Global stocks: Two buy and one sell - Facebook gives a buy signal

Published April 10, 2019

The market showed a small loss on Tuesday and S&P 500 (SP500) ended the day at 2878.20 points, which is a decline of 0.61 per cent. The index thereby reversed down after eight days of gains. 96 shares showed a gain and 394 showed a loss. 2 shares were unchanged and closed at the same price as the previous day.

The S&P 500 index is inside a rising trend in the medium term chart. This signals increasing optimism among investors and indicates continued rise. The broader index is only 1.8 per cent short of its all time high close that was established in September last year, while there is support around 2800 points for the index.

Today we cover three US stocks of which two are positive and one is negative.

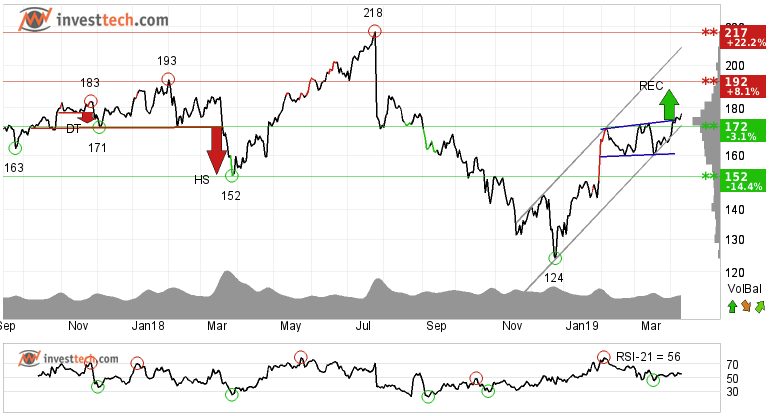

Facebook Inc (FB.US500) Close: 177.58

Investors have paid higher prices over time to buy Facebook Inc and the stock is in a rising trend channel in the medium term. This signals increasing optimism among investors.

After falling by almost 43 per cent in later half of 2018 and thereafter recovering by a good margin this year, the stock recently gave a buy signal as it broke above from a rectangle formation and a resistance level at 172 dollars both in the medium and short term. Further rise to 188 or more is signalled. The next resistance levels are at 192 and 217 dollars. There is now support between 172 and 160 dollars.

The short term momentum indicator RSI is above 70 and volume balance is positive, suggesting that more people are buying with rising price. These indicators strengthen the underlying trend in the short term. The stock is overall assessed as technically positive for the short to medium term.

Investtech's outlook (one to six months): Buy

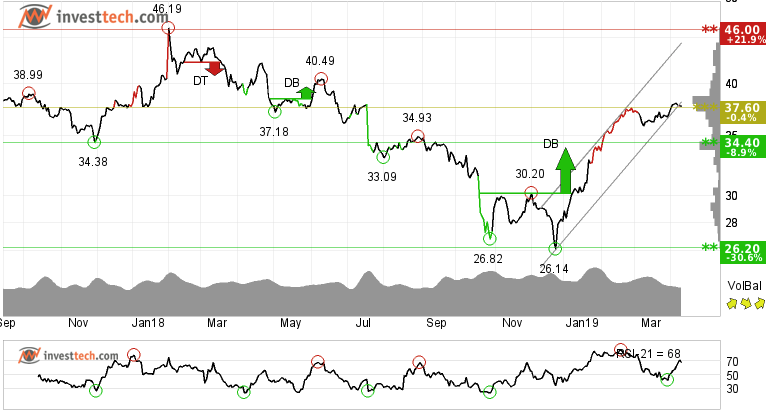

eBay Inc. (EBAY.US500) Close: 37.75

The e-commerce giant eBay Inc. has marginally broken the bottom of the rising trend channel and is taking support at 37.60 dollars in the medium term chart.

Since the beginning of new year, the stock has gone up by more than 40 per cent and is still looking strong. It is inside the rising trend channel in the long term price graph and the strong momentum, as indicated by RSI, does not seem to give way very easily.

Even though the volume balance indicator is more or less neutral, the price behaviour itself signals underlying strength in the existing trend. The stock may correct in the near term due to a developing divergence in RSI peaks. If so, there is support around 35.90 and 34.40 dollars. However, if the existing trend continues, the next price target could be around its previous top at 46.20 dollars, which is nearly 22 per cent from the last close. The stock is assessed as technically slightly positive for the medium term.

Investtech's outlook (one to six months): Weak Buy

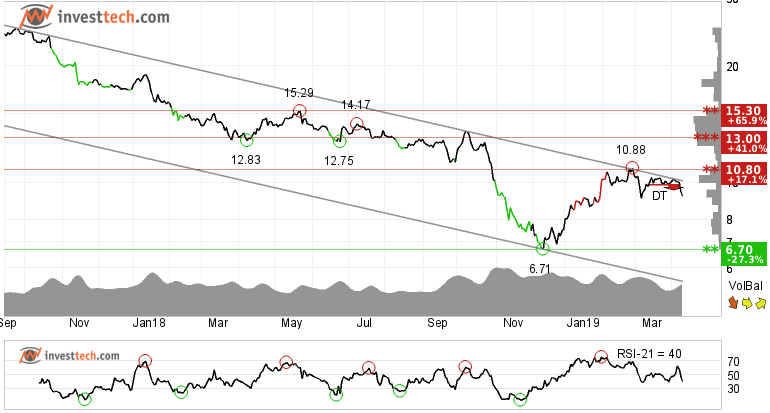

General Electric (GE.US500) Close: 9.22

General Electric is in a falling trend channel in all time frames, from short to long term. This signals increasing pessimism among investors. The stock has been in a falling trend since the beginning of 2017 and has fallen by more than 70 per cent.

Recently the stock tested resistance at the ceiling of the falling trend channel and gave a sell signal from a small double top formation. An established break and close below 9.10 may give another opportunity to sellers to be further bearish on the stock.

There is support around 6.70 dollars while resistance is around the 10.30 - 10.80 levels.

Investtech's outlook (one to six months): Sell

The analyses are based on closing price as per April 9, 2019

Note: These instruments are traded in currency based on the exchange or country they are listed on.

Geschreven door

Analist

in Investtech

"Investtech analyseert de psychologie in de markt en geeft u iedere dag concrete trading-voorstellen."

Partner & Senior Advisor - Investtech

Investeringsaanbevelingen worden gedaan door Investtech.com AS ("Investtech"). Investtech garandeert geen volledigheid of juistheid van de analyses. Eventuele fouten in de aanbevelingen, koop- en verkoopsignalen en mogelijke negatieve gevolgen hiervan zijn geheel het risico van de belegger. Investtech neemt geen enkele verantwoordelijkheid voor verlies, direct of indirect, als gevolg van het gebruik van Investtechs analyses. Meer informatie omtrent Investtechs analyses kunt u vinden op disclaimer.

Investeringsaanbevelingen worden gedaan door Investtech.com AS ("Investtech"). Investtech garandeert geen volledigheid of juistheid van de analyses. Eventuele fouten in de aanbevelingen, koop- en verkoopsignalen en mogelijke negatieve gevolgen hiervan zijn geheel het risico van de belegger. Investtech neemt geen enkele verantwoordelijkheid voor verlies, direct of indirect, als gevolg van het gebruik van Investtechs analyses. Meer informatie omtrent Investtechs analyses kunt u vinden op disclaimer.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices