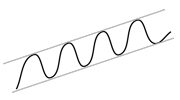

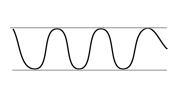

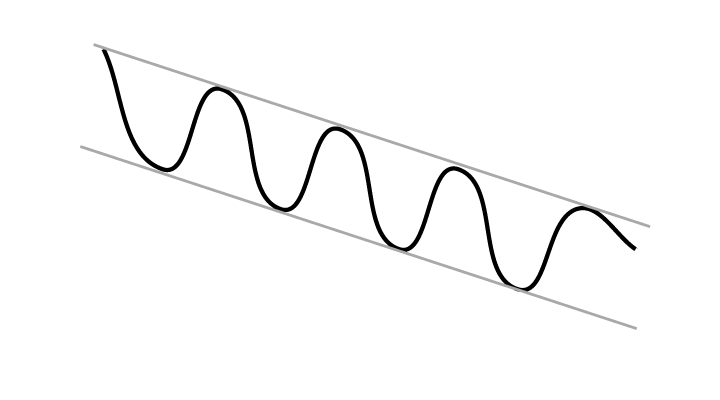

Falling trend

Falling trends indicate that the company experiences negative development and that buy interest among investors is in decline.

Falling trends indicate that the stocks will continue to fall. Trends often last for longer than investors think they will, and thus many buy a stock too soon. If you own a stock in a falling trend, you should normally sell it. If you are looking to buy stocks, you should stay away from stocks that are in falling trends.

- Sell stocks you own that are in falling trends.

- Do not buy stocks that are in falling trends.

When a stock is in a falling trend, investors have become ever more negative to the company. When this sort of movement has started among the investors, it tends to last over time. Negative impulses are picked up by the media, analysts and investors, and tend to reinforce each other. This leads to further negative development.

The market often overreacts to short term news and underreacts to long term news. Problems with a contract or a product line today, gives direct loss of profit in the short term. However, it also influences the company’s long term potential and chance of more problems tomorrow. Stocks in falling trends therefore often continue to fall.

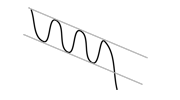

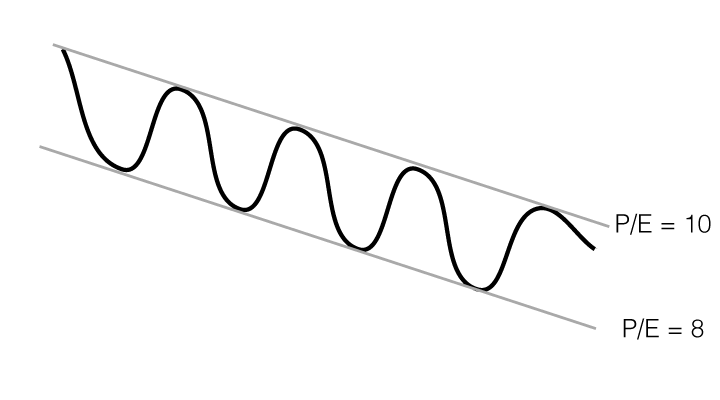

The commercial development in companies often moves in long term cycles. Yet the market will respond in the short term to news and other impulses. A company with shrinking markets or increasing competition and price pressure will tend to have low fundamental valuation near the floor of a trend channel, and a high valuation near the ceiling. For fundamental investors it can be advantageous to buy near the trend floor and sell near the trend ceiling. As such there is support near the trend floor and resistance near the trend ceiling.

The figure shows a stock in a falling trend where the fundamental key figure P/E (price-to-earnings ratio) fluctuates between 8 at the trend floor and 10 at the trend ceiling.

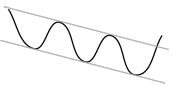

Warning signals for long term reversal upward

- Decreasing volume on falling prices and near bottoms.

- Increasing volume on rising prices and near tops.

- Price near ceiling, especially if the stock also sees horizontal support and positive volume development.

Warning signals for short term reaction upward

- Price near support with oversold RSI and often positive volume development.

Should warning signals trigger a purchase?

Falling trends often last longer than many investors think they will, and it is easy to buy too soon. Nevertheless, sometimes buying at early trend reversal warning signals gives very good purchases. The choice depends on risk assessment. Please note that it is easy to be fooled by very short term fluctuations. Keep investment horizon in mind and place less emphasis on analyses for other time horizons.

Buying stocks in falling trend channels is considered high risk, even if warning signals are triggered for a reversal upward. Investtech’s statistics show that stocks in falling trends keep falling in the short term, and underperform significantly in the long term.

Die Anlageempfehlungen werden von Investtech.com AS ("Investtech") ausgearbeitet. Investtech übernimmt keine Haftung für die Vollständigkeit oder Richtigkeit der jeweiligen Analyse. Ein etwaiges Engagement aufgrund der aus den Analysen resultierenden Empfehlungen/Signale erfolgt zur Gänze für Rechnung und Risiko des Anlegers. Investtech haftet nicht für Verluste, die sich direkt oder indirekt infolge der Nutzung von Investtechs Analysen ergeben. Angaben zu etwaigen Interessenkonflikten gehen stets aus der Anlageempfehlung hervor. Weitere Informationen zu Investtechs Analysen finden Sie unter disclaimer.

Die Anlageempfehlungen werden von Investtech.com AS ("Investtech") ausgearbeitet. Investtech übernimmt keine Haftung für die Vollständigkeit oder Richtigkeit der jeweiligen Analyse. Ein etwaiges Engagement aufgrund der aus den Analysen resultierenden Empfehlungen/Signale erfolgt zur Gänze für Rechnung und Risiko des Anlegers. Investtech haftet nicht für Verluste, die sich direkt oder indirekt infolge der Nutzung von Investtechs Analysen ergeben. Angaben zu etwaigen Interessenkonflikten gehen stets aus der Anlageempfehlung hervor. Weitere Informationen zu Investtechs Analysen finden Sie unter disclaimer.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices