Better the car than the stock

Published October 3, 2014

Many of the car stocks are technically negative, so if you need money for a new car, investing in car stocks may not be the way to go. This week we have a closer look at five car stocks. Daimler, best known for the Mercedes-Benz, stands out.

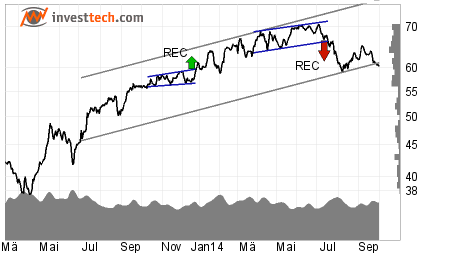

The Daimler stock has just broken downwards through the rising trend, which indicates a weaker rate of increase or more horizontal development. However, the price is near support at 59 euros, which opens for a reaction upwards. The stock broke downwards through support in a rectangle formation this summer, and even though the price target of 61.40 is reached, the formation signals continued negative development. In addition the stock is weakened by poor price/volume correlation. The fact that it is near support and in a rising trend, makes Daimler a weak positive candidate.

The Daimler stock has just broken downwards through the rising trend, which indicates a weaker rate of increase or more horizontal development. However, the price is near support at 59 euros, which opens for a reaction upwards. The stock broke downwards through support in a rectangle formation this summer, and even though the price target of 61.40 is reached, the formation signals continued negative development. In addition the stock is weakened by poor price/volume correlation. The fact that it is near support and in a rising trend, makes Daimler a weak positive candidate.

Investtech considers Daimler a technically weak positive candidate in the medium term.

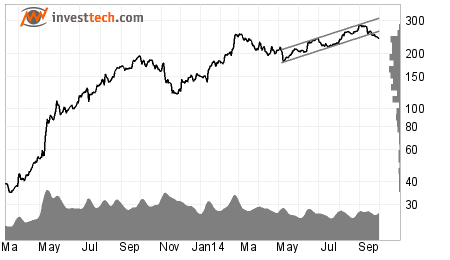

The price of Nasdaq listed Tesla has reacted downwards through support at 258 dollars. Further fall is indicated, and at reactions upwards there is now resistance at this level. In addition the rising trend is broken, and negative volume balance weakens the stock further in the short term. In the case of continued negative development, there is support at 186 dollars.

The price of Nasdaq listed Tesla has reacted downwards through support at 258 dollars. Further fall is indicated, and at reactions upwards there is now resistance at this level. In addition the rising trend is broken, and negative volume balance weakens the stock further in the short term. In the case of continued negative development, there is support at 186 dollars.

The broken trend, the fact that it is close to resistance, and the negative volume balance all make it more likely that the price will fall than rise in the next few months. Nevertheless, it will be a buy signal if the price breaks above 258 dollars.

Investtech considers Tesla Motors a technically weak negative candidate in the medium term.

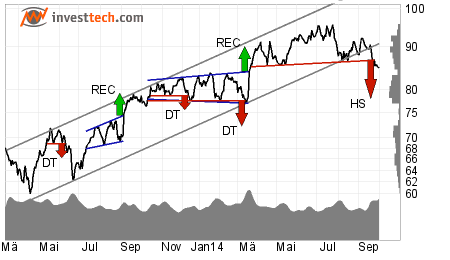

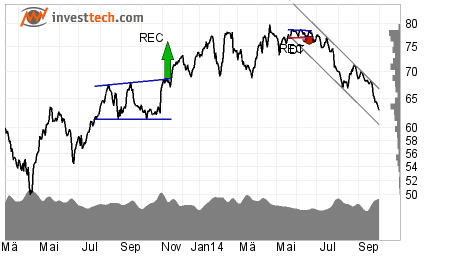

The BMW stock has broken the rising trend. The stock has also triggered a sell signal from a head and shoulders formation, and further fall to 78 euros or less is indicated. Poor correlation between price tops and volume tops and between price bottoms and volume bottoms further weaken the stock. The price is approaching support at 83.40 euro, however. This can give a reaction upwards, whereas a break downwards through this level will weaken the stock further.

The BMW stock has broken the rising trend. The stock has also triggered a sell signal from a head and shoulders formation, and further fall to 78 euros or less is indicated. Poor correlation between price tops and volume tops and between price bottoms and volume bottoms further weaken the stock. The price is approaching support at 83.40 euro, however. This can give a reaction upwards, whereas a break downwards through this level will weaken the stock further.

Investtech considers BMW a technically weak negative candidate in the medium term.

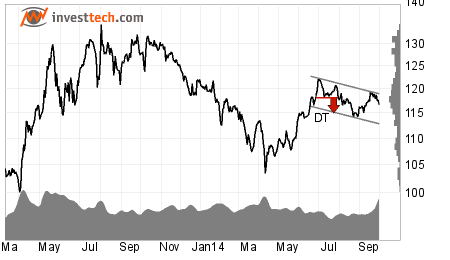

New York listed Toyota Motor Corp shows a falling trend, and continued negative development is indicated. The stock is also weakened by negative volume balance. The stock is traded more on days with falling prices than on days with rising prices. This shows that when sellers wish to sell, they will rather sell at low prices than wait until the buyers will pay more. There is good support at 114 dollars, while there is resistance at 120 dollars. Break through one of these levels will signal further development in the same direction.

New York listed Toyota Motor Corp shows a falling trend, and continued negative development is indicated. The stock is also weakened by negative volume balance. The stock is traded more on days with falling prices than on days with rising prices. This shows that when sellers wish to sell, they will rather sell at low prices than wait until the buyers will pay more. There is good support at 114 dollars, while there is resistance at 120 dollars. Break through one of these levels will signal further development in the same direction.

Investtech considers Toyota Motor Corp a technically negative candidate in the medium term.

Porsche Automobil Holding (PAH3)

Porsche Automobil Holding shows weak development in a falling trend channel, and continued fall is indicated. The negative trend is supported by poor correlation between volume tops and price tops and between volume bottoms and price bottoms. The stock is approaching support at 61.50 euros, which can give a reaction up, but the negative volume balance weakens the stock in the short term and increases the chance of a break downwards through support.

Porsche Automobil Holding shows weak development in a falling trend channel, and continued fall is indicated. The negative trend is supported by poor correlation between volume tops and price tops and between volume bottoms and price bottoms. The stock is approaching support at 61.50 euros, which can give a reaction up, but the negative volume balance weakens the stock in the short term and increases the chance of a break downwards through support.

Investtech considers Porsche Automobil Holding a technically negative candidate in the medium term.

The analyses are based on closing prices from Wednesday October 1st and are written for publication in Børsen.dk.

Written by

Analyst

at Investtech

Insight & Skills:

Correlation between price development and volume development

"Investtech analyses the psychology of the market and gives concrete trading suggestions every day."

Partner & Senior Advisor - Investtech

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices