try to get document id 52006

try to get document id 52006

try to get document id 52006

Investtech Research: Excess return from stocks in rising trends

Published 14 February 2020

"Trend" is a key concept in technical analysis. Technical analysis theory states that stocks in rising trends will continue to rise within the trend, and new research results from Investtech largely confirm this theory.

Trends are one of the most important elements of technical analysis. They are visual and intuitive and describe in which direction a stock is moving. A rising trend indicates lasting and increasing optimism among investors, often as a result of a great deal of positive news about the stock.

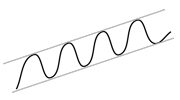

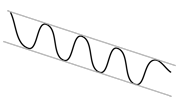

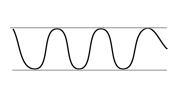

Identifying a trend requires studying the price movements. Stock prices rarely move in a straight line. Instead they move in a series of tops and bottoms. Drawing a straight line through two or more rising bottoms produces the support line in a rising trend. Continue to draw a line parallel to the support line through the rising tops. This line is called the trend’s resistance line. Support and resistance lines combined make up the trend. The trend gives the rate of increase for the stock price, and extrapolating trend lines gives the price target for the stock. There are gradual transitions between rising trends, horizontal trends and falling trends.

Figur 1: Rising trend.

Figure 2: Falling trend.

Figure 3: Horizontal trend.

Investtech’s algorithms identify trends for you. We have developed automatic algorithms for trend identification that find the "best" trend in the chart every day, taking into account trend density, number of data points near floor and ceiling, etc. In a medium term Investtech chart with 18 months' price history some 80,000 different trend alternatives are assessed every day. These are assigned a score and the trend with the highest score is selected. A current example may be Apple, which is in a rising trend in the short, medium and long term per 12 February.

Figure 4: Apple (AAPL.DJIA) Close: 327.20 (+7.59), Feb 12, 2020

Our subscribers can find stocks with these positive signals using for instance the tool Top50.

We wanted to study the statistical results yielded by buy signals from rising trends and therefore studied return from Norwegian, Swedish, Danish and Finnish stocks following buy and sell signals from rising and falling trends identified in Investtech’s price charts in the short, medium and long term. We had up to 23 years of data, from 1996 to 2018. We defined a buy signal as the first day a stock entered a rising trend, or when the stock was in a rising trend and it had been more than 22 days since the previous signal.

The chart below shows average price development following buy signals from rising trends identified in Investtech’s medium term price charts in the Nordic markets. The signals are triggered on day 0. Only days when the exchange is open are included, so 66 days equal approximately three months. The thick blue line shows the development of buy signal stocks. The shaded areas are the standard deviation of the calculations. The thin blue line shows benchmark development in the same period as the buy signal stocks.

Stocks in short term rising trends rose an average of 1.8 per cent in one month. Compared to benchmark in the same period, the stocks in rising trends did 0.8 percentage points better, which equals an annualised excess return of 10.1 percentage points.

Stocks in medium term rising trend rose an average of 4.9 per cent in three months. Compared to benchmark in the same period, stocks in rising trends did 1.8 percentage points better, which equals an annualised excess return of 7.5 percentage points.

Stocks in long term rising trends rose an average of 4.0 per cent in three months. Compared to benchmark in the same period, stocks in rising trends did 1.3 percentage points better, which equals an annualised return of 5.2 percentage points.

The time period for the study is fairly long, the quality of the data is considered to be good and the algorithms used are entirely automatic. Statistical measures suggest a high degree of significance. The results are similar across the four markets and signal strength variation over time has been small. This indicates that we have identified real effects in the markets, which persist over time.

There is high likelihood that trend signals will give good indications of how stocks will develop also in the future. Stocks in rising trends are expected to outperform benchmark.

Please find more details and results in the research reports here:

Rising and falling trends, short term

Rising and falling trends, medium term

Rising and falling trends, long term

Keywords: h_TR.

Skrivet av

Analytiker

i Investtech

Related articles:

Excess return after break upwards from rising trend

Negative excess return after breaks downwards from falling trends

Excess return from stocks in rising trends

Negative excess return from stocks in falling trends

Insight & skills:

"Investtech analyserar psykologin i marknaden och ger dig konkreta tradingförslag varje dag."

Partner & Senior Advisor - Investtech

Investtech garanterar inte fullständigheten eller korrektheten av analyserna. Eventuell exponering utifrån de råd / signaler som framkommer i analyserna görs helt och fullt på den enskilda investerarens räkning och risk. Investtech är inte ansvarig för någon form för förlust, varken direkt eller indirekt, som uppstår som en följd av att ha använt Investtechs analyser. Upplysningar om eventuella intressekonflikter kommer alltid att framgå av investeringsrekommendationen. Ytterligare information om Investtechs analyser finns på infosidan.

Investtech garanterar inte fullständigheten eller korrektheten av analyserna. Eventuell exponering utifrån de råd / signaler som framkommer i analyserna görs helt och fullt på den enskilda investerarens räkning och risk. Investtech är inte ansvarig för någon form för förlust, varken direkt eller indirekt, som uppstår som en följd av att ha använt Investtechs analyser. Upplysningar om eventuella intressekonflikter kommer alltid att framgå av investeringsrekommendationen. Ytterligare information om Investtechs analyser finns på infosidan.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices