How to stay invested in a market like this?

Published June 05, 2019

How to trade or invest in a scenario when international indices are looking shaky while domestic market is going gaga?

Nifty 50 index is around all time high and closed above 12000 points for second day in a row. 42 stocks of all NSE listed companies have touched new 52 week high in Tuesday's trade, while 75 have hit a new low for the same period. In a bull market this statistic should have been other way around.

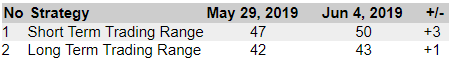

Hausse index, created by Investtech, show the level of optimism among short term and long term investors, and whether the optimism is rising or falling. In special situations, following long rises or falls, hausse analysis can identify the turning points in the market. As per the numbers given in the box below, short term investors are indecisive in which direction they want to take the market. While the long term hausse index clearly shows an overweight of pessimists than optimists. This broadly suggests caution and one must always maintain a stop loss at all times.

An important piece of advice would be to stay away from stocks that are already in a falling trend in the longer to medium term charts, or are breaking down from any price formations combined with RSI value to be below 50 or preferably below 30. Stocks like RELINFRA, CADILAHC, IDEA, RPOWER, ECLERX, RCOM, etc. for that matter should be avoided.

Our research on Trend and RSI for NSE listed stocks for the period 1 January 2007 to 31 December 2018 has remarkable results. Stocks, where RSI-21 breaks below 30, has given an annualized excess return of -10.9 percentage points with respect to Nifty 50 index. Also stocks in falling trend channel has underperformed the index by giving an annualized excess return of -12.3 percentage points.

On the other hand, stocks in rising trend has continued to perform better and has outperformed the index by 9.1 percentage points annually. Additionally in stocks where RSI21 broke above 70, outperformance of 9.0 percentage points was recorded. Latest example for stocks with rising trend and positive RSI are JUSTDIAL, AXISBANK, ATUL, BAJFINANCE, TCS, NESTLEIND, KEI, LT, RELIANCE, etc. You can find the short, medium and long term analysis of all stocks on our website. For today we write analysis of Nifty 50.

Nifty 50 (NIFTY.NS) Close: 12022.00

Investors have paid higher prices over time to buy Nifty 50 stocks and the index is in a rising trend channel in the short, medium and long term. This signals increasing optimism among investors and indicates continued rise. The index has support around 11700 and then around 11150-11130 points.

The short term momentum of the index is strongly positive, with RSI above 70. This indicates increasing optimism among investors. The index is assessed as technically positive for the short to medium term.

Recommendation one to six months: Positive

The analyses are based on closing price as per June 04, 2019. Maintaining proper stop loss is always recommended.

Skrevet av

Analytiker

i Investtech

Archive:

29 May: Three buy signals, strong momentum and positive volume balance

21 May: Two buy and one interesting to watch

6 May: This banking stock has gone up by 20% in the last six months

2 May: Three exciting buy opportunities - Price breakouts

24 April: Exclusive research report: Rectangles and return from breakouts

17 April: Stock with 20 per cent upside potential

11 April: Three buy opportunities, price-volume breakout

29 March: Two stocks to stay from

27 March: Recent breakouts in three stocks, short term opportunity

21 March: Three buy and one sell

12 March: Cement stocks are posing good opportunity

08 March: Clear breakout and reversal from intermediate downtrend

07 March: Deepak Nitrite Limited looks promising to enter into a trade

06 March: Three buy candidates for medium to long term

28 February: Breakout in these three stocks invites for early opportunity

26 February: Two buy opportunities for the near term future

21 February: Stocks with RSI above 70, based on our research

19 February: Close to selling point, time to be cautious

15 February: These two sugar stocks look promising

14 February: Three short to medium term opportunities

08 February: One buy and one sell in stocks while index suggests caution

06 February: One buy and one sell, short to medium term opportunities

01 February: Upside breakout from price formations

30 January: Buying opportunity: Reversing from trend channel support

9 January: One positive and one to stay away from

2 January: A good investment opportunity

2018

21 December: Good buying opportunities

14 December: Positive on these three stocks

11 December: One buy and one sell signal

07 December: Sell Signals in Three Big Stocks

04 December: Highest scorer of our Top 50 list

30 November: Positive stocks with 5-11 per cent upside potential

28 November: Buy signal on high volume

27 November: One Buy and One Sell Signal

23 November: Fear dominates these stocks

21 November: Sell signal, time to stay away

20 November: Early opportunity from short term buy signal?

16 November: Two Buy Signals and One Sell Signal

15 November: Buy signal in this one

13 November: Big auto stocks comparison

09 November: What to wait for?

06 November: Banking stocks look positive

02 November: Positive on this one

01 November: TECHM, NIFTY50 and Hausse

31 October: What are investors thinking?

30 October: Bullish on these three stocks

26 October: Three potential candidates to ride on

24 October: Three big Metal stocks, Seasonal variation

22 October: Among top performers on our Top 50 list

18 October: Three stocks investors should stay away from

17 October: Flowing against the tide

16 October: Positive on these 2 stocks

11 October: Over 45 per cent rise

9 October: The Indian banking space

5 October: Nifty closes at a crucial level

2 October: Price formations in the long-term charts

28 September: Positive on Biocon Limited

"Investtech analyserer psykologien i markedet og gir deg konkrete tradingforslag hver dag."

Partner & Senior Advisor - Investtech

Investeringsanbefalingen(e) er utarbeidet av Investtech.com AS ("Investtech"). Investtech garanterer ikke fullstendigheten eller riktigheten av analysen. Eventuell eksponering i henhold til rådene / signalene som fremkommer i analysene står fullt og helt for investors regning og risiko. Investtech er ikke ansvarlig for noe tap, verken direkte eller indirekte, som oppstår som en følge av bruk av Investtechs analyser. Opplysninger om eventuelle interessekonflikter vil alltid fremgå av investeringsanbefalingen. Ytterligere informasjon om Investtechs analyser finnes på informasjonssiden.

Investeringsanbefalingen(e) er utarbeidet av Investtech.com AS ("Investtech"). Investtech garanterer ikke fullstendigheten eller riktigheten av analysen. Eventuell eksponering i henhold til rådene / signalene som fremkommer i analysene står fullt og helt for investors regning og risiko. Investtech er ikke ansvarlig for noe tap, verken direkte eller indirekte, som oppstår som en følge av bruk av Investtechs analyser. Opplysninger om eventuelle interessekonflikter vil alltid fremgå av investeringsanbefalingen. Ytterligere informasjon om Investtechs analyser finnes på informasjonssiden.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices