Three buy opportunities, price-volume breakout

Published April 11, 2019

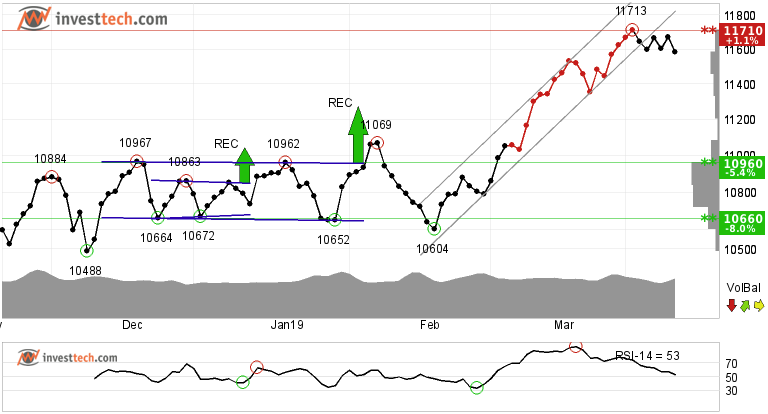

The market showed a small loss on Wednesday and Nifty 50 (NIFTY) ended the day at 11584 points, which is a decline of 0.75 per cent. For the past few trading sessions, the broader index has been playing around its previous highest close of 11739 points and trying to breach that mark. However, the short term momentum indicator RSI-14 just got shy and started to diverge at the point when Nifty 50 was in its full power attempting to close above 11700. It suggests that market momentum was little short of giving that extra push that could have taken the index to a new high.

May be it is waiting for the election results to give us all an unexpected surprise. That we have to wait to see. But there are three stocks that we have identified today which have given a breakout from bottom price formations and could turn out to be good potential investments.

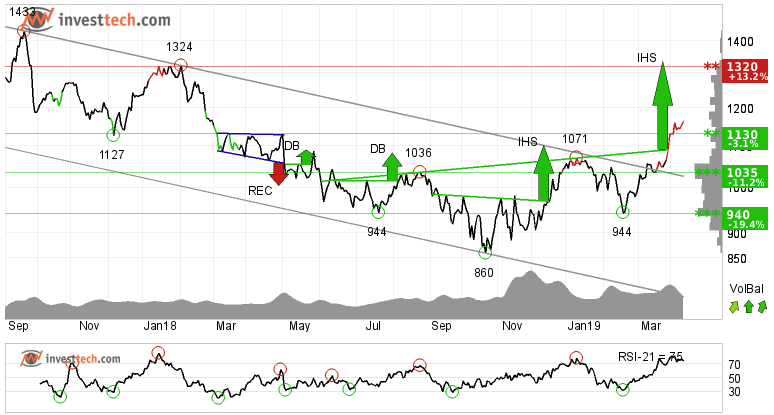

Siemens Limited (SIEMENS.NS) Close: 1165.65

Siemens has broken out of the falling trend channel in the medium term chart. It has given a price breakout from the inverted head and shoulders formation both in the medium and long term charts and is now above its resistance of 1130 rupees. Further rise to 1336 or more is signalled.

Momentum is strong in the stock as indicated by the RSI curve. Over the past few month,s buyers have been pushing the price higher while sellers have been passive in selling the stock at lower levels. This has resulted in positive volume balance.

The stock has support at the 1130 and 1050 levels. While resistance is around the 1320-1340 and 1430 area. The stock is overall assessed as technically positive in the short to medium term.

Recommendation one to six months: Positive

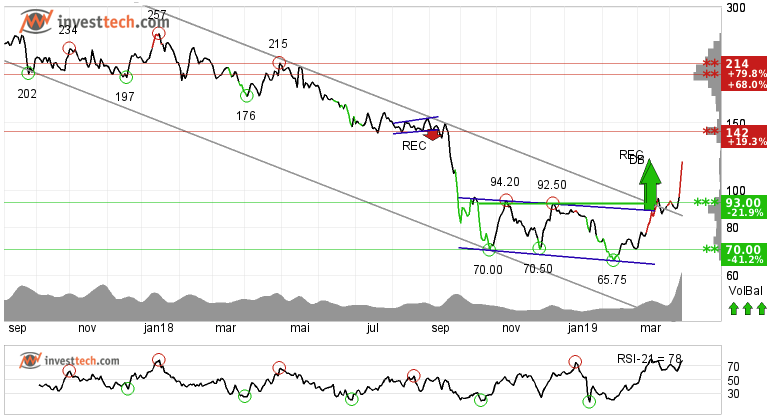

Indiabulls Real Estate (IBREALEST.NS) Close: 119.05

Indiabulls Real Estate Limited has given a price-volume breakout by breaking through the ceiling of a falling trend channel in the medium and long term charts. After a period of condensation, the stock has given buy signal from a rectangle formation by a break up through a long standing resistance. Further rise to 121 or more is signalled. The stock has support at rupee 93.00 and resistance at rupees 142 and 200.

Positive volume balance indicates that buyers are aggressive while sellers are passive, and strengthens the stock. RSI is above 70 after a good price increase the past weeks. The stock has strong positive momentum and further increase is indicated.

Given the sharp rise in price which may or may not be followed by a period of retracement or consolidation, one must be cautious and also of high volatility in the stock . Hence identifying your entry and maintaining tight stoploss are always recommended.

Recommendation one to six months: Positive

Tata Motors Limited (TATAMOTORS.NS) Close: 216.05

Tata Motors limited has a similar story as Indiabulls Real Estate Limited. The stock retraced back after giving a breakout from a double bottom formation and early this month broke above the resistance of 185 rupees on high volume. Currently there is no established trend in the stock, but the price-volume breakout suggests further rise in price in the short term.

Positive volume balance and rising momentum strengthen the breakout and support the price rise. There is now support around 185 rupees and first resistance could be around 275 rupees, as suggested by the long term chart. The stock is overall assessed as technically positive in short to medium term.

Recommendation one to six months: Positive

The analyses are based on closing price as per April 10, 2019. Maintaining proper stop loss is always recommended.

Skrivet av

Analytiker

i Investtech

Archive:

29 March: Two stocks to stay from

27 March: Recent breakouts in three stocks, short term opportunity

21 March: Three buy and one sell

12 March: Cement stocks are posing good opportunity

08 March: Clear breakout and reversal from intermediate downtrend

07 March: Deepak Nitrite Limited looks promising to enter into a trade

06 March: Three buy candidates for medium to long term

28 February: Breakout in these three stocks invites for early opportunity

26 February: Two buy opportunities for the near term future

21 February: Stocks with RSI above 70, based on our research

19 February: Close to selling point, time to be cautious

15 February: These two sugar stocks look promising

14 February: Three short to medium term opportunities

08 February: One buy and one sell in stocks while index suggests caution

06 February: One buy and one sell, short to medium term opportunities

01 February: Upside breakout from price formations

30 January: Buying opportunity: Reversing from trend channel support

9 January: One positive and one to stay away from

2 January: A good investment opportunity

2018

21 December: Good buying opportunities

14 December: Positive on these three stocks

11 December: One buy and one sell signal

07 December: Sell Signals in Three Big Stocks

04 December: Highest scorer of our Top 50 list

30 November: Positive stocks with 5-11 per cent upside potential

28 November: Buy signal on high volume

27 November: One Buy and One Sell Signal

23 November: Fear dominates these stocks

21 November: Sell signal, time to stay away

20 November: Early opportunity from short term buy signal?

16 November: Two Buy Signals and One Sell Signal

15 November: Buy signal in this one

13 November: Big auto stocks comparison

09 November: What to wait for?

06 November: Banking stocks look positive

02 November: Positive on this one

01 November: TECHM, NIFTY50 and Hausse

31 October: What are investors thinking?

30 October: Bullish on these three stocks

26 October: Three potential candidates to ride on

24 October: Three big Metal stocks, Seasonal variation

22 October: Among top performers on our Top 50 list

18 October: Three stocks investors should stay away from

17 October: Flowing against the tide

16 October: Positive on these 2 stocks

11 October: Over 45 per cent rise

9 October: The Indian banking space

5 October: Nifty closes at a crucial level

2 October: Price formations in the long-term charts

28 September: Positive on Biocon Limited

"Investtech analyserar psykologin i marknaden och ger dig konkreta tradingförslag varje dag."

Partner & Senior Advisor - Investtech

Investtech garanterar inte fullständigheten eller korrektheten av analyserna. Eventuell exponering utifrån de råd / signaler som framkommer i analyserna görs helt och fullt på den enskilda investerarens räkning och risk. Investtech är inte ansvarig för någon form för förlust, varken direkt eller indirekt, som uppstår som en följd av att ha använt Investtechs analyser. Upplysningar om eventuella intressekonflikter kommer alltid att framgå av investeringsrekommendationen. Ytterligare information om Investtechs analyser finns på infosidan.

Investtech garanterar inte fullständigheten eller korrektheten av analyserna. Eventuell exponering utifrån de råd / signaler som framkommer i analyserna görs helt och fullt på den enskilda investerarens räkning och risk. Investtech är inte ansvarig för någon form för förlust, varken direkt eller indirekt, som uppstår som en följd av att ha använt Investtechs analyser. Upplysningar om eventuella intressekonflikter kommer alltid att framgå av investeringsrekommendationen. Ytterligare information om Investtechs analyser finns på infosidan.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices