Support and Resistance: Profitable to buy stocks that are near resistance

Published 10 October 2019

New research results from Investtech show that stocks with signals that in theory should predict falling prices, have in fact risen in the following period, outperforming benchmark. The results contradict established technical analysis theory. Instead of selling stocks that are approaching resistance, it has proven profitable to buy stocks that are near resistance.

According to technical analysis theory, support and resistance are among the most central concepts in technical analysis and can in theory be used to find good buy and sell levels.

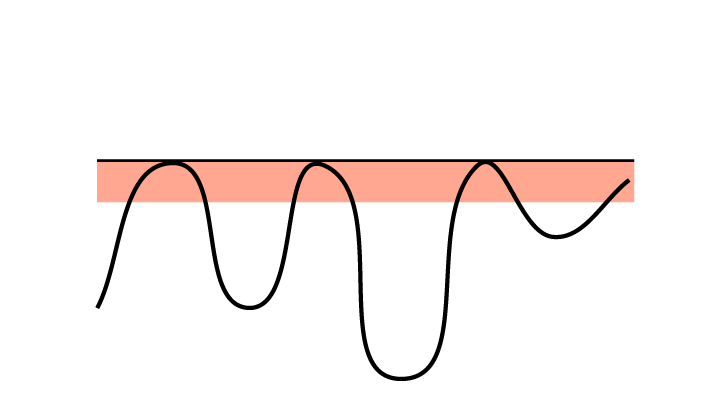

Figure 1: Price is near resistance. The stock has reversed here before. Many investors now find it to be expensive and may wish to sell.

Figure 1: Price is near resistance. The stock has reversed here before. Many investors now find it to be expensive and may wish to sell.

In theory, price near a resistance level is an indication that the price will fall. The definition of resistance says that more and more sellers will be active the closer the price gets to the resistance level. It can be favourable to place a sell order a little below the resistance level when wanting to sell such stocks

Please note that a break upwards through resistance will trigger a buy signal. The price can potentially rise very much in a short time. Especially in the case of positive volume development or stocks in a rising trend, it can be a good idea to wait and not sell on resistance.

Research results

We have studied return from Norwegian, Swedish, Danish and Finnish stocks following signals triggered by stocks' movements in relation to support and resistance levels in technical price charts. We used support and resistance levels automatically identified in Investtech’s medium term price charts. We had 23 years of data, from 1996 to 2018.

The chart below shows average price development following sell signals from stocks with reaction upwards to resistance identified in Investtech’s medium term price charts. The signals are triggered on day 0. Only days when the exchange is open are included, so 66 days equal approximately three months. The thick red line shows the development of sell signal stocks. The shaded areas are the standard deviation of the calculations. The thin red line shows benchmark development in the same period as the sell signal stocks.

Figure 2: Return following sell signals from stocks with reaction downwards to resistance identified in Investtech's medium term price charts. Thick red line is signal stocks, thin red line is benchmark. The Nordic markets, 1996-2018.

| Annualised return (based on 66-day figures) | Norway | Sweden | Denmark | Finland | Weighted average |

| Sell signal | 12.8 % | 14.3 % | 11.9 % | 7.7 % | 12.9 % |

| Benchmark in same period | 11.9 % | 11.8 % | 9.9 % | 5.4 % | 10.9 % |

| Excess return sell signal | 0.8 pp | 2.5 pp | 2.0 pp | 2.3 pp | 1.9 pp |

pp = percentage points

The chart and table show that stocks with sell signal from reaction downwards to resistance have risen in the following period. The first two weeks the stocks followed benchmark closely, and in the next two and a half months they rose a little more than benchmark.

Three months after the sell signals, the sell signal stocks had risen 3.2 per cent, equal to 0.5 percentage points more than benchmark. This equals an annualised excess return of 1.9 percentage points.

Statistically these sell signals have not worked well. Despite theoretically predicted fall, the stocks have outperformed benchmark in the following period. The results contradict established technical analysis theory.

The data set is large, with 63,954 signals over a period of up to 23 years. Statistical t-value is 5.1, indicating high statistical significance.

The above is a key finding which questions an important element of classic technical analysis theory. Instead of selling stocks that are approaching resistance, it has been profitable to buy stocks that are near resistance.

Article on buy signals:

Support and Resistance: Research results cause doubt about buy signals

Read the research report here.

Keywords: h_ResClose.

Written by

Head of Research and Analysis

at Investtech

Research articles:

Support and Resistance: Research results cause doubt about buy signals

Support and Resistance: Profitable to buy stocks that are near resistance

Support and Resistance: Break upwards through resistance is a buy signal

Support and Resistance: Break downwards through support is a sell signal

Support and Resistance: Buy signal when stock is above support and lacks resistance

Support and Resistance: Good sell signals from stocks that are far below resistance and lack support

Please note:

Changes to Support and Resistance algorithms

Insight & Skills:

"Investtech analyses the psychology of the market and gives concrete trading suggestions every day."

Partner & Senior Advisor - Investtech

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices