Die Trendbibel

Telefon: +47 21 555 888

Telefon: +47 21 555 888 E-Mail senden

E-Mail senden Bitte um Rückruf

Bitte um Rückruf Besuchen Sie uns

Besuchen Sie uns

Buy and hold stocks in rising trends. Sell and stay away from stocks in falling trends.

Technical Analysis Theory on Trends

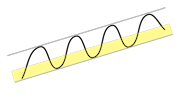

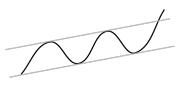

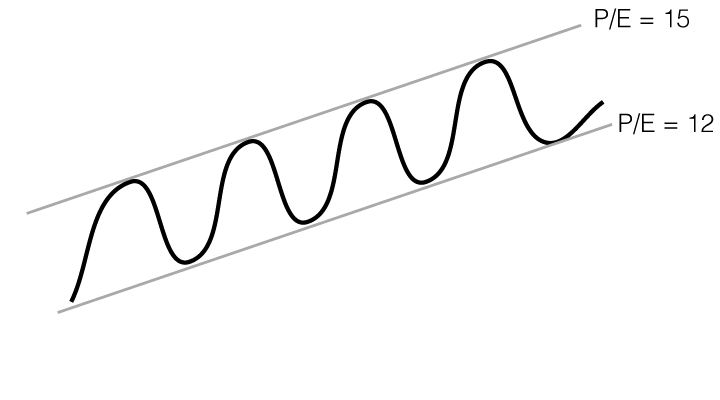

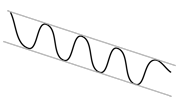

Rising trend where a stock with positive fundamental development over time ranges from price P/E=12, which many investors think is cheap, to P/E=15, which many investors think is expensive.

Investtech's help pages about trends and other technical indicators is located under the Insight & Skills tab and also show which of the bigger companies are in rising trends right now.

The following is taken from Investtech’s help pages on trends.

The trend is one of the most important indicators of technical analysis. According to technical analysis theory, stocks that are in rising trends will continue to rise, and stocks in falling trends will continue to fall. Investtech’s research shows that this theory is correct; please find the research reports under the Research tab on top of the page.

This makes it very important to identify whether a stock is in a rising or falling trend. It is also important to recognise when trends change, in order to get out early in the case of a falling trend and get in early in the case of a rising one.

The trend is a simple indicator to follow. Every day Investtech’s systems identify the qualitatively best trend for each stock. Stocks in rising trends should be bought and stocks in falling trends should be sold.

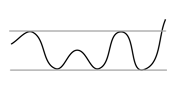

Buy and hold stocks in rising trends

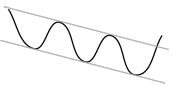

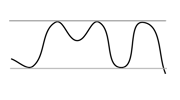

Sell and stay away from stocks in falling trends

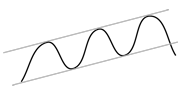

Stocks in sideways trends can be bought near the trend floor and sold near the trend ceiling

Main principles

The bottom line of trend analysis is simple: The trend is your friend.

- Buy and hold stocks in rising trends.

- Sell and stay away from stocks in falling trends.

- Stocks in sideways trends can be bought near the trend floor and sold near the trend ceiling.

Warning signals

- Price near trend floor indicates greater upside, but also greater risk of a break downward.

- Price near trend ceiling indicates a smaller upside, but also a greater chance of a break upward.

Trend breaks

It may appear that a stock should be sold when it breaks downwards from a rising trend. However, this often simply signals that the stock is taking a small break and will continue upwards soon. The following applies when assessing trend breaks:

- High volume strengthens a break and signals a possible trend reversal.

- Low volume indicates that the stock will soon continue in the same trend direction.

- For rising trends: break below previous bottom signals a reversal downward.

- For falling trends: break above the previous top signals a reversal upward.

The key principle of trend analysis is simple: the stock will continue in the direction of the trend.

Depending on where the price is in relation to the trend channel, strong or weak development is indicated.

- Stocks with rising trends will continue upwards, and stocks with falling trends will continue to fall.

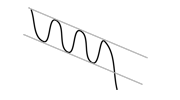

- Break upwards through the ceiling of a rising trend indicates further rise at a stronger rate of increase that previously.

- Break downwards through the floor of a rising trend indicates further rise or more horizontal development, with a weaker rate of increase than previously.

- Break downwards though the floor of a falling trend indicates further fall with a stronger rate of decrease than previously.

- Break upwards through the ceiling of a falling trend indicates further fall or a more horizontal development, with a weaker rate of decrease than previously.

- Stocks with break upwards from horizontal trend will continue upwards, and stocks with break downwards from horizontal trend will continue downwards.

The conditions above are theoretically valid for all time perspectives, both in the short term of even a few days or weeks, up to the long term with trends that encompass several years.

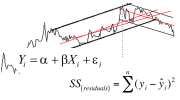

The Trend Bible shows how correct this theory proved to be in practice on the Nordic stock exchanges in the period 1996 to 2015, and describes how such research can be carried out objectively.

Read more and see examples from today’s market on Investtech’s help pages for technical analysis.

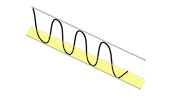

Stocks within a trend:

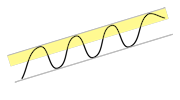

Stocks breaking out of a trend:

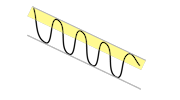

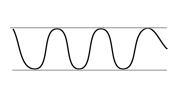

Sideways trend:

Investtechs forskningsværk baseret på studier af mere end 350.000 signaler fra trender

i børsnoterede nordiske aktier fra 1996 til 2015.

Praktisk brug - Værktøj - Statistik - Algoritmer - Teori

Trendbibelen - startside Mere om Investtechs forskning

Trendbibelen er skrevet af Investtechs forskningschef Geir Linløkken i 2016. Forskningsteamet bag Trendbibelen består af seniorforskerne Asbjørn Taugbøl og Fredrik Tyvand samt Linløkken selv.

Investtech har arbejdet med forskning inden for adfærdsbaseret finans og teknisk og kvantitativ aktieanalyse siden 1997. Virksomheden har udviklet et analysesystem, der blandt andet identificerer trender, støtte og modstand, formationer og volumenmønstre i aktiekurser, og giver købs- og salgsanbefalinger baseret på dette. Investtech gør udstrakt brug af avancerede matematiske algoritmer og tunge statistiske metoder i sine dataprogrammer og internettbaserede abonnementstjenester.

Die Anlageempfehlungen werden von Investtech.com AS ("Investtech") ausgearbeitet. Investtech übernimmt keine Haftung für die Vollständigkeit oder Richtigkeit der jeweiligen Analyse. Ein etwaiges Engagement aufgrund der aus den Analysen resultierenden Empfehlungen/Signale erfolgt zur Gänze für Rechnung und Risiko des Anlegers. Investtech haftet nicht für Verluste, die sich direkt oder indirekt infolge der Nutzung von Investtechs Analysen ergeben. Angaben zu etwaigen Interessenkonflikten gehen stets aus der Anlageempfehlung hervor. Weitere Informationen zu Investtechs Analysen finden Sie unter disclaimer.

Die Anlageempfehlungen werden von Investtech.com AS ("Investtech") ausgearbeitet. Investtech übernimmt keine Haftung für die Vollständigkeit oder Richtigkeit der jeweiligen Analyse. Ein etwaiges Engagement aufgrund der aus den Analysen resultierenden Empfehlungen/Signale erfolgt zur Gänze für Rechnung und Risiko des Anlegers. Investtech haftet nicht für Verluste, die sich direkt oder indirekt infolge der Nutzung von Investtechs Analysen ergeben. Angaben zu etwaigen Interessenkonflikten gehen stets aus der Anlageempfehlung hervor. Weitere Informationen zu Investtechs Analysen finden Sie unter disclaimer.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices