Global stocks: Good opportunities in Tesla and Baidu stocks

Published November 13, 2019

Tesla Inc (TSLA.US) Close: 349.93

Tesla Inc. has broken the ceiling of the falling trend in the medium term. In the beginning this indicates either a slower initial falling rate or the development of a more sideways trend. However, the stock is in a rising trend channel both in the short and long term charts. This makes the overall trend image for the stock brighter.

The stock has recently broken the resistance at 264 and 290 dollars on high volume. The sharp rise in price is also accompanied by higher volatility. Hence one can expect swift movements in the stock price for the days to come.

The next resistance level is around 376-380 dollars which has been tested on many occasions earlier. A break and close above this level may initiate fresh buying in the stock.

Positive volume balance, with high volume on days of rising prices and low volume on days of falling prices, strengthens the stock in the short term. RSI above 70 shows that the stock has strong positive momentum in the short term. Investors have steadily paid more to buy the stock, which indicates increasing optimism and that the price will continue to rise.

Investtech's outlook (one to six months): Positive

Baidu, Inc. (BIDU.US) Close: 121.80

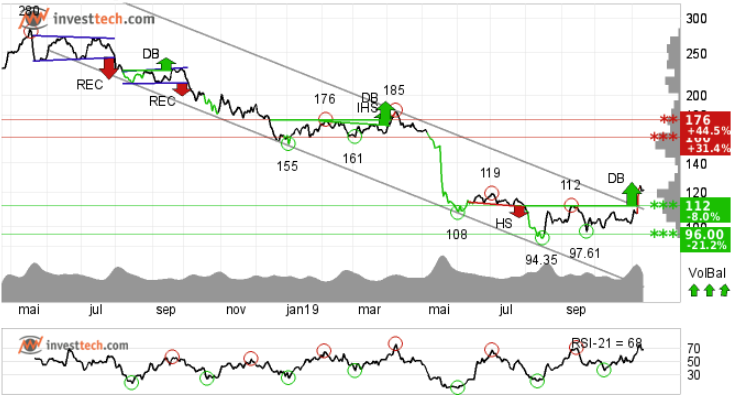

Baidu Inc. has broken above the ceiling of the falling trend channel stretching over a year, both in the medium and long term charts. The stock has also given a buy signal through a breakout from a double bottom formation. The target from the formation is around 126 dollars, but the formation itself suggest further rise in price. The next resistance is at 160 and 176 dollars respectively, and the support is at 112 and 90 dollars.

The current movement has strong momentum as the momentum indicator RSI is above 70. It suggests that the investors have steadily paid more to buy the stock, which indicates increasing optimism and that the price will continue to rise. The volume balance indicator is also turning its head towards positive and indicates that more and more players are now buying the stock at rising prices. Further rise in stock price is expected.

Investtech's outlook (one to six months): Positive

The analyses are based on closing price as per November 12, 2019.

These instruments are traded in currency based on the Exchange or country they are listed on.

Kirjoittaja

Analyst

Investtech

"Investtech analysoi markkinoiden psykologiaa ja antaa konkreettisia kaupankäyntisuosituksia päivittäin."

Partner & Senior Advisor - Investtech

Investtech ei takaa analyysien tarkkuutta tai kattavuutta. Kaikkien analyysien tuottamien neuvojen ja signaalien käyttäminen on täysin käyttäjän vastuulla. Investtech ei vastaa mistään tappioista, jotka saattavat syntyä Investtechin analyysien käytön seurauksena. Mahdollisten eturistiriitojen yksityiskohdat mainitaan aina sijoitusneuvon yhteydessä. Lisätietoja Investtechin analyyseistä löytyy täältä disclaimer.

Investtech ei takaa analyysien tarkkuutta tai kattavuutta. Kaikkien analyysien tuottamien neuvojen ja signaalien käyttäminen on täysin käyttäjän vastuulla. Investtech ei vastaa mistään tappioista, jotka saattavat syntyä Investtechin analyysien käytön seurauksena. Mahdollisten eturistiriitojen yksityiskohdat mainitaan aina sijoitusneuvon yhteydessä. Lisätietoja Investtechin analyyseistä löytyy täältä disclaimer.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices