De trendbijbel

Telefoon: +47 21 555 888

Telefoon: +47 21 555 888 Verstuur e-mail

Verstuur e-mail Word gebeld

Word gebeld Bezoek ons

Bezoek ons

Stocks in rising trends breaking upwards have continued upwards, and at a stronger rate of increase than before. Stocks breaking downwards through the floor of a falling trend have seen strongly negative price development.

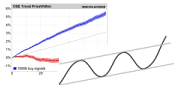

Research Results – Breaks Upwards and Downwards from Trends

Figure 1: Breaks in the trend direction. Average price development for stocks breaking upwards through the ceiling of rising trends and downwards through the floor of falling trends in Investtech’s medium long term technical charts.

Figure 2: Breaks opposite of trend direction. Average price development for stocks breaking downwards through the floor of rising trend and upwards through the ceiling of falling trend in Investtech’s medium long term technical charts.

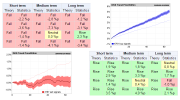

| Relative return, rising trends and breaks | Norway | Sweden | Denmark | Finland | Weighted average |

| Breaking upwards from rising trend | 4.7 ppt | 2.8 ppt | 2.6 ppt | 1.1 ppt | 3.3 ppt |

| Within rising trend | 2.3 ppt | 1.5 ppt | 2.3 ppt | 0.2 ppt | 1.8 ppt |

| Breaking downwards from rising trend | 0.4 ppt | 0.4 ppt | 1.1 ppt | -0.6 ppt | 0.4 ppt |

| Relative return, falling trends and breaks | Norway | Sweden | Denmark | Finland | Weighted average |

| Breaking downwards from falling trend | -7.8 ppt | -6.3 ppt | -9.9 ppt | -5.6 ppt | -7.3 ppt |

| Within falling trend | -3.2 ppt | -2.0 ppt | -4.9 ppt | -2.0 ppt | -2.8 ppt |

| Breaking upwards from falling trend | -0.2 ppt | 0.3 ppt | -1.1 ppt | 1.3 ppt | 0.0 ppt |

ppt: percentage points

The charts and tables above show that stocks in rising trends with breaks upwards continue to rise with a stronger rate of increase than stocks within rising trends. Stocks with breaks downwards from rising trends have also continued upwards, but at a rate of increase clearly weaker than stocks within a rising trend and only barely above the market development.

Stocks breaking downwards through the floor of a falling trend have seen very negative further development with a fall of 7.3 percentage points more than benchmark for the weighted average of all the Nordic signals. This is clearly weaker than stocks within a falling trend. Stocks that have broken upwards through the ceiling of a falling trend have developed neutrally compared to the marked in the coming period, which in absolute number gives a rise of 3.5 per cent in the next three months.

The above results fit well with technical analysis theory on breaks from trends. Breaks upwards have given rising prices and stronger rate of increase than earlier. Breaks downwards from rising trends have given continued rise but at a weaker rate of increase. Breaks downward from falling trends have given further fall at a stronger rate of decrease than before.

The results contradict the theory for one indicator: breaks upwards from falling trends. This has not given further fall, but instead an increase in line with the market.

Rising trend breaking upwards. Read the theory and see which stocks are currently breaking upwards through the ceiling of rising trends.

Rising trends breaking downwards. Read the theory and see examples here.

Falling trend breaking downwards. Read the theory and see which stocks are currently breaking downwards from falling trends.

Investtech's reference work based on studies of more than 350,000 signals from trends in stocks listed on

the Nordic stock exchanges from 1996 to 2015.

Practical use - Tools - Statistics - Algorithms - Theory.

The Trend Bible - Start Page More on Investtech's research

The Trend Bible was written in 2016 by Investtech’s Head of Research Mr. Geir Linløkken. The research team behind the Trend Bible also consists of Senior Researchers Asbjørn Taugbøl and Fredrik Tyvand.

Investtech has worked on research into behavioural finance and technical and quantitative stock analysis since 1997. The company has developed an analysis system that identifies trends, support and resistance, formations and volume patterns in stock prices, and uses these to generate buy and sell signals. Investtech uses advanced mathematical algorithms and statistical methods in computer programmes and online subscription services.

Investeringsaanbevelingen worden gedaan door Investtech.com AS ("Investtech"). Investtech garandeert geen volledigheid of juistheid van de analyses. Eventuele fouten in de aanbevelingen, koop- en verkoopsignalen en mogelijke negatieve gevolgen hiervan zijn geheel het risico van de belegger. Investtech neemt geen enkele verantwoordelijkheid voor verlies, direct of indirect, als gevolg van het gebruik van Investtechs analyses. Meer informatie omtrent Investtechs analyses kunt u vinden op disclaimer.

Investeringsaanbevelingen worden gedaan door Investtech.com AS ("Investtech"). Investtech garandeert geen volledigheid of juistheid van de analyses. Eventuele fouten in de aanbevelingen, koop- en verkoopsignalen en mogelijke negatieve gevolgen hiervan zijn geheel het risico van de belegger. Investtech neemt geen enkele verantwoordelijkheid voor verlies, direct of indirect, als gevolg van het gebruik van Investtechs analyses. Meer informatie omtrent Investtechs analyses kunt u vinden op disclaimer.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices