Global stocks: Energy stocks look strong in the medium term

Published December 12, 2018

Webinar December 13

Join our free online webinar on December 13, 15.00-15.45 CET. Analyst Kiran Shroff and Country Manager Jan Marius van Leeuwen will give an introduction to Investtech's analyses and present stock picking tools & strategies.

The US markets have been in a somewhat sideways to downward trend in the past few weeks. But one sector that is enjoying a good time is utilities stocks. Many of them are near multi-year high. It's worth giving them a glance as some of them have given breakouts from rising trend channels, which Investtech has done a lot of research on, mainly in Scandinavian markets.

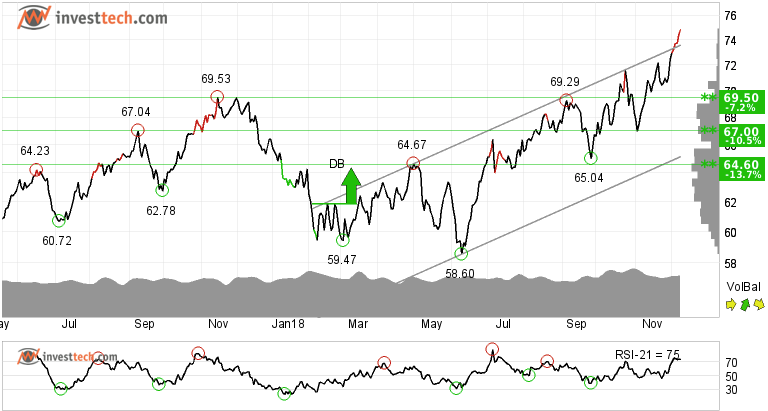

Wisconsin Energy Corp (WEC.US500) Close: 74.89

Wisconsin Energy Corp has broken up through the ceiling of the rising trend channel in the medium term, which signals an even stronger rising rate. As per Investtech's quantitative research done in the Scandinavian markets, shares that have broken up from rising trend channels has given an annualized excess return of 14.7 % in the medium term. Read more at thetrendbible.com

The stock has support at 71.60 and 69.50 dollars. The short term momentum of the stock is strongly positive, with RSI above 70. This indicates increasing optimism among investors and further price increase for Wisconsin Energy Corp. However, particularly for big stocks, high RSI may be a sign that the stock is overbought and that there is a chance of a short term reaction downwards.

The stock is overall assessed as technically positive for the medium term.

Investtech's outlook (one to six months): Buy

Cms Energy Corp (CMS.US500) Close: 53.16

Cms Energy Corp is in a rising trend channel in the medium long term. This signals increasing optimism among investors and indicates continued rise. The stock has support at 51.70 - 50.70 dollars.

RSI above 70 shows that the stock has strong positive momentum in the short term. Investors have steadily paid more to buy the stock, which indicates increasing optimism and that the price will continue to rise. The volume balance indicator is also positive, supporting the rising price.

The stock is overall assessed as technically positive for the medium term.

Investtech's outlook (one to six months): Buy

The analyses are based on closing price as per December 11, 2018.

Note: These instruments are traded in currency based on the exchange or country they are listed on.

Written by

Analyst - Investtech

"Investtech analyses the psychology of the market and gives concrete trading suggestions every day."

Partner & Senior Advisor - Investtech

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices