Global stocks: BITCOIN in a rush

Published May 13, 2019

Bitcoin is in a rush. Since our last published analysis on April 3 and til the time we write this analysis on May 13 at 2030 hrs CET, the cryptocurrency has risen from 4958 to 7785 dollars, which is up by 57 percent.

What is driving the crypto giant crazy? It could be anything from US-China tussle to pure speculation, or simply buyers interest. No one can give a concrete fundamental reason behind this leap. This is where technical analysis makes itself extremely useful and handy. Just by looking at the charts early in April, one could have obtained certain hints that there is something cooking behind the scenes and awaiting our attention. And we at Investtech like morning birds gave our readers an early wake-up call. We had given a weak buy on April 3 at a price of 4957.52 dollars. What is in store ahead?

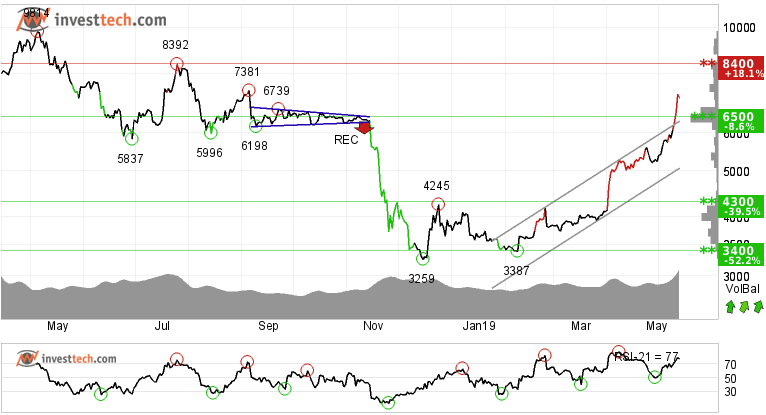

Bitcoin (BTC.CPT) Close: 7 112.33 (-140.23), May 13 (intraday), 2019

Looking at last friday's closing price and the latest uploaded intraday charts on Investtech's website, it is clearly a buy signal in all time frames whether short, medium or long term as the price has broken out of its resistance area around 6500 dollars.

Investors have paid higher prices over time to buy in Bitcoin and the price has broken through the ceiling of rising trend channel in the medium term. The cryptocurrency has support at 6500 and resistance at 8400.

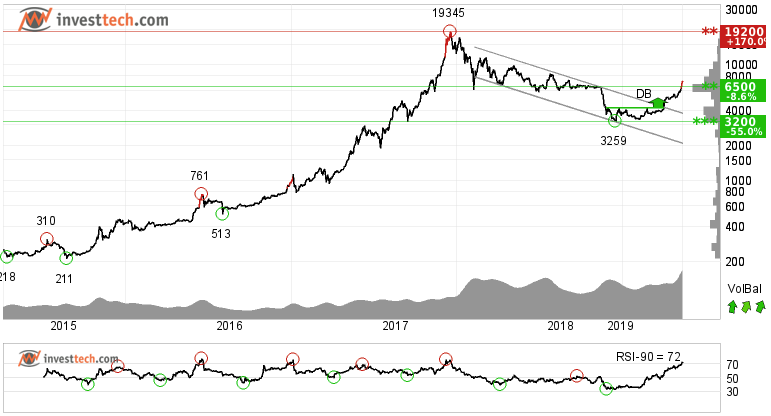

In the long term chart, the price has broken out of the long term falling trend channel and also gave a breakout from a double bottom formation. The longer term RSI-90 is also above 70 which indicated underlying strength and shows rising momentum in the crypto.

Positive volume balance, with high volume on days of rising prices and low volume on days of falling prices, strengthens the price in the short term. The short term momentum of the stock is strongly positive, with RSI above 70. This indicates increasing optimism among investors and further price increase for Bitcoin.

We upgrade our recommendation for Bitcoin as technically positive from weak positive.

The analyses are based on closing price as per May 13, intraday, 2019

Note: These instruments are traded in currency based on the exchange or country they are listed on.

Kirjoittaja

Analyst

Investtech

"Investtech analysoi markkinoiden psykologiaa ja antaa konkreettisia kaupankäyntisuosituksia päivittäin."

Partner & Senior Advisor - Investtech

Investtech ei takaa analyysien tarkkuutta tai kattavuutta. Kaikkien analyysien tuottamien neuvojen ja signaalien käyttäminen on täysin käyttäjän vastuulla. Investtech ei vastaa mistään tappioista, jotka saattavat syntyä Investtechin analyysien käytön seurauksena. Mahdollisten eturistiriitojen yksityiskohdat mainitaan aina sijoitusneuvon yhteydessä. Lisätietoja Investtechin analyyseistä löytyy täältä disclaimer.

Investtech ei takaa analyysien tarkkuutta tai kattavuutta. Kaikkien analyysien tuottamien neuvojen ja signaalien käyttäminen on täysin käyttäjän vastuulla. Investtech ei vastaa mistään tappioista, jotka saattavat syntyä Investtechin analyysien käytön seurauksena. Mahdollisten eturistiriitojen yksityiskohdat mainitaan aina sijoitusneuvon yhteydessä. Lisätietoja Investtechin analyyseistä löytyy täältä disclaimer.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices