Breakout in these three stocks invites for early opportunity

Published February 28, 2019

The market showed a small loss on Wednesday, and Nifty 50 (NIFTY) ended the day at 10807 points, which is a decline of 0.26 per cent. As per NSE data Advance to Declines ratio stood at 0.88 with a slight bias to falling stocks.

Three stocks that we have analysed today have given recent breakouts while recovering from their current bottoms. They could turn out to be good opportunities in the near term future specially if the markets stabilise and start to move higher.

Corporation Bank (CORPBANK.NS) Close: 30.85

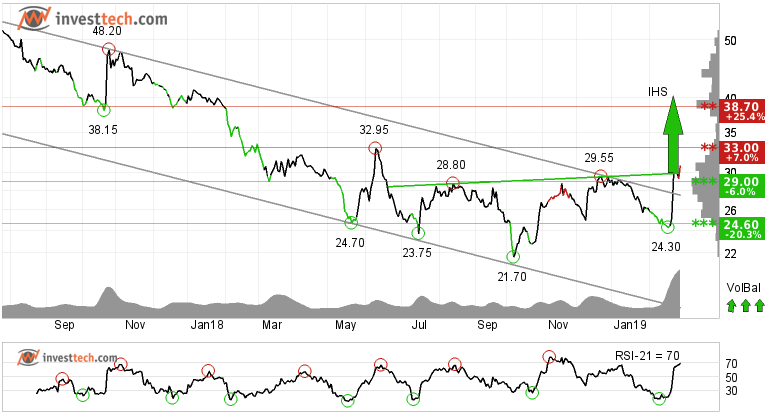

Corporation Bank has broken through the ceiling of a falling trend channel in the medium term. The stock has broken up through an inverse head and shoulders formation. A decisive break, preferably with increasing volume, is considered a confident signal and the stock may continue to rise further.

The stock is between the support at rupee 29.00 and the resistance at rupee 33.00. Also, there is a long term resistance at 31.40 which may act as an intermediate resistance. A wise entry with proper stoploss is suggested. Positive volume balance and rising momentum strengthen the stock in the short term.

Please note that the volume in the stock may vary over time which may project difficulty in getting out of the stock if price swings are comparatively higher.

Recommendation one to six months: Positive

Oberoi Realty Limited (OBEROIRLTY.NS) Close: 497.65

Oberoi Realty Limited is inside a falling trend channel in the medium term but inside a rising trend channel in the long term. On the short term chart, the stock has broken above the resistance at 483 rupees and eventually the neckline of the inverted head and shoulders formation in the medium term almost at the same level. A target of 632 is given.

The rise in stock price since its bottom in October has been supported by rising momentum and optimistic buyers, as indicated by the green arrows of the volume balance indicator. On the upside there is resistance around 513 and 555 levels, while support is around 482 and 454 rupees respectively.

Recommendation one to six months: Weak Positive

Sundaram Finance Limit (SUNDARMFIN.NS) Close: 1611.30

Almost the same as above mentioned stocks. Sundaram Finance Limited has broken above from the falling trend channel and a double bottom and inverted head and shoulders formations. Further rise to 1690 rupees or more is suggested. There is resistance around 1640 and support at 1500 rupees in the short term.

The stock is inside a rising trend channel in the long term chart and has closed above the resistance of 1580. This is a positive sign. The volume balance is positive and strengthens the stock in the short term. RSI is above 70 after a good price increase the past weeks. The stock has strong positive momentum and further increase is indicated. The stock is overall assessed as technically positive for the short term.

Recommendation one to six months: Positive

The analyses are based on closing price as per February 27, 2019. Maintaining proper stop loss is always recommended.

Written by

Analyst - Investtech

Archive:

26 February: Two buy opportunities for the near term future

21 February: Stocks with RSI above 70, based on our research

19 February: Close to selling point, time to be cautious

15 February: These two sugar stocks look promising

14 February: Three short to medium term opportunities

08 February: One buy and one sell in stocks while index suggests caution

06 February: One buy and one sell, short to medium term opportunities

01 February: Upside breakout from price formations

30 January: Buying opportunity: Reversing from trend channel support

9 January: One positive and one to stay away from

2 January: A good investment opportunity

2018

21 December: Good buying opportunities

14 December: Positive on these three stocks

11 December: One buy and one sell signal

07 December: Sell Signals in Three Big Stocks

04 December: Highest scorer of our Top 50 list

30 November: Positive stocks with 5-11 per cent upside potential

28 November: Buy signal on high volume

27 November: One Buy and One Sell Signal

23 November: Fear dominates these stocks

21 November: Sell signal, time to stay away

20 November: Early opportunity from short term buy signal?

16 November: Two Buy Signals and One Sell Signal

15 November: Buy signal in this one

13 November: Big auto stocks comparison

09 November: What to wait for?

06 November: Banking stocks look positive

02 November: Positive on this one

01 November: TECHM, NIFTY50 and Hausse

31 October: What are investors thinking?

30 October: Bullish on these three stocks

26 October: Three potential candidates to ride on

24 October: Three big Metal stocks, Seasonal variation

22 October: Among top performers on our Top 50 list

18 October: Three stocks investors should stay away from

17 October: Flowing against the tide

16 October: Positive on these 2 stocks

11 October: Over 45 per cent rise

9 October: The Indian banking space

5 October: Nifty closes at a crucial level

2 October: Price formations in the long-term charts

28 September: Positive on Biocon Limited

"Investtech analyses the psychology of the market and gives concrete trading suggestions every day."

Partner & Senior Advisor - Investtech

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices