Bitcoin wakes up from sleep, gains over 20 per cent in two days

Published April 03, 2019

Commodities have had a good quarter in Q1 2019 with Bloomberg Commodity Index rising from 160.30 points in the beginning of 2019 to 169.82 points by the end of March, giving a positive return of 8.4 per cent. In the cryptocurrency space, Bitcoin just got a wake-up call and showed a significant gain of almost 20 per cent in only two days' time.

Those who study inter-market relationships to predict market movement can always look at historical price charts to see the level of correlation between commodity and stock markets. This may not be possible with the cryptocurrency market as it is relatively new and does not have enough historical data to draw any correlation or conclusion.

We look at the medium term charts of Bitcoin, Brent Crude Nymex and Gold futures and how they have behaved in the recent past and are likely to behave in the near future.

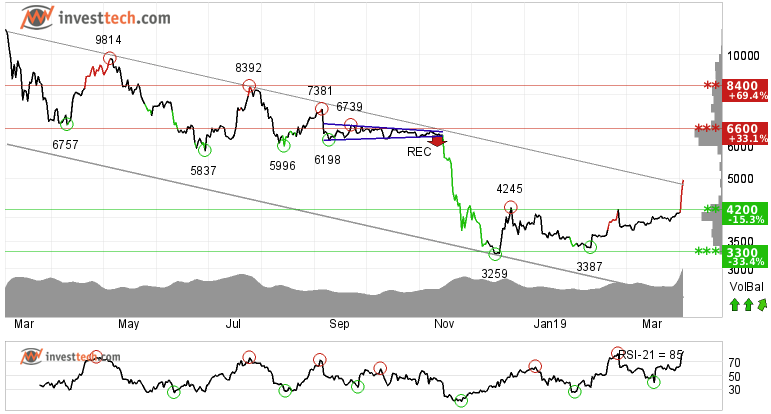

Bitcoin (BTC.CPT) Close: 4957.52

The cryptocurrency benchmark Bitcoin gave a surprise two days ago by gaining over 13 per cent on Monday and 6 per cent on Tuesday. It broke above its downtrend channel in the medium term. In the first place, a breakout from falling trend channel indicates either a slower rate of fall or possibly development of a sideways trend. It has now risen above its resistance of 4200 dollars. In the short term chart it has sharply broken above the rising trend channel on high volume. There is now support at 4200 and resistance at 6600. Hence reward to risk ratio is favourable.

Positive volume balance, with high volume on days with rising prices and low volume on days with falling prices, strengthens the cryptocurrency. RSI above 70 shows that there is strong positive momentum in the short term. Investors have steadily paid more to buy the crypto, which indicates increasing optimism and that the price may continue to rise. Positive volume balance and strong momentum make Bitcoin a weak buy instead of a watch in Investtech's short and medium term charts.

Investtech's outlook (one to six months): Weak Buy

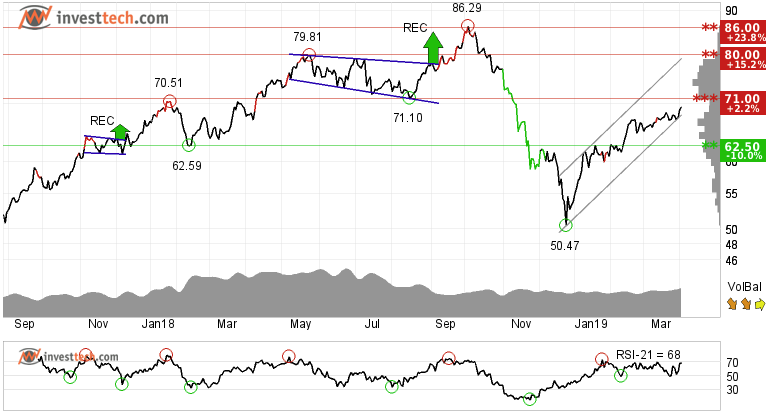

Brent Crude NYMEX (BZ.FUT) Close: 69.45

Investors have paid higher prices over time to buy Brent Crude NYMEX and the futures contract is in a rising trend channel both in the medium and long term. This signals increasing optimism among investors. Further rise is anticipated.

The commodity bottomed out right before Christmas 2018 and has gained around 37.5 per cent in the past three months. It is very close to its earlier resistance of 71 dollars, which can give the commodity a reaction downwards. However, if broken on the upside then the price can rise up to 80 dollars which is 15.2 % higher than yesterday's close. There is support between 67 and 64.80 dollars in the short term.

Investtech's outlook (one to six months): Weak Buy

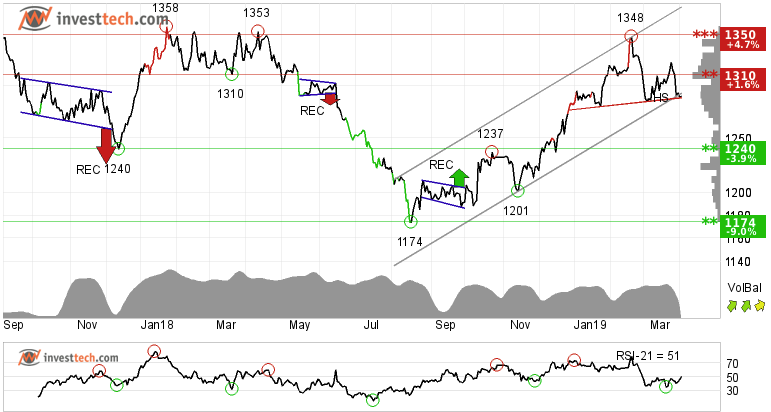

Gold (GC.FUT) Close: 1290.00

Gold futures made a low in September last year and established their recent peak in February. Gold prices gained by around 15 per cent before they decided to shed some of the gains and fell nearly 4 per cent from the peak of 1348 dollars to close at 1290 dollars per ounce.

Gold prices are currently testing support at the bottom of the rising trend channel and are constructing a potential head and shoulders formation. The price has already broken support at 1310 dollars. A break down and close below 1280 dollars may initiate fresh selling in Gold. But if buyers manage to reverse and take the prices back in the trend channel and preferably above 1310, then it will be safe to invest in this commodity again. If the prices dive south then there is support at 1240 dollars.

Investtech's outlook (one to six months): Watch

The analyses are based on closing price as per April 02, 2019

Note: These instruments are traded in currency based on the exchange or country they are listed on.

Geschreven door

Analist

in Investtech

"Investtech analyseert de psychologie in de markt en geeft u iedere dag concrete trading-voorstellen."

Partner & Senior Advisor - Investtech

Investeringsaanbevelingen worden gedaan door Investtech.com AS ("Investtech"). Investtech garandeert geen volledigheid of juistheid van de analyses. Eventuele fouten in de aanbevelingen, koop- en verkoopsignalen en mogelijke negatieve gevolgen hiervan zijn geheel het risico van de belegger. Investtech neemt geen enkele verantwoordelijkheid voor verlies, direct of indirect, als gevolg van het gebruik van Investtechs analyses. Meer informatie omtrent Investtechs analyses kunt u vinden op disclaimer.

Investeringsaanbevelingen worden gedaan door Investtech.com AS ("Investtech"). Investtech garandeert geen volledigheid of juistheid van de analyses. Eventuele fouten in de aanbevelingen, koop- en verkoopsignalen en mogelijke negatieve gevolgen hiervan zijn geheel het risico van de belegger. Investtech neemt geen enkele verantwoordelijkheid voor verlies, direct of indirect, als gevolg van het gebruik van Investtechs analyses. Meer informatie omtrent Investtechs analyses kunt u vinden op disclaimer.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices