Exclusive research report: Rectangles and return from breakouts

Published April 24, 2019

In technical analysis there are only two independent factors, price and volume, that can be studied on their own. Now in price itself can be found many patterns that can be used as a good entry or exit tool. And to accompany such patterns, volume is another factor that one must not forget at any point. Volume reflects the quality of the breakout, if there is overweight of buyers or sellers.

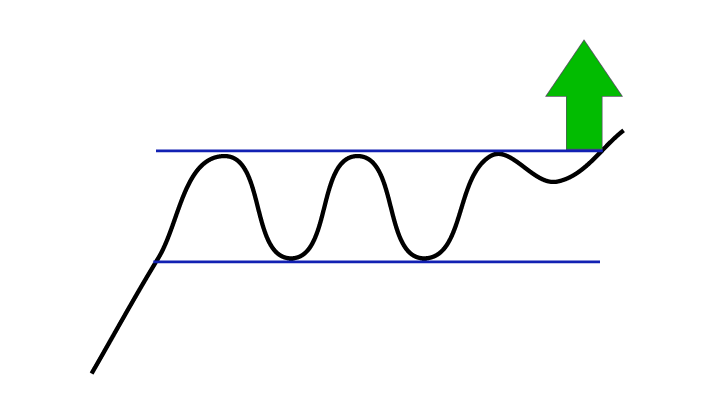

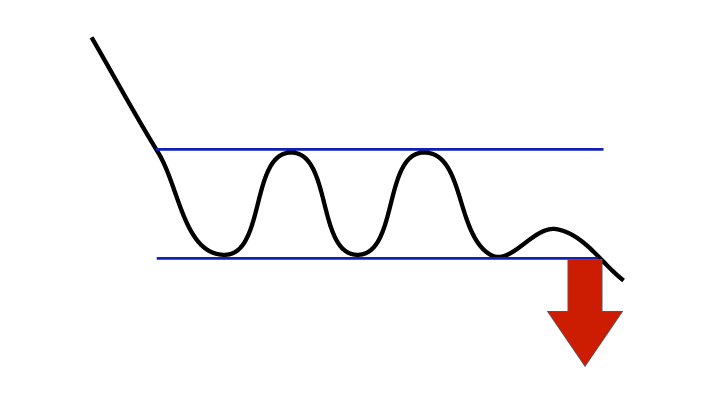

A rectangle formation is one of the most popular and easy to identify price patterns that are created when buyers and sellers of the stock are balanced over time. In other words, one can say there is indecisiveness among investors and traders as to which way the price should move. Hence a sideways move.

Figure 1: Buy signal from rectangle formation.

Figure 2: Sell signal from rectangle formation.

Technical analysis theory suggests that investor psychology is about to change when the price breaks out from such formations. Such breakouts are considered stronger if they are accompanied by a surge in volume whether its a buy or a sell signal. Target from the formation (as shown in the image below) is the height of the formation projected from the point of breakout/breakdown.

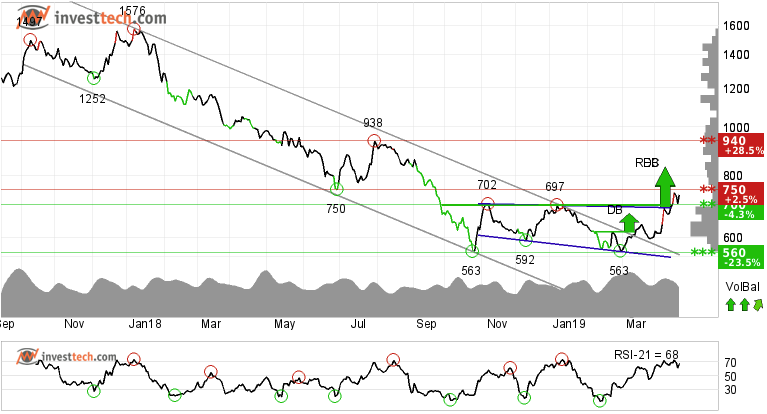

Figure 3: A stock develops a rectangle formation when the price moves sideways between a support line and a resistance line. If the price breaks up from the rectangle, it triggers a buy signal, and according to technical analysis theory the stock price will rise at least as much as the height of the formation. If the price breaks downwards, it triggers a sell signal, and the stock price will fall accordingly.

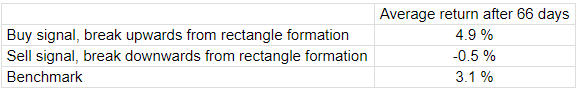

Background and outcome: A report based on 12 years of data from the National Stock Exchange in India shows that stocks with buy signal (3,717 buy signals identified) from rectangle formations on average have risen by 4.9 per cent after three months, while stocks with sell signal (3,004 sell signals identified) from rectangle formations have fallen 0.5 per cent. There is an excess return of 1.8 percentage points compared to benchmark, which on average increased by 3.1 per cent.

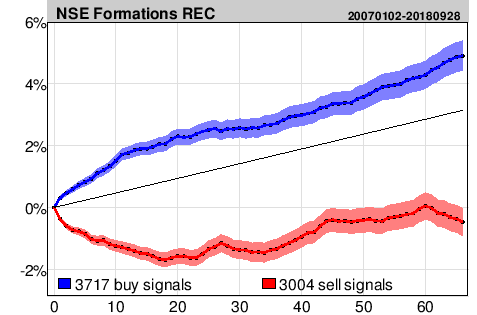

Below is the graph that shows results from Investtech's automatic algorithms in medium term charts. The signals are triggered on day 0. Only days when the exchange is open are included, so 66 days equal approximately 3 months. Buy signals are the blue line and the sell signals are the red one. The shaded areas show the standard deviation for these calculations. The black line is the benchmark index.

Rectangle formations and average benchmark

Figure 4: Average price development first 66 days after stocks triggered buy signal (blue) and sell signal (red) from rectangle formations in Investtech's medium long term technical charts. Average benchmark development is the black line. Click the chart for bigger version.

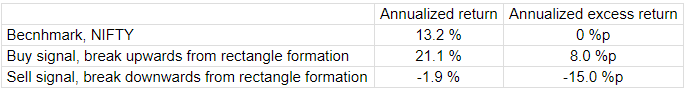

Annualized return: The table below shows annualized return and excess return in percentage points (%p). Annualized return is calculated by repeating the 66 day return four times. Excess return is calculated by subtracting average 66 day return of benchmark index four times. Buy signals gave an annualized excess return of 8.0 percentage points, while sell signals gave negative returns of 15 percentage points with respect to the benchmark Nifty 50 index.

%p: percentage points

Our opinion: Based on historical prices for stocks on the National Stock Exchange in the period 2007 to 2018, stocks with buy signals from rectangle formations have clearly outperformed benchmark the following three months. Similarly, stocks with sell signals from rectangle formations have underperformed.

Complete report available here.

As you navigate through our menu on the Indian page of our website, you can click on 'signals' and choose between positive or negative stocks, breakouts from different price formations and different time frames. This will give you an overview of stocks that match with your preset criteria.

On the same note we now analyze two stocks that have recently given breakout from rectangle formations.

ABB India Limited (ABB.NS) Close: 372.20

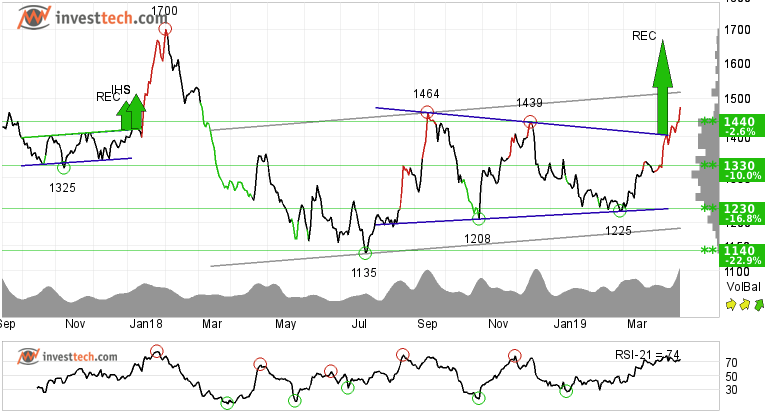

ABB India Limited is within an approximate horizontal trend channel in the medium and long term. The stock has given a buy signal via a breakout from a rectangle formation and closing above the resistance of 1440 rupees. Further rise to 1669 or more is signalled. On the downside there is support between 1440 and 1330.

The breakout in price was accompanied by a rise in volume. This suggests that more people were interested to buy the stock and did not want to be left behind. In addition, RSI is above 70 after a good price increase the past weeks. The stock has strong positive momentum and further increase is indicated. The stock is overall assessed as technically positive for the medium term.

Recommendation one to six months: Positive

Motilal Oswal Financia (MOTILALOFS.NS) Close: 1057.95

Motilal Oswal Financial Services Limited has broken through the ceiling of a falling trend channel in the medium and long term. The stock has given a positive signal from a rectangle formation by a break up through the resistance at 690. Further rise to 832 or more is signalled. The stock is between the support at rupee 700 and the resistance at rupee 750. A definitive break through of one of these levels predicts the new direction.

RSI is above 70 after a good price increase the past weeks. The stock has strong positive momentum and further increase is indicated. The RSI curve shows a rising trend and the volume balance indicator is also positive. Combined these indicators support the positive trend. The stock is overall assessed as technically positive for the medium term.

Recommendation one to six months: Positive

We will be publishing a similar report by the end of this week for stocks in rising and falling trend for NSE listed stocks, and how much return they have given in the coming three and twelve months.

The analyses are based on closing price as per April 23, 2019. Maintaining proper stop loss is always recommended.

Skrevet av

Analytiker

i Investtech

Archive:

17 April: Stock with 20 per cent upside potential

11 April: Three buy opportunities, price-volume breakout

29 March: Two stocks to stay from

27 March: Recent breakouts in three stocks, short term opportunity

21 March: Three buy and one sell

12 March: Cement stocks are posing good opportunity

08 March: Clear breakout and reversal from intermediate downtrend

07 March: Deepak Nitrite Limited looks promising to enter into a trade

06 March: Three buy candidates for medium to long term

28 February: Breakout in these three stocks invites for early opportunity

26 February: Two buy opportunities for the near term future

21 February: Stocks with RSI above 70, based on our research

19 February: Close to selling point, time to be cautious

15 February: These two sugar stocks look promising

14 February: Three short to medium term opportunities

08 February: One buy and one sell in stocks while index suggests caution

06 February: One buy and one sell, short to medium term opportunities

01 February: Upside breakout from price formations

30 January: Buying opportunity: Reversing from trend channel support

9 January: One positive and one to stay away from

2 January: A good investment opportunity

2018

21 December: Good buying opportunities

14 December: Positive on these three stocks

11 December: One buy and one sell signal

07 December: Sell Signals in Three Big Stocks

04 December: Highest scorer of our Top 50 list

30 November: Positive stocks with 5-11 per cent upside potential

28 November: Buy signal on high volume

27 November: One Buy and One Sell Signal

23 November: Fear dominates these stocks

21 November: Sell signal, time to stay away

20 November: Early opportunity from short term buy signal?

16 November: Two Buy Signals and One Sell Signal

15 November: Buy signal in this one

13 November: Big auto stocks comparison

09 November: What to wait for?

06 November: Banking stocks look positive

02 November: Positive on this one

01 November: TECHM, NIFTY50 and Hausse

31 October: What are investors thinking?

30 October: Bullish on these three stocks

26 October: Three potential candidates to ride on

24 October: Three big Metal stocks, Seasonal variation

22 October: Among top performers on our Top 50 list

18 October: Three stocks investors should stay away from

17 October: Flowing against the tide

16 October: Positive on these 2 stocks

11 October: Over 45 per cent rise

9 October: The Indian banking space

5 October: Nifty closes at a crucial level

2 October: Price formations in the long-term charts

28 September: Positive on Biocon Limited

"Investtech analyserer psykologien i markedet og gir deg konkrete tradingforslag hver dag."

Partner & Senior Advisor - Investtech

Investeringsanbefalingen(e) er utarbeidet av Investtech.com AS ("Investtech"). Investtech garanterer ikke fullstendigheten eller riktigheten av analysen. Eventuell eksponering i henhold til rådene / signalene som fremkommer i analysene står fullt og helt for investors regning og risiko. Investtech er ikke ansvarlig for noe tap, verken direkte eller indirekte, som oppstår som en følge av bruk av Investtechs analyser. Opplysninger om eventuelle interessekonflikter vil alltid fremgå av investeringsanbefalingen. Ytterligere informasjon om Investtechs analyser finnes på informasjonssiden.

Investeringsanbefalingen(e) er utarbeidet av Investtech.com AS ("Investtech"). Investtech garanterer ikke fullstendigheten eller riktigheten av analysen. Eventuell eksponering i henhold til rådene / signalene som fremkommer i analysene står fullt og helt for investors regning og risiko. Investtech er ikke ansvarlig for noe tap, verken direkte eller indirekte, som oppstår som en følge av bruk av Investtechs analyser. Opplysninger om eventuelle interessekonflikter vil alltid fremgå av investeringsanbefalingen. Ytterligere informasjon om Investtechs analyser finnes på informasjonssiden.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices