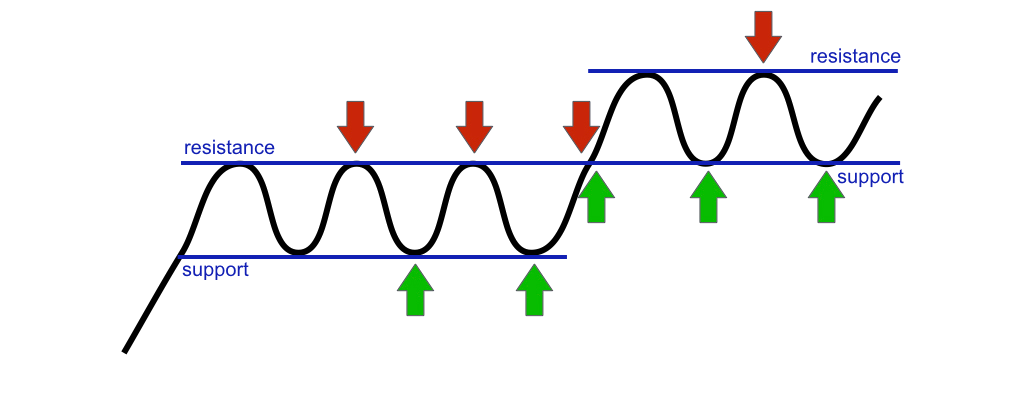

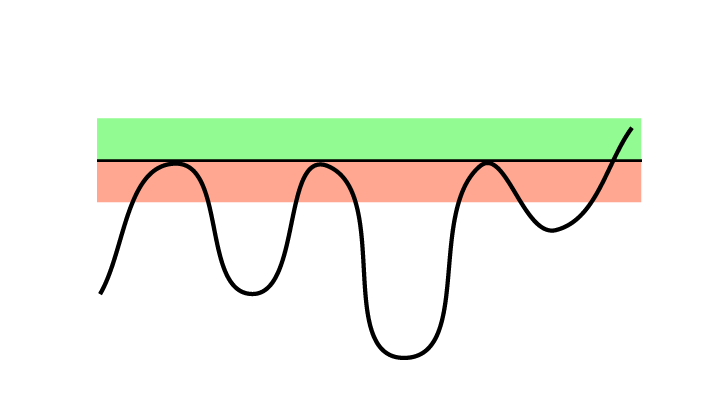

This is how support and resistance are normally used:

- Buy when the stock falls towards support.

- Sell when the stock rises towards resistance.

- Buy when the stock breaks up through resistance.

- Sell when the stock breaks down through support.

Please note that the price is often very volatile in the areas near support and resistance levels, i.e. it sees great short term fluctuations here. Consequently care should be taken not to place orders directly at support and resistance levels. The price will often not reach all the way to these levels. If you want to buy a stock, it may be a good idea to place a buy order a little above a support level. Similarly it may be a good idea to place a sell order somewhat below a resistance level.

When the price breaks through a resistance level, a buy signal is triggered. When it breaks through a support level, it triggers a sell signal. The price may then change several percentage points in a short time. Trade quickly or wait for a reaction back to get a better price.

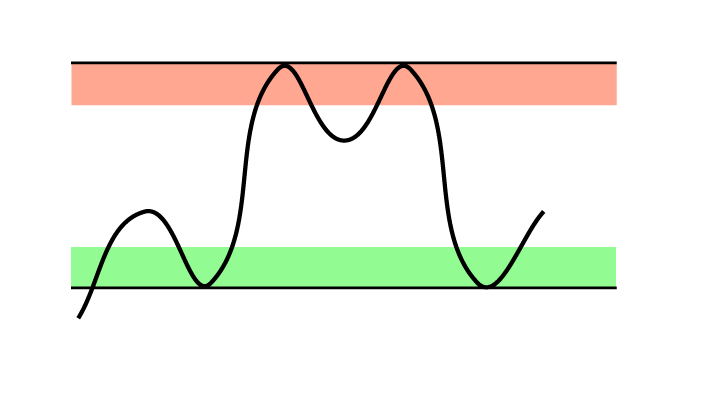

The figure shows how to trade based on support and resistance. Buy near support and sell near resistance. Buy at breaks upward through resistance.

Support is indicated with green horizontal lines and resistance with red lines in Investtech’s charts. The strength of the support and resistance levels are indicated with one to three stars, where three is the strongest. Support will always be below the current price, while resistance will always be above it.

Special circumstances

Support and resistance are especially important when the market moves sideways. Very good results can then be achieved through buying near support and selling near resistance.

However, if a stock is in a trend movement, i.e. a rising or falling trend, the trend overrides support and resistance.

Stocks in rising trends

Rising trends in general are strong and reliable positive trend movements. Rising trends continue for longer than many investors think, and often break upward through resistance. This triggers a sell signal, and the price may rise particularly strongly.

In principle this is why a stock in a rising trend should not be sold, even if it approaches resistance, especially in the case of long term investors.

On the contrary, it can be advantageous to buy stocks in rising trends when the stock also approaches horizontal support.

Stocks in falling trends

The opposite is true for falling trends.

In general, do not buy stocks in falling trends, even if they approach support. There is high risk for a break downward which will trigger a sell signal.

On the contrary, it can be advantageous to sell stocks in falling trends when the price has reacted upwards towards horizontal resistance.

Identification of support and resistance

Support levels indicate where there will probably be a surplus of buyers. Resistance levels indicate where there will probably be a surplus of sellers. Investtech tries to find these levels by looking at how investors think.

Why will an investor buy when the price falls to a certain level? The following applies:

- The investor thinks the stock is fundamentally cheap at this level.

- The investor has seen the stock turn upwards from this level before, without being able to buy. S/he sees that others have made good trades and want to be part of it this time.

- The investor has bought the stock at this level before and seen that it was a good trade. S/he wants to repeat the success and buy again.

- The investor sees that the stock is approaching a round figure, such as 10, 20, or 50. This gives increased attention. It is also easier to think that a stock is cheap if it breaks this kind of level, rather than if it moved between for example 36 and 38 dollars, and one wants to buy early.

The reason investors want to sell a stock can be explained in the same way.

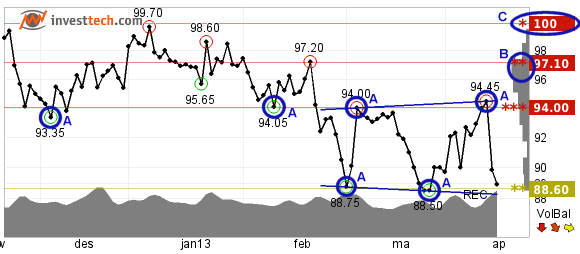

Thus the following are important elements in identifying support and resistance:

- Tops and bottoms in the price chart (pivot points). A in the chart below.

- Price levels where many stocks are traded (high accumulated volume). B in the chart below.

- Round figures. C in the chart below.

Investtech’s systems run mathematical routines in order to find the best support and resistance levels. Potential levels are identified and their strength calculated by, among other things, assessing how many previous tops and bottoms are in the chart near the price levels being considered. The calculation is done anew every day and all the prices in the chart are used as input.

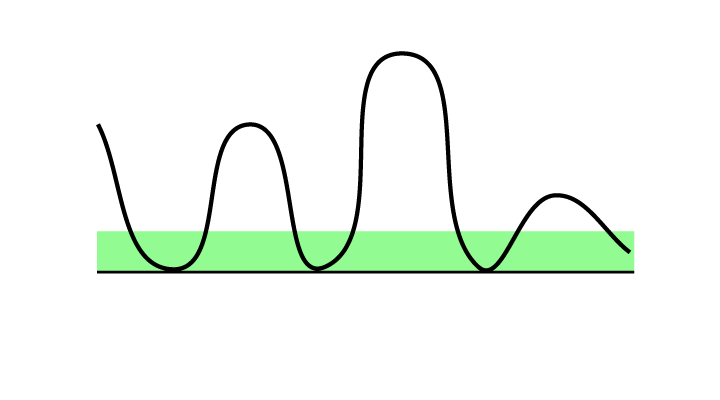

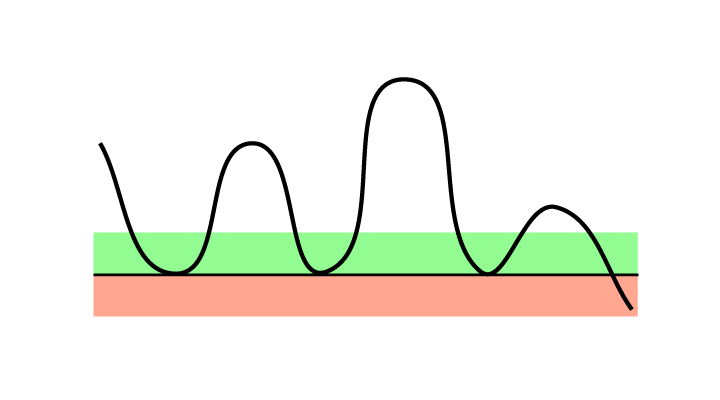

Price near support

Price is near support. The stock has reversed here before. Many investors now find it to be cheap and may wish to buy again.

Price near support is an indication that the price will rise. The definition of support says that more and more buyers are active the closer the price gets to the support level. It can be favourable to set a buy order a little above the support level when wanting to buy such stocks.

Price near support is an indication that the price will rise. The definition of support says that more and more buyers are active the closer the price gets to the support level. It can be favourable to set a buy order a little above the support level when wanting to buy such stocks.

Please note that a break downward through support will trigger a sell signal. The price can potentially fall very much in a short time. It can be risky to buy on support especially if volume development is negative or the stock is in a falling trend.

Investtech research: Price near support

statSummaryRelNeg statSummaryRelNegNumber

| Annualised return (based on 66-day figures) | |

| Signaux positifs moyen terme | 8.9% |

| Reference index | 9.6% |

| Excess return | -0.7pp |

statSummaryTemplate

Lire plus

- Research Report: Investtech Research: Return for stocks testing support and resistance in stock prices, the Nordic markets, 1996-2018 (Niveau d'accès exigé: PRO)

- Research Article: Support and Resistance: Research results cause doubt about buy signals

- Research Report: Investtech-forskning: Støtte og motstand - signalstatistikk Norden 2019 og 2020 (Niveau d'accès exigé: PRO)

- Research Report: Investtech-forskning: Støtte og motstand - signalstatistikk Norden 2008-2020 (Niveau d'accès exigé: PRO)

- Research Article: Investtech-forskning: Farlig å kjøpe på støtte

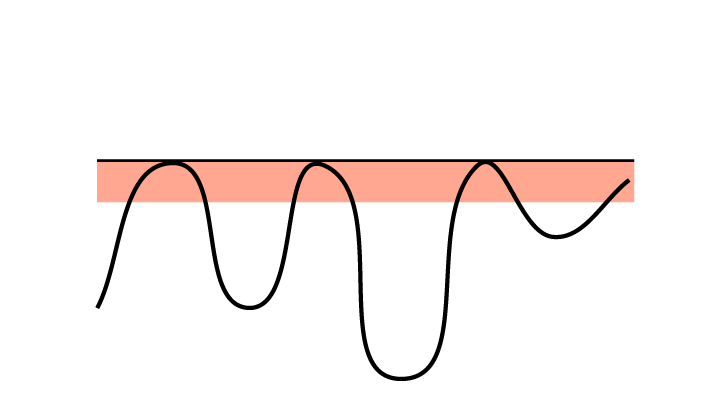

Price near resistance

Price is near resistance. The stock has reversed here before. Many investors now find it to be expensive and may wish to sell.

Price near a resistance level is an indication that the price will fall. The definition of resistance says that more and more sellers will be active the closer the price gets to the resistance level. It can be favourable to place a sell order a little below the resistance level when wanting to sell such stocks.

Price near a resistance level is an indication that the price will fall. The definition of resistance says that more and more sellers will be active the closer the price gets to the resistance level. It can be favourable to place a sell order a little below the resistance level when wanting to sell such stocks.

Please note that a break upward through resistance will trigger a buy signal. The price can potentially rise very much in a short time. Especially in the case of positive volume development or stocks in a rising trend, it can be a good idea to wait and not sell on resistance.

Investtech research: Price near resistance

statSummaryRelNeutral statSummaryRelPosNumber

| Annualised return (based on 66-day figures) | |

| Signaux négatifs moyen terme | 10.0% |

| Reference index | 9.7% |

| Excess return | 0.4pp |

statSummaryTemplate

Lire plus

- Research Report: Investtech Research: Return for stocks testing support and resistance in stock prices, the Nordic markets, 1996-2018 (Niveau d'accès exigé: PRO)

- Research Article: Support and Resistance: Profitable to buy stocks that are near resistance

- Research Report: Investtech-forskning: Støtte og motstand - signalstatistikk Norden 2019 og 2020 (Niveau d'accès exigé: PRO)

- Research Report: Investtech-forskning: Støtte og motstand - signalstatistikk Norden 2008-2020 (Niveau d'accès exigé: PRO)

- Research Article: Investtech-forskning: Svake signaler fra kurs nær støtte eller motstand

Break upward through resistance

A break upward through resistance is a buy signal. This is especially true if volume is also increasing. The sellers who used to be at this level are gone, but there is still buy pressure in the stock.

A stock that recently broke through a resistance level is expected to continue rising. Buying such stocks allows the investor to enter the stock early in a rising phase. If the stock has risen significantly since the break, a better price can be achieved by waiting for a reaction back.

A stock that recently broke through a resistance level is expected to continue rising. Buying such stocks allows the investor to enter the stock early in a rising phase. If the stock has risen significantly since the break, a better price can be achieved by waiting for a reaction back.

Please note that stocks in falling trends often give false buy signals on breaks upward through resistance. When buying such stocks, a long term and strong resistance level should be broken, and the break should be accompanied by increasing volume and positive volume development.

Investtech Research

The Nordic markets 1996-2018, a total of 43,367 buy signals.

Stocks with buy signal after break upwards through resistance have on average continued to rise and risen more than benchmark in the following months. Annualised return has been 5.1 percentage points better than benchmark

Read the research article here>>

Investtech research: Break upward through resistance

statSummaryRelPos statSummaryRelPosNumberSignificant

| Annualised return (based on 66-day figures) | |

| Signaux positifs moyen terme | 15.1% |

| Reference index | 11.0% |

| Excess return | 4.1pp |

statSummaryTemplate

Lire plus

- Research Report: Investtech Research: Return following testing of and breaks through support and resistance in stock prices, the Nordic markets, 1996-2018 (Niveau d'accès exigé: PRO)

- Research Article: Investtech Research: Support and Resistance - Summary

- Research Report: Investtech-forskning: Støtte og motstand - signalstatistikk Norden 2019 og 2020 (Niveau d'accès exigé: PRO)

- Research Report: Investtech-forskning: Støtte og motstand - signalstatistikk Norden 2008-2020 (Niveau d'accès exigé: PRO)

- Research Article: Investtech-forskning: Brudd opp gjennom motstand/ned gjennom støtte gir verdifulle tekniske signaler

Break downward through support

A break downward through support is a sell signal. Especially if volume is also increasing. The buyers who used to be at this level are gone, but there is still sales pressure in the stock.

A stock that recently broke downwards through a support level is expected to continue to fall. Selling or not buying such stocks help the investor avoid the continued fall. If the stock has fallen significantly since the break, a better price can be achieved by waiting for a reaction back.

A stock that recently broke downwards through a support level is expected to continue to fall. Selling or not buying such stocks help the investor avoid the continued fall. If the stock has fallen significantly since the break, a better price can be achieved by waiting for a reaction back.

Please note that stocks in rising trends often trigger false sell signals on breaks downward through support. Investors who own such stocks should normally see a break downward through a long term, strong support level, preferably on high volume, before selling.

Investtech research: Break downward through support

statSummaryRelNeg statSummaryRelNegNumber

| Annualised return (based on 66-day figures) | |

| Signaux négatifs moyen terme | 8.4% |

| Reference index | 11.2% |

| Excess return | -2.8pp |

statSummaryTemplate

Lire plus

- Research Report: Investtech Research: Return following testing of and breaks through support and resistance in stock prices, the Nordic markets, 1996-2018 (Niveau d'accès exigé: PRO)

- Research Article: Investtech Research: Support and Resistance - Summary

- Research Report: Investtech-forskning: Støtte og motstand - signalstatistikk Norden 2019 og 2020 (Niveau d'accès exigé: PRO)

- Research Report: Investtech-forskning: Støtte og motstand - signalstatistikk Norden 2008-2020 (Niveau d'accès exigé: PRO)

- Research Article: Investtech-forskning: Brudd opp gjennom motstand/ned gjennom støtte gir verdifulle tekniske signaler

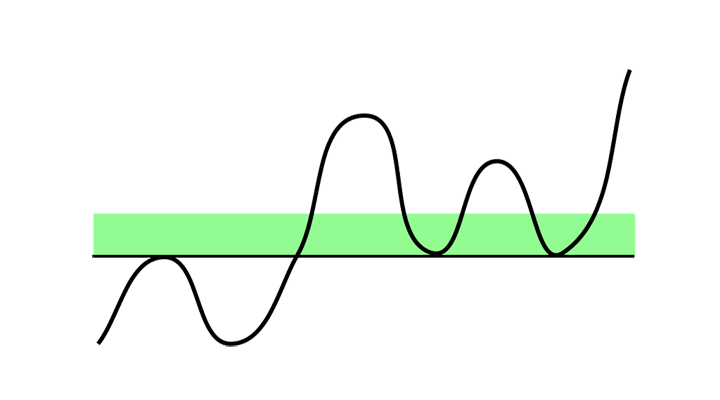

Price above support

The price is above a support level, where the stock has previously turned upwards. Many investors may consider it cheap if it falls towards support again, and may then wish to buy.

Support is where many buyers are thought to become active. It is normally assumed that the stock will not fall below support. Support is thus often used to calculate the downside potential in the stock, especially for short term investors. A stock with a long way down to support has a bigger downside than a stock near support.

Support is where many buyers are thought to become active. It is normally assumed that the stock will not fall below support. Support is thus often used to calculate the downside potential in the stock, especially for short term investors. A stock with a long way down to support has a bigger downside than a stock near support.

Especially in rising and horizontal trends, support expresses the downside potential in the stock. If, at the same time, there is little to no resistance above the current price, the upside potential tends to be high.

Investtech research: Price above support

statSummaryRelPos statSummaryRelPosNumberSignificant

| Annualised return (based on 66-day figures) | |

| Signaux positifs moyen terme | 18.2% |

| Reference index | 8.1% |

| Excess return | 10.1pp |

statSummaryTemplate

Lire plus

- Research Report: Investtech Research: Return for stocks that are above support and lack resistance and for stocks that are below resistance and lack support in price charts, the Nordic markets, 1996-2018 (Niveau d'accès exigé: PRO)

- Research Article: Support and Resistance: Buy signal when stock is above support and lacks resistance

- Research Article: Investtech Research: Support and resistance are important indicators

- Research Report: Investtech-forskning: Støtte og motstand - signalstatistikk Norden 2019 og 2020 (Niveau d'accès exigé: PRO)

- Research Report: Investtech-forskning: Støtte og motstand - signalstatistikk Norden 2008-2020 (Niveau d'accès exigé: PRO)

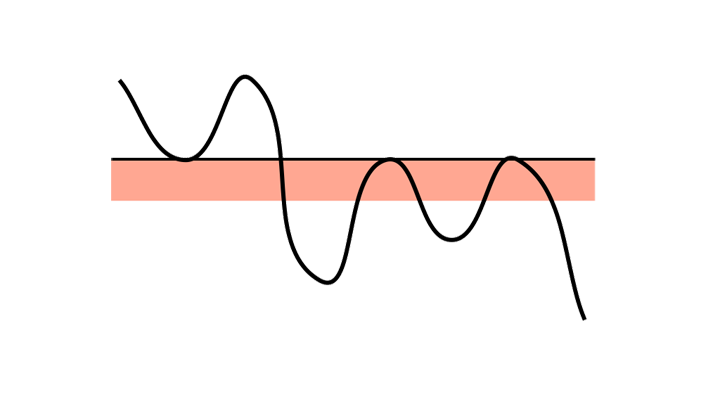

Price below resistance

The price is below a resistance level, where the stock has previously turned downwards. Many investors may consider it expensive if it rises up to resistance, and may then wish to sell.

Resistance is a level where many sellers are thought to become active. It is normally assumed that the stock will not rise above the resistance level. Resistance is thus often used to calculate the upside potential of a stock, especially for short term investors. A stock with a long way up to resistance has a bigger upside potential than a stock near resistance.

Resistance is a level where many sellers are thought to become active. It is normally assumed that the stock will not rise above the resistance level. Resistance is thus often used to calculate the upside potential of a stock, especially for short term investors. A stock with a long way up to resistance has a bigger upside potential than a stock near resistance.

Especially in falling and horizontal trends, resistance expresses the upside potential in the stock. If, at the same time, there is little to no support below the current price, the downside potential tends to be big.

Investtech research: Price below resistance

statSummaryRelNeg statSummaryRelNegNumberSignificant

| Annualised return (based on 66-day figures) | |

| Signaux négatifs moyen terme | 4.5% |

| Reference index | 11.6% |

| Excess return | -7.1pp |

statSummaryTemplate

Lire plus

- Research Report: Investtech Research: Return for stocks that are above support and lack resistance and for stocks that are below resistance and lack support in price charts, the Nordic markets, 1996-2018 (Niveau d'accès exigé: PRO)

- Research Article: Support and Resistance: Buy signal when stock is above support and lacks resistance

- Research Article: Investtech Research: Support and resistance are important indicators

- Research Article: Støtte og motstand: Gode salgssignaler fra aksjer som ligger under motstand og mangler støtte

- Research Report: Investtech-forskning: Støtte og motstand - signalstatistikk Norden 2019 og 2020 (Niveau d'accès exigé: PRO)

Price between support and resistance

Price is between support and resistance. Many investors find it cheap near support and expensive near resistance. A break upward will be a buy signal, whereas a break downward will be a sell signal.

When the stock price is between a support level and a resistance level, without being particularly near either of them, it does not signal anything about the future stock price.

When the stock price is between a support level and a resistance level, without being particularly near either of them, it does not signal anything about the future stock price.

If the price is falling towards support, it indicates that it will reverse and rise again. This is especially the case if it is a rising trend.

If the price is rising towards resistance, it indicates that it will reverse and fall back again. This is especially the case if it is a falling trend.

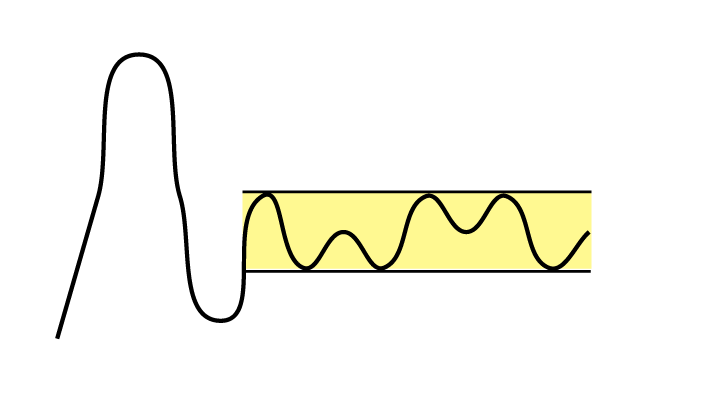

Price in support/resistance channel

The price is in a narrow channel between support and resistance. A break upward will be a buy signal, while a break downward will be a sell signal.

When the price is in an area where it has reversed many times before and turnover has been high, it is in a support/resistance channel. The price will often continue this sideways development for some time. This easily builds up tension in the stock. When the price breaks out of the channel, it can trigger a powerful buy or sell signal.

When the price is in an area where it has reversed many times before and turnover has been high, it is in a support/resistance channel. The price will often continue this sideways development for some time. This easily builds up tension in the stock. When the price breaks out of the channel, it can trigger a powerful buy or sell signal.

These situations will often cause the formation of a rectangle pattern in the chart. Especially breaks upward from such formations have proven to be reliable buy signals.

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices