Price formations

The price chart reflects the fluctuations of investors’ levels of optimism over time. Looking at their ups and downs, we can say something about what they think and feel. And thus something about what they will do next.

Certain patterns, called price formations, can be explained by precise descriptions of the investors’ psychological state. When these patterns are formed in price charts, clear buy or sell signals are triggered. Identification of and trading from price formations are very central to technical analysis.

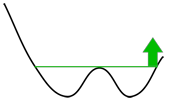

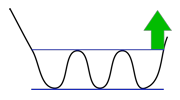

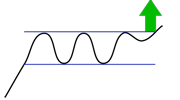

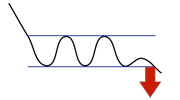

Investtech has created computer programmes that identify formations and plot them in charts. Buy signals are shown as green arrows and sell signals as red arrows. The height of the arrows denotes expected price movement.

Main principles

- Buy stocks that have triggered buy signals from price formations.

- Sell stocks that have triggered sell signals from price formations.

Top formations

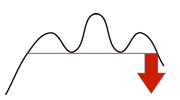

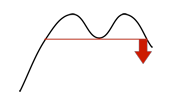

Head and shoulders formation

Double top formation

Rectangle formation

- Warn that a rising trend is over and that a falling trend begins

- Sell!

Bottom formations

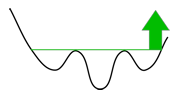

Inverse head and shoulder formation

Double bottom formation

Rectangle formation

- Warn that a falling trend is over and that a rising trend begins

- Buy!

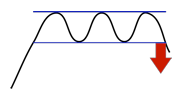

Continuing formations

Rectangle formation buy

Rectangle formation sell

- Warn that a consolidation is over.

- May trigger a buy signal that says a rising trend will continue up.

- May trigger a sell signal that says a falling trend will continue to fall.

Important details

- The strength of a price movement is described by its volume. Increasing volume strengthens the signal from a formation. A volume reduction often indicates it was a false signal.

- The price often moves significantly immediately after a break. Ideally one should therefore act quickly following a break. However the price will often fall again a little later, so a new opportunity may present itself for those who missed it the first time.

- Even if the price reaches target (the height of the arrow), the stock can often go much further. Price formations indicate a beginning or continuation of trends. Trends are the strongest indicators we have. While the trend remains intact, the stocks should normally be kept.

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices