Volume balance is a reliable indicator

Published 2 May 2019

A research report from Investtech based on 12 years of data from the National Stock Exchange in India shows that stocks with high volume balance have continued to rise and stocks with low volume balance have given significant negative excess return compared to benchmark.

Volume balance is the correlation between price change and volume. The indicator is calculated for 5, 22 and 66 days, corresponding to a week, a month and a quarter respectively.

The indicator has values between –100 for maximally negative and +100 for maximally positive. The exact values are shown in the table in Investtech's chart pages, and visualized by arrows in the bottom right hand corner of the charts. Green arrows pointing upwards show that volume balance is positive and red arrows pointing downwards show that volume balance is negative. Yellow sideways arrows show neutral volume balance.

High volume on increasing prices indicates that optimism is increasing and many investors pay more to secure stocks. Low volume on falling prices indicates that few investors will reduce the price to secure a sell and that they are comfortable keeping the stock. This is positive, and mirrored in a high volume balance.

High volume on increasing prices indicates that optimism is increasing and many investors pay more to secure stocks. Low volume on falling prices indicates that few investors will reduce the price to secure a sell and that they are comfortable keeping the stock. This is positive, and mirrored in a high volume balance.

The green columns show volume on days with increasing prices, while the red show volume on days with falling prices. High green columns and low red ones give positive volume balance. This chart above is copied from Investtech's subscription service.

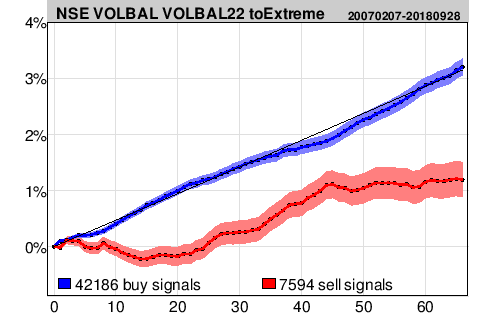

We have studied what happened in the 42,186 cases where the 22 day volume balance, volbal22, went above the 40 limit, defined as a buy signal, and the 7,594 cases where volbal22 fell below the -40 limit, defined as a sell signal.

The figure above shows price development in the first 66 days after volume balance signals vs average benchmark development for the whole period. The blue line is buy signals, the red line is sell signals and the black line is benchmark.

The table below shows annualized excess return following volbal22 signals. The figures are based on the quarterly figures, i.e. excess return 66 days (3 months) after the signal was triggered.

| Annualized excess return | |

| Buy signal volbal22 goes above 40 | 0,3 %p |

| Sell signal volbal22 falls below -40 | -8,3 %p |

%p: percentage points

The results show that stocks with negative volume balance have fallen over time. Statistically they continue to underperform vs benchmark. High volume balance in Investtech's charts is positive, but should be accompanied by signals from other indicators like rising trend or high momentum in order to indicate good excess return.

Investtech offers a number of stock picking tools, and using Stock selection you can set criteria for volume balance, allowing you to find for instance all stocks with volbal22 above 40. You can also set criteria for liquidity and volatility.

Please find more research results and details in the complete research report here.

Keywords: Buy signal,NSE,RSI,RSI-momentum,Sell signal,statistics.

Written by

Head of Research and Analysis

at Investtech

Insight & Skills:

Pro tip:

Stock selection

Using the tool Stock selection you can set criteria for volbal22, allowing you to screen all stocks with volbal22 above 40 and liquidity of your choice.

"Investtech analyses the psychology of the market and gives concrete trading suggestions every day."

Partner & Senior Advisor - Investtech

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices