Xtrackers DAX UCITS ET (DBXD.ETF)

Algorithmic Overall Analysis

Weak Positive (Score: 43)

Apr 25, 2025. Updated daily.

Analyses

Short

Medium

Long

Overall

Investor Psychology - Behavioural Finance - Quantitative Analysis - Scientific Methods

Technical Analysis - Insider Trades - Seasonal Variations - Intraday Trading

Stock data

| Price date | Apr 25, 2025 |

| Currency | EUR |

| ISIN | LU0274211480 |

| Rise from year low | 27.97% |

| Fall from year high | -4.91% |

Automatic technical analysis. Short term

Short term

Xtrackers DAX UCITS ETF 1C is within an approximate horizontal trend channel in the short term. This indicates that investors are uncertain and waiting for signals of further direction. A break upwards will be a positive signal, while a break downwards will be a negative signal. The price has reacted back after a break of the rectangle formation. There is resistance around 210, which now opens good sales opportunities. A decisive break of this resistance will neutralize the negative signal. The ETF is testing resistance at euro 210. This could give a negative reaction, but an upward breakthrough of euro 210 means a positive signal. Negative volume balance indicates that volume is high on days with falling prices and low on days with rising prices, which weakens the ETF. The ETF is overall assessed as technically slightly negative for the short term.Recommendation one to six weeks: Weak Negative (Score: -34)

Automatic technical analysis. Medium term

Medium term

Xtrackers DAX UCITS ETF 1C shows strong development within a rising trend channel in the medium long term. Rising trends indicate that the ETF experiences positive development and that buy interest among investors is increasing. The price has reacted back after a break of the rectangle formation. There is resistance around 210, which now opens good sales opportunities. A decisive break of this resistance will neutralize the negative signal. The ETF has support at euro 185 and resistance at euro 220. Negative volume balance weakens the ETF in the short term. The ETF is overall assessed as technically slightly positive for the medium long term.Recommendation one to six months: Weak Positive (Score: 38)

Automatic technical analysis. Long term

Long term

Xtrackers DAX UCITS ETF 1C is in a rising trend channel in the long term. This shows that investors over time have bought the ETF at higher prices and indicates good development for the ETF. There is no resistance in the price chart and further rise is indicated. In case of a negative reaction, the ETF has support at approximately 155 euro. Negative volume balance indicates that volume is high on days with falling prices and low on days with rising prices, which weakens the ETF. The ETF is overall assessed as technically positive for the long term.Recommendation one to six quarters: Positive (Score: 75)

Full history

Candlesticks 95 days

Candlesticks 22 days

Seasonal variations

Seasonal prediction from today's date

Monthly and annual statistics

Average development per month, last 7 years

Average development throughout the year, last 7 years

Annual development from 2018 to 2024

Early warning

Alerts

No alertsKey ratios

Data missingHelp and information - Research shows the importance of Trend, Momentum and Volume

Investtech’s analyses focus on a stock’s trend status, short term momentum and volume development. These are central topics of technical analysis theory that describe changes in investor optimism or fluctuations in a company’s financial development. However, Investtech’s strong focus on these elements is due to research results that clearly indicate causation between these factors and future return on the stock market.

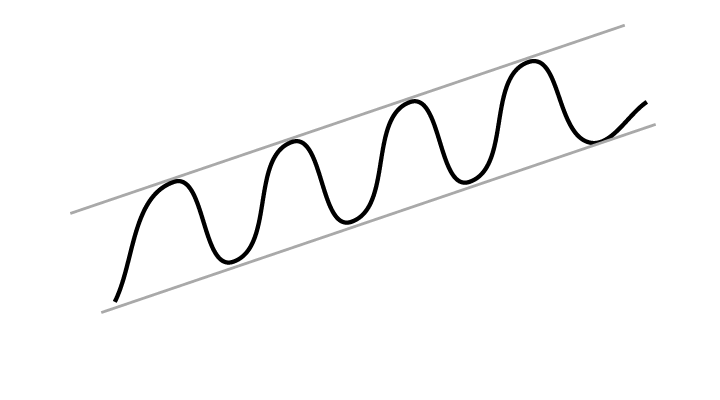

Trend

Theory: Stocks in rising trends will continue to rise.

Psychology/economy: Rising trends indicate that the company experiences positive development and increasing buy interest among investors. Read more

Research: Stocks in rising trend channels in Investtech’s medium long term charts have been followed by an annualized excess return of 7.8 percentage points compared to average benchmark development. This is shown by Investtech’s research into 34,880 cases of stocks in rising trends on the Nordic Stock Exchanges in the period 1996 to 2015.

Read more about the research results here

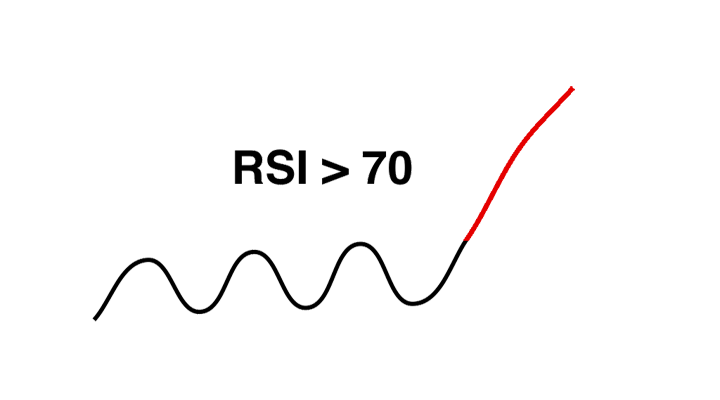

Momentum

Theory: Stocks with rising short term momentum will continue to rise. Stocks with very strong momentum (overbought) will react backwards.

Psychology/economy: RSI above 70 shows strong positive momentum. The stock has risen in the short term without any significant reactions downwards. Investors have kept paying more to buy stocks. This indicates that more investors want to buy the stock and that the price will continue to rise. Read more

Research: Stocks with strong momentum have on average continued to rise, and more so than the average stock listed on the Exchange. This is shown by Investtech’s research into 24,208 cases of stocks on the Nordic Stock Exchanges in the period 1996 to 2015 where RSI went above 70 points, indicating strong and increasing short term momentum. On average, annualized, the stocks rose the equivalent of 11.4 percentage points more than the average stock.

Read the research report here

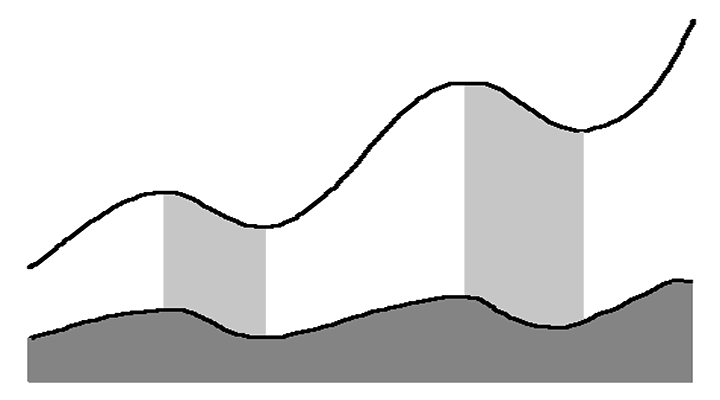

Volume

Theory: Rising prices on high volume and falling prices on low volume indicate strength in a stock. Volume can confirm a rising trend or signal that a falling trend is ending.

Psychology/economy: When investors very much want to buy a stock, they have to increase the price to find new sellers. Rising price on high volume shows that some investors are so aggressive that they push the price up to be able to buy the stock. Investtech’s Volume Balance tool measures the relation between price rise and volume and measures investor aggression at rising and falling prices. Read more

Research: Stocks with volume balance above 40 have been followed by an average annual return of 4.7 percentage points on the Nordic Stock Exchanges, shown by research conducted by Investtech into 24,580 cases.

Read the research report here

Investtech's analyses

Investtech has combined theory, psychology and research into powerful investment tools.

About Investtech

Investtech are behavioural finance and quantitative stock analysis specialists. The company sells analysis products to private, professional and institutional investors. Investtech manage the AIFM company Investtech Invest, which invests customers’ funds in the stock market.

Investtech’s computers analyze more than 28,000 stocks from 12 different countries every day. The analyses are presented in eight languages and sold to customers worldwide. In addition to the automatic analyses, the company’s analysts present subjective assessments and recommendations for some markets. The analyses are available to customers in the form of daily morning reports and cases, and weekly market updates and model portfolios.

Investtech’s algorithms for analysis, ranking and stock recommendations are based on research dating back to 1993. Part of the research was conducted in cooperation with Oslo University and the Norwegian Research Council. Research still has high priority for Investtech. Many of the company’s research results are available for customers on the company’s web site.

The company’s basic product starts at approx. 30 euro per month. Investtech also provides bespoke products for integration on partners’ web sites and for use in newsletters, for example to stock brokers and the media. Contact us by e-mail to info@investtech.com or by phone +47 21 555 888 for more information. A free trial subscription is available to order on our web site www.investtech.com.

Head Office

Investtech ASStrandveien 17

1366 Lysaker

+47 21 555 888

Postal address

Investtech ASStrandveien 17

1366 Lysaker

info@investtech.com

VAT no. 978 655 424 MVA

Research Department

Instituttveien 102007 Kjeller

www.investtech.com

Investor Psychology - Behavioural Finance - Quantitative Analysis - Scientific Methods

Technical Analysis - Insider Trades - Seasonal Variations - Intraday Trading

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices