Return following signals from long term rectangle formations on the Oslo Stock Exchange 1996-2014

Research report written by Geir Linløkken, 23 January 2017

Published in English on 22 February 2017. Norwegian original here >>

About the author

Geir Linløkken is the Head of Analysis and Research at Investtech, and is responsible for portfolios and money management. He founded Investtech in 1997, to provide independent technical analyses based on science and investor psychology. Mr. Linløkken has an MSc. in Computer Science, specializing in Mathematical Modeling, at the University of Oslo. He is the author of the book “Technical Stock Analysis”. His daily work includes analysing stocks and developing quantitative methods for stock market investments.

Keywords: rectangle formation, buy signal, sell signal, Oslo stock exchange, technical analysis, statistics

Abstract:

Geometric price patterns, like rectangles, are used in technical analysis to predict future price development. Many investors use this as an important part of their decision making process when buying or selling stocks. We have looked at the price movements that followed long term buy and sell signals from rectangle formations on the Oslo Stock Exchange in a period of 19 years, from 1996 to 2014. Stocks with buy signals have on average increased by 8.1 % after three months, while stocks with sell signals have fallen 3.5 %. Compared to average stock exchange development in the same period, buy signals did 4.9 percentage points better and sell signals did 6.7 percentage points worse.

Research into technical price formations

This research report is part of a bigger research project conducted by Investtech into price development following technical formations in stock prices. This report studies long term rectangle formations on the Oslo Stock Exchange in Norway.

| Short term | Medium term | Long term | |

| Rectangle | Report | Report | Present |

| Inverse/ head and shoulders | Report | Report | Report |

| Double top, double bottom | Report | Report | Report |

We have already studied signals from long term head and shoulders formations and inverse head and shoulders formations, and double top and double bottom formations, on the Oslo and Stockholm Stock Exchanges. We found good price increases following buy signals and falling or sideway prices following sell signals. However, we had fairly few observations and the combined results were not very significant. Therefore we wanted to look at more technical indicators that signal long term trend reversals, which is an important motivator for this report.

Rectangle formations

Identification of geometric price patterns in stock prices is an important area of technical analysis. The idea is that these patterns describe the investors’ mental state, i.e. whether they will want to sell or buy stocks in the time ahead, and they thereby indicate the future direction of the stock price. Rectangle formations are one type of such patterns.

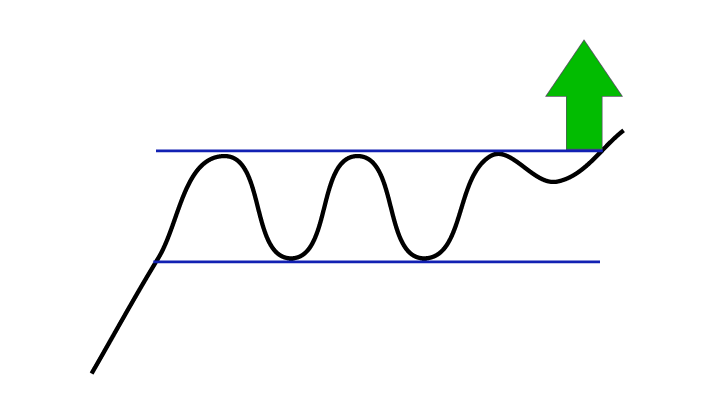

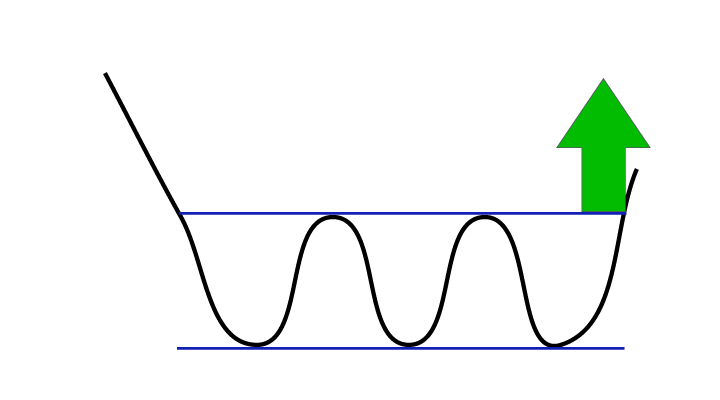

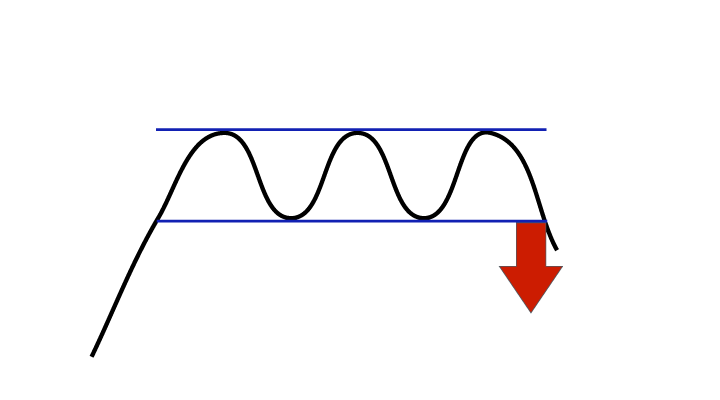

The development of a rectangle formation indicates that the investors are unsure about the future direction of the stock. The price moves sideways between a support level and a resistance level. A break upwards mirrors the investors’ increasing optimism. According to technical analysis theory, the price will then rise by at least as much as the height of the rectangle, see figure 1.

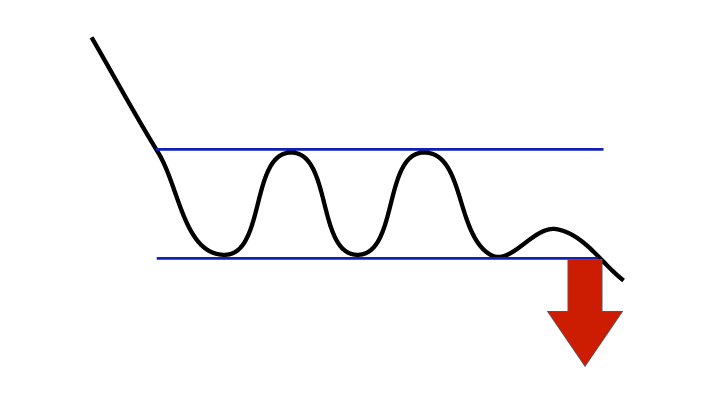

Figure 1: A stock develops a rectangle formation when the price moves sideways between a support line and a resistance line. If the price breaks up from the rectangle, it triggers a buy signal, and according to technical analysis theory the stock price will rise at least as much as the height of the formation. If the price breaks downwards, it triggers a sell signal, and the stock price will fall accordingly.

Figure 2: Buy signal from rectangle formation.

Figure 3: Sell signal from rectangle formation.

In technical analysis terminology we say that a break upwards triggers a buy signal. Similarly a break downwards from a rectangle formation triggers a sell signal. We have investigated the price movements following buy and sell signals from rectangle formations on Norway’s Oslo Stock Exchange.

There are two main types of rectangle formations; continuation rectangles and reversing rectangles. We will study both types combines first, and then look at the two separately.

Identification

Identification of rectangle formations in stock prices is no simple task. The figure above shows that the price moves sideways between a clearly defined support level and a similar resistance level. However, stock prices are rarely as even as those in the illustration. Often there are rectangle-like figures where the support and resistance lines may be a little crooked or otherwise diverge.

Many investors identify rectangle formations by looking at price charts and drawing support and resistance lines by hand. This method has many weaknesses, most of all that it is subjective, allowing you to see the formations you want to see, and it is very time consuming. Therefore we need an automatic algorithm whereby computers identify the formations and the signals they trigger.

Investtech has studied technical and quantitative analysis since 1997. We have developed mathematical algorithms for automatic identification of rectangle formations in stock prices. The formations are entered into the technical analysis charts, shows in signal lists and presented updated daily to Investtech’s subscribers.

In this report we have looked at the price movements that follow buy and sell signals from rectangle formations on the Oslo Stock Exchange. The statistics are based on rectangle formations automatically recognized by Investtech’s computer programs. No parameter optimization or changes to algorithms have been made during this study. This is an analysis based on the existing historical material.

The Base Data

We have used stock prices from 1.1.1996 to 10.10.2014 as the basis for the statistics. In this period, the main index on the Oslo Exchange rose from 106.9 to 573.6 points, which is 437 % or approximately 9.3 % a year. Compared to the risk free interest rate in this period, this is approximately what can be expected for similar periods of time.

In eight of these 19 years, the exchange rose by over 30 %, while it fell by more than 10 % in five of the years, and varied between minus 10 % to plus 30 % in five of the years. We have had both good and bad periods, and several sideways periods as well, and consider this representative for a normal period of time on the exchange.

All stocks that have been listed in the period are included. Stocks that have been delisted due to for instance mergers, takeovers and bankruptcy are included. However, we only have data for these companies for as long as they were listed. A company which went bankrupt will then have a final trading price which is not zero, which is a weakness in this study. However, this is only the case for a small number of companies. Most companies also fall a lot before they are delisted, so the difference between the price fall from when they were listed and a price fall down to zero will be small.

It is also very rare that new buy signals are generated from rectangle formations when a company’s stock price is falling. Therefore it matters very little to the statistics for buy signals. Return from sell signals would however have been a little weaker had we corrected for bankruptcies. Combined it is our opinion that these conditions have minimal impact on the results of this study.

All prices are adjusted for splits, dividend payments, reverse splits, and other corporate capital changes, in order to reflect the actual value development of the stocks.

715 time series are included, of which 597 are stocks with at least 66 days of trading. At the end of the period, approximately 220 stocks were listed on the exchange.

The stock’s daily closing price is used. We have only used prices and turnover figures from the stock’s primary market place. Alternative markets like Chi-X, Bats and Burgundy are excluded.

The Data Set

We have used Investtech’s algorithms for automatic identification of rectangle formations. The algorithms were run on long term charts made up of 1,399 price days, approximately 6 calendar years. We consider the algorithms good at identifying actual rectangle formations, and they do not classify indistinct rectangles as actual rectangles.

At identification of signals, only data up to the date the signal was triggered were used. The later data were hidden from the algorithm.

Basically all signals identified from rectangle formations are used. Normally each formation only triggers one signal. However, in rare cases they may trigger several signals. This happens if the price following the break reacts back into the formation, creates a modified formation and then breaks out again.

Sometimes one stock can also trigger several signals on the same day. This happens if the algorithms have recognized several formations of different length and height which are broken out from at the same time.

In order to have the data set as representative for the Oslo Stock Exchange as possible, we remove certain signals from the data set:

- Duplicate signals are removed. This will be the case when there have been mergers and ticker changes, where Investtech has two editions of the same historical time series. For instance, we remove a buy signal from DNB if we already have it for DNBNOR.

- Signals that are very close in time to a previous signal are removed. It is a requirement that there have been at least seven calendar days since the previous signal from the same stock in order for a new signal to be counted.

- Formations that are less than 2 % in height are discarded. These are small and considered to have low signal value.

- Signals from stocks with poor liquidity are discarded. This is because it is difficult for investors to make actual trades in such stocks, and also because the price is often uneven and with big leaps, making pricing uncertain and subject to noise.

We discard signals where daily average turnover on the Oslo Exchange in the past ten days including the signal day was lower than half a million Norwegian krone (NOK) or where the stock was traded on less than half the days. This also removed all signals from the exchange indices, leaving us with signals from stocks and equity certificates only, and a few traded funds. The actual turnover of stocks that gave signals may have been above this limit, as trade in other markets than the Oslo Exchange, like Chi-X, Bats and Burgundy, are not included. - Signals with less than 66 days' price history following the signals are removed. This gives complete price history for the first 66 days following the signals.

Our data set now consists of 231 identified buy signals and 140 sell signals from rectangle formations in stocks and equity certificates on the Oslo Stock Exchange in the period 1996 to 2014.

Results

Figure 4: Figure 4: Price development following buy and sell signals from rectangle formations on the Oslo Stock Exchange identified by Investtech’s automatic algorithms in long term charts. Click the image for bigger version

The chart shows average price development following buy and sell signals from rectangle formations. The signals are triggered on day 0. Only days when the exchange is open are included, so 66 days equal approximately three months. Buy signals are the blue line and sell signals are the red one. The shaded areas are the standard deviation of the calculations. Benchmark index is the black line.

Buy signals

| Buy signal | Day 1 | 10 | 22 | 66 | 250 |

| Absolute | 0.31 % | 2.36 % | 4.18 % | 8.08 % | 15.18 % |

| Benchmark | 0.05 % | 0.48 % | 1.05 % | 3.18 % | 12.61 % |

| Relative | 0.27 | 1.89 | 3.13 | 4.89 | 2.57 |

| T-value | 0.90 | 2.91 | 3.33 | 2.27 | 0.82 |

Buy signals from rectangle formations identified in Investtech’s long term charts have historically given increasing prices in the following months. On average, stocks that triggered buy signals have risen 8.1 % in the following three months. This is much better than index, which rose 3.2 % in the same period of time.

The increase is stronger the first few days following the signal, but the stocks keep rising both in absolute terms and relative to index during the whole period. In the first 22 days, equal to about the first month, the signal stocks rise by 0.21 % on average per day, estimated with least-squares method adapted to the yield curve. In the next 44 days, the stocks on average rise by 0.11 % per day.

The average figures are calculated based on 231 observations. This is a fairly low number, which means the uncertainty of the estimates is high. The blue shaded area shows the standard deviation of the estimates. Assuming normal distribution, the average price development following buy signals from rectangle formations has a 68 % probability of falling within this interval.

After 66 days the return is T=2.3 standard deviations from the benchmark index. This is a little too low to conclude that the results are significant. It is however still an indication that stocks with signals from long term rectangle formations give excess return compared to verage benchmark development. More data is required for a longer period of time or fromother stock exchanges to enable a better analyses with more significant results.

Sell signals

| Sell signal | Day 1 | 10 | 22 | 66 | 250 |

| Absolute | 0.10 % | -0.23 % | 0.47 % | -3.48 % | -0.02 % |

| Benchmark | 0.05 % | 0.48 % | 1.05 % | 3.18 % | 12.61 % |

| Relative | 0.06 | -0.70 | -0.58 | -6.67 | -12.62 |

| T-value | 0.13 | -0.77 | -0.47 | -3.03 | -2.25 |

Sell signals from rectangle formations identified in Investtech’s long term price charts have historically developed sideways the first month after the signal, and then considerably weaker the next two months. On average the stocks have fallen 3.5 % the following three months, which is 4.9 percentage points below benchmark in an average three month period.

The average figures are calculated based on a mere 140 observations and the uncertainty of the estimate is high. However, the large deviation from benchmark gives a T-value of 3.0, which is fairly high and indicates that sell signals from rectangle formations on the Oslo Stock Exchange, identified in Investtech’s long term price charts, on average make a good indicator of future negative excess return for the stocks in question.

Robustness against extreme volatility in individual stocks

The results are based on average return figures. If any individual stock is extremely volatile, for example has a price increase of several hundred per cent, this may strongly impact the average figures. To investigate this, we have calculated how much each stock weighs in the calculation of the average figures.

Figure 5: Weight per stock in the calculation of average price development following buy signals. The 10 most highly weighted stocks are indicated in their own sectors of the pie chart.

Figure 6: Weight per stock in the calculation of average price development following sell signals.

In the case of buy signals, Itera made up 9 % of the overall results. The ten most heavily weighted stocks make up 33 % of the total. For the sell signals, the 10 most heavily weighted stocks make up 37 % of the total. A relatively small number of stocks count heavily in the results. This confirms the standard deviation analysis and visual inspection of average charts that indicate we have few data and the uncertainty of the estimates is quite high.

The importance of liquidity

In the calculations above we have included signals from stocks with an average daily turnover of at least half a million Norwegian krone on the Oslo Stock Exchange at the time the signal was triggered. Varying the liquidity parameters allows us to investigate if there is a difference in signal strength for smaller and bigger companies.

Drawing the line at five million krone splits the companies into two roughly similar groups. Signals from stocks with turnover below five million come to 204 signals, and those with turnover above five million come to 167.

Figures 7 and 8 show that buy signals from the group of smaller companies have done better than buy signals from the bigger companies. At the same time, sell signals from the bigger companies have been better, i.e. the price development has been weaker, than for the smaller companies. A closer look at the numbers shows that return 66 days after buy signal is 11.4 % for the smaller companies and 4.3 % for the bigger ones. Return after sell signals is -0.2 % for the smaller companies and -5.4 % for the bigger ones.

This indicates that buy signals from long term rectangle formations are stronger for smaller companies, while sell signals are relatively stronger for bigger companies. But this is based on few observations, which causes the high uncertainty illustrated by the wide standard deviation shades in the chart. Thus we should not put too much emphasis on these results.

Long term signal power

The signals studied in this report are identified in Investtech’s long term technical charts. Such charts are used to analyse the stock exchange in view of price development for the next three to eighteen months. Therefore it is also interesting to look at the price development beyond 66 days after the signal was triggered.

Figure 9: Price development at buy and sell signals from rectangle formations on the Oslo Stock Exchange. The chart includes price development for 22 days before the signals were triggered to 250 days after. Click the image for bigger version.

A year after signal, stocks with buy signals have continued to rise, while stocks with sell signals have moved quite horisontally. The difference between the graphs have increased most of the time, so when choosing a class of stocks in which to invest, the chart indicates it is significantly better to own stocks with buy signals than stocks with sell signals.

Continuation rectangles and reversing rectangles

There are two main types of rectangle formations, continuation rectangles and reversing rectangles. A continuation rectangle formation indicates that a stock will continue to develop in the trend direction following consolidation. See figures 2 and 3 above.

Reversing rectangles indicate that a stock’s trend direction changes, from rising to falling or vice versa, see figures below.

Figure 10: Buy signal from reversing rectangle is a bottom formation. It indicates that a stock has reached the end of a falling trend and begun a rising trend.

Figure 11: Sell signal from a reversing rectangle is a top formation. It indicates that a stock has finished a rising trend and started a falling trend.

We have split the signals from our identified rectangle formations into the two different types. The results are shown below.

Figures 12 and 13 show that stocks with buy signals from both continuation and reversing rectangle formations have on average continued to rise over the coming months. And stocks with sell signals from both types of rectangle formations continue to fall.

Sell signals from continuation formations have shown especially strong signal power, which buy signals from reversing formations also have. It is somewhat surprising that reversing rectangles with buy signals have shown stronger signal power than continuation rectangles, since a stock is theoretically supposed to continue in the trend direction, but this could be due to the small number of observations and the uncertainty this entails. Results from the Swedish Stockholm stock exchange indicate that continuation rectangles have clearly stronger signal power, both for buy and sell signals, than reversing rectangles.

The Stockholm Stock Exchange in Sweden

Figure 14. Price development following signals from long term rectangle formations on the Stockholm Stock Exchange 2003-2014.

We have conducted the same study on the Stockholm Stock Exchange in Sweden, for the period 1 April 2003 to 10 October 2014. Investtech’s computers identified 361 buy signals and 185 sell signals in this period.

On the Stockholm Exchange, as well, buy signals from rectangle formations were followed by rising prices the next three months, and rose more than the exchange in an average three-month period. Stocks with sell signals from rectangle formations on average fell in the next three months, showing significantly weaker development than average benchmark index development.

The results for the sell signals are clearer than on the Oslo Stock Exchange, whereas the results for the buy signals are less clear. The data from Sweden indicate that the signals have better predictive power for small companies and that continuation rectangles have clearly better predictive power than reversing rectangles. However we have few observations in Sweden as well and cannot give a definite conclusion on this basis.

Read the summary of the Swedish study here.

Summary and discussion

We have studied return from stocks on the Oslo Stock Exchange with signals from technical rectangle formations over a period of 19 years, from 1996 to 2014. Investtech’s automatic algorithms identified a total of 231 buy signals and 140 sell signals from such formations in long term price charts. The buy signals gave an average return of 8.1 % in the following three months, and sell signals gave a return of -3.5 %. Relative to average benchmark index development, the buy signals gave an excess return of 4.9 percentage points, while the sell signals gave a negative excess return of 6.7 percentage points.

We have relatively few observations in the data set, which makes the results somewhat uncertain. A similar study from the Stockholm Stock Exchange shows similar results. Combined these studies indicate that signals from long term rectangle formations can be used for decision support when picking stocks, assuming an investment perspective of 3 to 12 months.

The results from Sweden indicate that signals from long term continuation rectangles have significantly stronger signal power than those from reversing rectangles. We see no such correlation in Norway. However, it will be interesting to look at trend signals separately, and also signals from continuation and reversing rectangles, in the short term.

Literature

- Investtech, help pages. Price formations. Link

- Investtech, help pages. Buy signal from rectangle formation. Link

- Investtech, help pages. Sell signal from rectangle formation. Link

- Geir Linløkken. Buy signals from rectangle formations - how often are they successful? Investtech.com, 2005. Link

- Geir Linløkken and Steffen Frölich. Technical StockAnalysis - for reduced risks and increased returns. Investtech.com, 2001.

- John J. Murphy. Technical Analysis of the Financial Markets. New York Institute of Finance, 1999.

Keywords: Buy signal,Oslo Stock Exchange,rectangle formation,Sell signal,statistics.

Verfasst von

Forschungs- und Analysechef

Investtech

"Investtech analysiert die Psychologie des Marktes und macht Ihnen täglich konkrete Tradingvorschläge."

Partner & Senior Advisor - Investtech

Die Anlageempfehlungen werden von Investtech.com AS ("Investtech") ausgearbeitet. Investtech übernimmt keine Haftung für die Vollständigkeit oder Richtigkeit der jeweiligen Analyse. Ein etwaiges Engagement aufgrund der aus den Analysen resultierenden Empfehlungen/Signale erfolgt zur Gänze für Rechnung und Risiko des Anlegers. Investtech haftet nicht für Verluste, die sich direkt oder indirekt infolge der Nutzung von Investtechs Analysen ergeben. Angaben zu etwaigen Interessenkonflikten gehen stets aus der Anlageempfehlung hervor. Weitere Informationen zu Investtechs Analysen finden Sie unter disclaimer.

Die Anlageempfehlungen werden von Investtech.com AS ("Investtech") ausgearbeitet. Investtech übernimmt keine Haftung für die Vollständigkeit oder Richtigkeit der jeweiligen Analyse. Ein etwaiges Engagement aufgrund der aus den Analysen resultierenden Empfehlungen/Signale erfolgt zur Gänze für Rechnung und Risiko des Anlegers. Investtech haftet nicht für Verluste, die sich direkt oder indirekt infolge der Nutzung von Investtechs Analysen ergeben. Angaben zu etwaigen Interessenkonflikten gehen stets aus der Anlageempfehlung hervor. Weitere Informationen zu Investtechs Analysen finden Sie unter disclaimer.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices