Correlation between price development and volume development

Correlation between price development and volume development shows whether volume confirms the overall trend or if it warns of a coming reversal.

Ordinarily volume should increase in the trend direction. In rising trends we want high volume on rises and near tops, and low volume on falling prices and near bottoms. This development signals a healthy stock with ever more optimistic investors, and strengthens an overall positive trend.

Similarly high volume on falling prices and near bottoms in a falling trend will confirm the overall negative trend and indicate it will continue to fall.

Deviations from the above warn of a coming trend reversal.

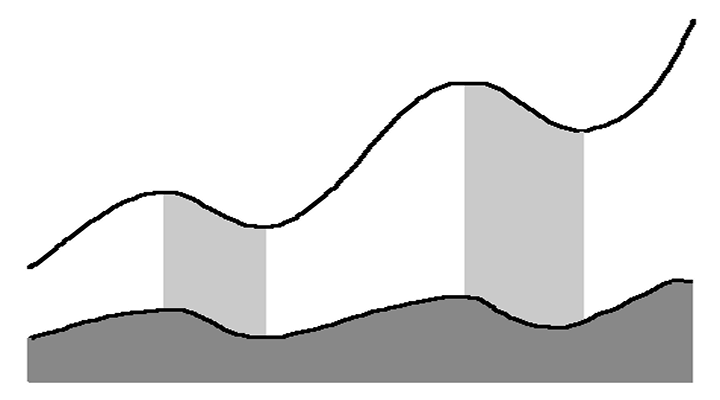

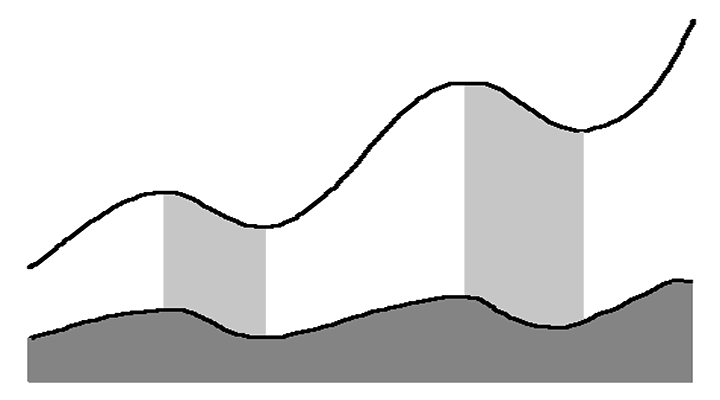

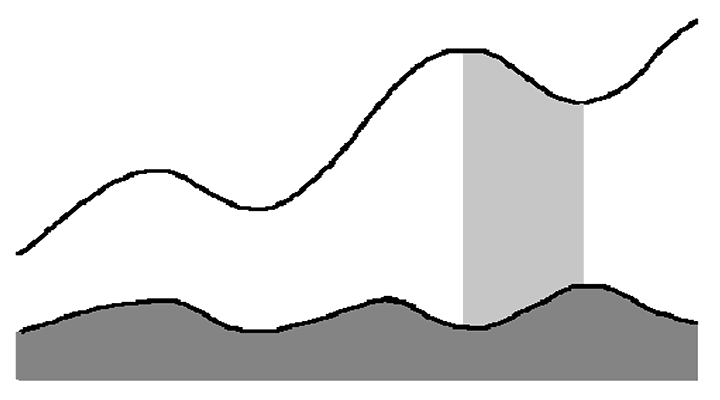

Normal situations

Volume should increase in the trend direction. The figure shows a rising trend with high volume near tops and low volume near bottoms. Aggressive investors have to pay more to get the stocks that they want. Few investors sell near bottoms, as they are positive to the stock and comfortable keeping it.

Volume should increase in the trend direction. The figure shows a rising trend with high volume near tops and low volume near bottoms. Aggressive investors have to pay more to get the stocks that they want. Few investors sell near bottoms, as they are positive to the stock and comfortable keeping it.

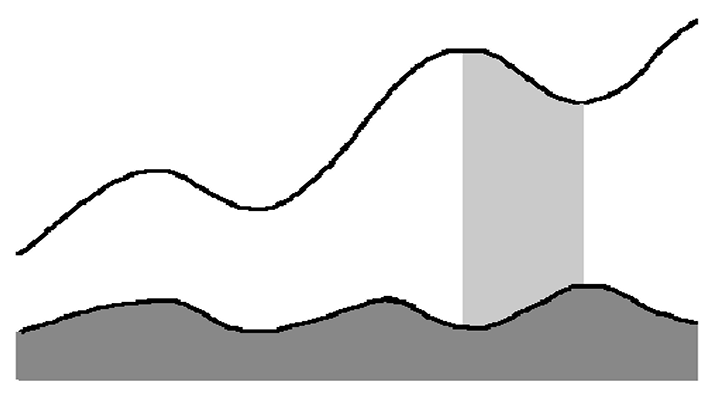

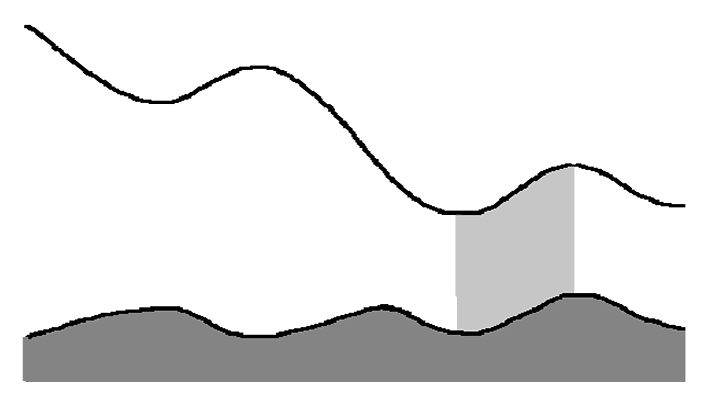

Decreasing volume in the trend direction warns of a possible trend break. In the figure to the left the buyers have little power, as volume near the last top is low. At the same time, sellers are aggressive when the price falls. This indicates nervous sellers and hesitant buyers, and signals a potential break downward.

Decreasing volume in the trend direction warns of a possible trend break. In the figure to the left the buyers have little power, as volume near the last top is low. At the same time, sellers are aggressive when the price falls. This indicates nervous sellers and hesitant buyers, and signals a potential break downward.

Trading opportunities

Volume development can indicate trading opportunities. When the correlation between price development and volume development is clearly positive in falling or sideways trends, this may open up for good short term trading opportunities. Such situations often involve high risk, but the upside can be very good.

Volume development can indicate trading opportunities. When the correlation between price development and volume development is clearly positive in falling or sideways trends, this may open up for good short term trading opportunities. Such situations often involve high risk, but the upside can be very good.

The best trading opportunities are when the price falls on a low volume in rising trends and approaches the trend floor.

Special circumstances

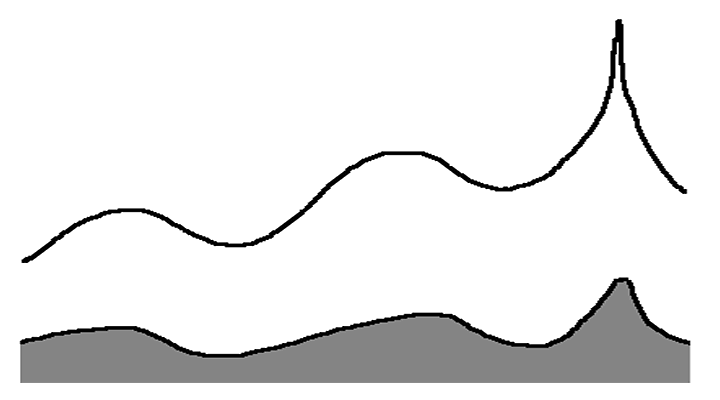

Greatly increasing volume along with a serious price increase can indicate a final rally. Such situations tend to occur when a rising trend has lasted for a long time. Following new positive news or new focus in the media, everyone wants to own the stock. This results in a great and sudden price increase on high volume. If the situation is followed by significant price reduction, it may have been a final rally.

Greatly increasing volume along with a serious price increase can indicate a final rally. Such situations tend to occur when a rising trend has lasted for a long time. Following new positive news or new focus in the media, everyone wants to own the stock. This results in a great and sudden price increase on high volume. If the situation is followed by significant price reduction, it may have been a final rally.

However, please note that rising trends tend to last longer than many investors think, and the stocks often keep rising, even after significant price increases on very high volume.

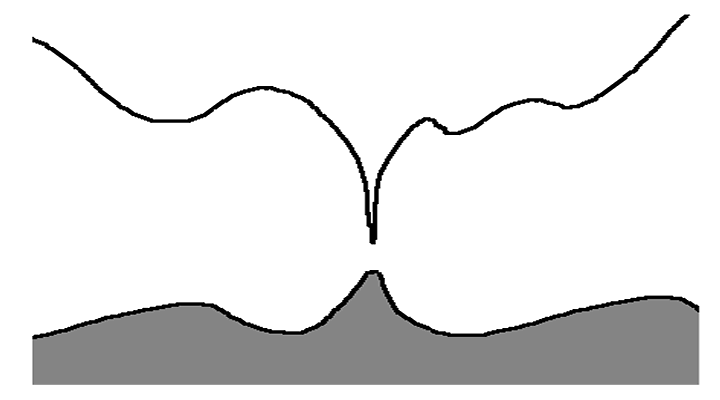

A significant price fall on very high volume in a falling trend may indicate a sell off. Following a long list of negative news, the last investors give up. If the price then rises and volume increases, it signals that the investors have been as negative as they can possibly get and that optimism is returning.

A significant price fall on very high volume in a falling trend may indicate a sell off. Following a long list of negative news, the last investors give up. If the price then rises and volume increases, it signals that the investors have been as negative as they can possibly get and that optimism is returning.

Please note, however, that falling trends often last for a long time, and disappointment is often followed by more disappointment. Beware of buying into the stock after a fall like this, at least until a clearly positive volume development is seen, preferably in combination with a short term positive overall trend. And even then the risk will still be high.

Investtech ei takaa analyysien tarkkuutta tai kattavuutta. Kaikkien analyysien tuottamien neuvojen ja signaalien käyttäminen on täysin käyttäjän vastuulla. Investtech ei vastaa mistään tappioista, jotka saattavat syntyä Investtechin analyysien käytön seurauksena. Mahdollisten eturistiriitojen yksityiskohdat mainitaan aina sijoitusneuvon yhteydessä. Lisätietoja Investtechin analyyseistä löytyy täältä disclaimer.

Investtech ei takaa analyysien tarkkuutta tai kattavuutta. Kaikkien analyysien tuottamien neuvojen ja signaalien käyttäminen on täysin käyttäjän vastuulla. Investtech ei vastaa mistään tappioista, jotka saattavat syntyä Investtechin analyysien käytön seurauksena. Mahdollisten eturistiriitojen yksityiskohdat mainitaan aina sijoitusneuvon yhteydessä. Lisätietoja Investtechin analyyseistä löytyy täältä disclaimer.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices