Global stocks: Three positive candidates from Model Portfolio Germany

Published September 4, 2019

One of our most sought after products is the model portfolio. We offer this special feature for almost all leading European markets that we publish technical analysis for. There is a procedure that needs to be followed to pick seven stocks for the model portfolios. We update the portfolios every week by going through all the stocks on the exchange and replace any losing bet with another one where we see good potential in the coming future. A few of the key features of our selection process are:

- Good historical return in the long term.

- Risk in line with the exchange and good sector dispersion.

- Medium term holding time, often one to six months per stock.

- Consists of stocks that are technically positive.

- Keep good investments for a long time, sell quickly when losing.

For long term investors, this kind of service is a good source of inspiration for those who have a moderate risk profile for their investments. However, one must be mindful of the fact that the portfolio is fictitious with no actual stock exchange investment and the stocks have same weight and are rebalanced every day. You can read more about the model portfolio strategy here.

To look at the numbers, in 2019 (till last close on September 3) so far the return on the portfolio has been 16.22 per cent (including commission) while the broader index DAX has returned only 12.80 per cent. In the past three years, annualised return is 30.2 per cent (portfolio traded at next close), while the Dax (Performanceindex) is at 11.5 per cent.

For now let us look at three out of seven stocks that are currently in our Model Portfolio for Germany.

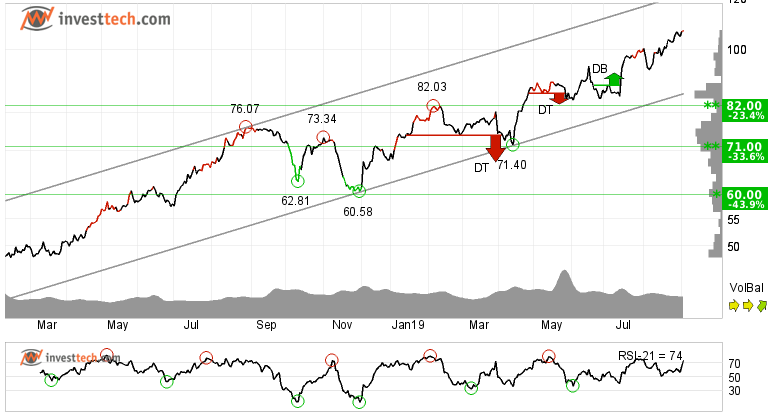

Carl-Zeiss Meditec AG (AFX.DE) Close: 107.00

Investors have paid higher prices over time to buy Carl-Zeiss Meditec AG and the stock is in a rising trend channel in all time frames: short, medium and long term. This signals increasing optimism among investors and indicates continued rise. In the longer term chart, the stock is approaching the ceiling of the trend channel. A break and close above that may lead the stock to rise with relatively more strength.

Since November last year, the stock has gained over 75 per cent and the annualised rate of increase is 58 %. Currently the stock is trading at an all time high, hence there is no visible resistance. On the other hand, there is support at 100 euros in the short term.

The momentum indicator is positive and supports the underlying strength in price. The stock is overall assessed as technically positive for the medium term.

Investtech's outlook (one to six months): Positive

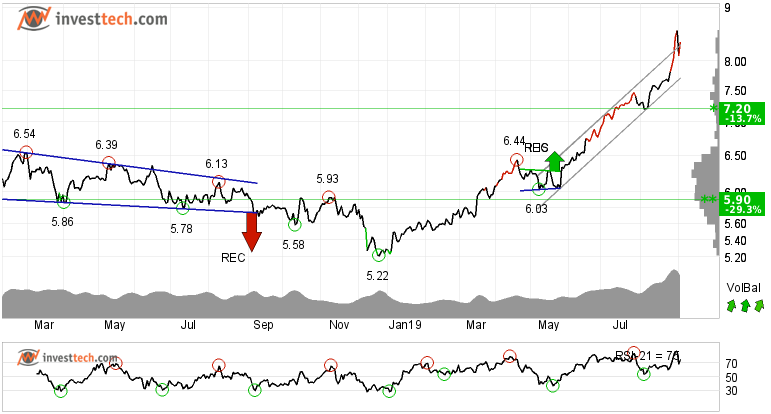

Encavis AG (CAP.DE) Close: 8.34

Encavis AG has broken up through the ceiling of the rising trend channel in the medium term, which signals an even stronger rate of growth for the stock price. In the long term, the stock gave a buy signal from a rectangle formation in July this year and has now broken above its previous long established resistance of five years around 8.24 euros. Further rise in price is expected. In case of any reaction on the downside, there is support around 7.48 euros.

Positive volume balance shows that volume is higher on days with rising prices than days with falling prices. This indicates increasing optimism among investors. The short term momentum of the stock is strongly positive, with RSI above 70. This indicates increasing optimism among investors and further price increase for Encavis AG. The stock is overall assessed as technically positive for the medium and long term.

Investtech's outlook (one to six months): Positive

PNE Wind AG (PNE3.DE) Close: 3.58

The CDAX listed company showed strong development in a rising trend and later in August broke above the ceiling of the rising trend channel in all time frames: short, medium and long term. This indicates that optimism among investors has been steadily rising as they have paid more over and over again to buy the stock. After a long period of consolidation of nine months, the stock had given a buy signal from a rectangle formation. Even though the objective from the formation is met, the formation indicates continuation in price rise until reversed. Support is around 2.90 euros.

The liquidity in the stock increased dramatically in the last few weeks, hence one must be cautious as the 66 days average liquidity is 0.77 million euros.

The volume balance indicator is positive and strengthens the stock. This indicator suggests that the volume is higher on days with stock price rising and lower on days with stock price falling. The momentum indicator RSI is above 70 and indicates strength in underlying trend.

Investtech's outlook (one to six months): Positive

The analyses are based on closing price as per September 3, 2019.

Note: These instruments are traded in currency based on the Exchange or country they are listed on.

Written by

Analyst - Investtech

"Investtech analyses the psychology of the market and gives concrete trading suggestions every day."

Partner & Senior Advisor - Investtech

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices