Global stocks: Breakout in big stocks both in the medium and long term

Published November 20, 2019

S&P 500 (SP500) moved more or less horizontally on Tuesday and closed at 3120 points (-0.06 per cent). The index thereby reversed down after five days of gains. The index is around its all time high and the strong momentum supports the rising index.

We have three big American stocks for you that have given breakout from rectangle formations in both the medium and the long term charts.

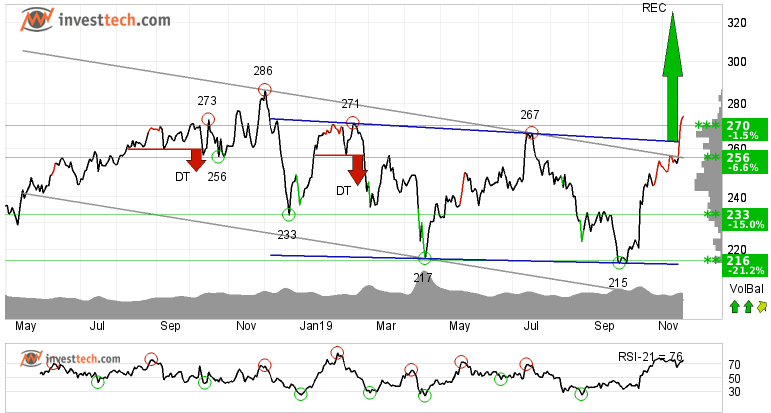

United Health Grp. (UNH.US500) Close: 274.23

United Health Grp. has broken the ceiling of a falling trend in the medium term, which indicates a slower initial falling rate. The stock has given several positive signals; breakout through the ceiling of the rising trend channel in the short term, breakout from rectangle formations by a break up through the resistance at 263 dollars both in the medium and long term charts. Further rise to 326 dollars or more is signalled.

The stock has broken up through the resistance at 270 dollars. This predicts a further rise. In case of negative reactions, there will now be support at 270 and 250 levels.

Positive volume balance indicates that buyers are aggressive while sellers are passive, and strengthens the stock. RSI is above 70 after a good price increase the past weeks. The stock has strong positive momentum and further increase is indicated. However, particularly for big stocks, high RSI may be a sign that the stock is overbought and that there is a chance of a reaction downwards. The stock is overall assessed as technically positive for the medium term.

Investtech's outlook (one to six months): Positive

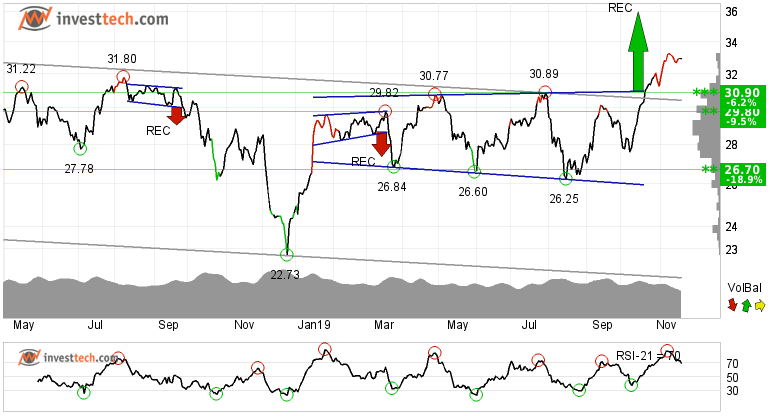

Bank of America Corp. (BAC.US500) Close: 32.94

A sideways price movement that started in January this year is finally broken. Bank of America Corp. has given a buy signal from a rectangle formation both in the medium and long term charts. Further rise to 35.98 dollars or more is signalled. The stock has also broken up through resistance at 30.90 dollars and further rise in the stock is expected. There is no resistance in the price chart and further rise is indicated. In case of a negative reaction, the stock has support at 30.90 dollars.

The current movement has strong momentum as the momentum indicator RSI is above 70. It suggests that the investors have steadily paid more to buy the stock, which indicates increasing optimism and that the price will continue to rise. Further rise in stock price is expected.

Investtech's outlook (one to six months): Positive

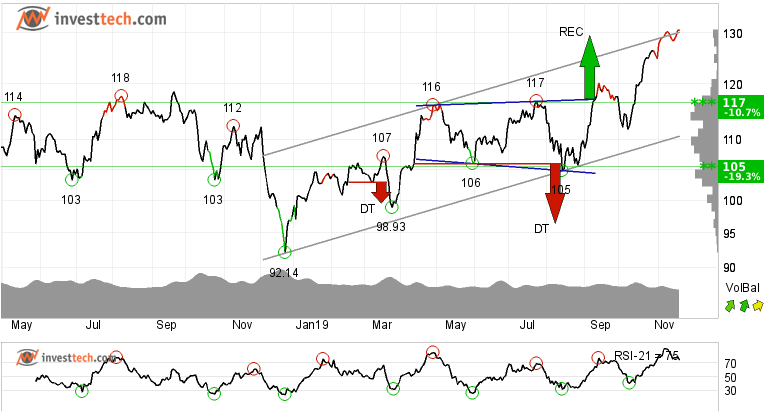

JP Morgan Chase (JPM.US500) Close: 130.58

JP Morgan Chase has marginally broken up through the ceiling of the rising trend channel in the medium term, which signals an even stronger rising rate. A lot of research has been done by Investtech in the area regarding position of price with respect to the trend channel, support and resistance and the average return for stocks with respect to the broader index. More about the research can be studied here.

In September, the stock gave a price breakout from a rectangle formation in the medium and long term charts. Even though the target of 130 dollars from the price formation has been met, it still indicates a positive price development for the stock. The stock is around its all time high, hence there is no significant resistance. On the other hand, support is around 125 and 120 dollars in the short term.

Talking about the momentum, it is strong and positive. The volume balance indicator suggests that more and more investors are coming in when the stock price goes up and fewer people are selling when the price is correcting downwards. This is a sign of strength and strengthens the underlying trend. The stock is overall assessed as technically positive in the medium term.

Investtech's outlook (one to six months): Positive

The analyses are based on closing price as per November 19, 2019.

These instruments are traded in currency based on the Exchange or country they are listed on.

Verfasst von

Analyst

Investtech

"Investtech analysiert die Psychologie des Marktes und macht Ihnen täglich konkrete Tradingvorschläge."

Partner & Senior Advisor - Investtech

Die Anlageempfehlungen werden von Investtech.com AS ("Investtech") ausgearbeitet. Investtech übernimmt keine Haftung für die Vollständigkeit oder Richtigkeit der jeweiligen Analyse. Ein etwaiges Engagement aufgrund der aus den Analysen resultierenden Empfehlungen/Signale erfolgt zur Gänze für Rechnung und Risiko des Anlegers. Investtech haftet nicht für Verluste, die sich direkt oder indirekt infolge der Nutzung von Investtechs Analysen ergeben. Angaben zu etwaigen Interessenkonflikten gehen stets aus der Anlageempfehlung hervor. Weitere Informationen zu Investtechs Analysen finden Sie unter disclaimer.

Die Anlageempfehlungen werden von Investtech.com AS ("Investtech") ausgearbeitet. Investtech übernimmt keine Haftung für die Vollständigkeit oder Richtigkeit der jeweiligen Analyse. Ein etwaiges Engagement aufgrund der aus den Analysen resultierenden Empfehlungen/Signale erfolgt zur Gänze für Rechnung und Risiko des Anlegers. Investtech haftet nicht für Verluste, die sich direkt oder indirekt infolge der Nutzung von Investtechs Analysen ergeben. Angaben zu etwaigen Interessenkonflikten gehen stets aus der Anlageempfehlung hervor. Weitere Informationen zu Investtechs Analysen finden Sie unter disclaimer.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices