RSI is a good momentum indicator

Published 20 February 2019

A research report from Investtech based on 23 years of data from the Norwegian Oslo Stock Exchange, and 16 years of data from the stock exchanges in Sweden, Denmark and Finland, shows that stocks with high RSI, above the critical 70 level, have continued to rise. Similarly stocks with low RSI, below the critical 30 level, have continued to underperform vs benchmark.

RSI is an oft-used indicator in technical analysis. RSI means Relative Strength Index, and it measures how well a stock has performed compared to itself. The figure is calculated by looking at the strength of days with rising prices compared to strength of days with falling prices over a certain period of time and it gets a value between 0 and 100.

Many investors feel that RSI indicates whether a stock has risen or fallen too much and will react back. Investtech’s research shows that this overbought/oversold interpretation is not statistically correct. The results show that RSI is a good indicator of whether the stock has positive momentum or negative momentum and that this “RSI momentum” is a good indicator of future price development.

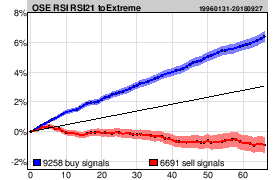

We have studied 35,733 cases where RSI21 crossed above the 70 limit and 23,590 cases where RSI21 fell below the 30 limit. We called this strategy RSI momentum and called it a buy signal when RSI went above 70 and a sell signal when RSI fell below 30.

Figure 1. RSI21 Norway. Price development the first 66 days after RSI momentum signals in Norway. Stocks with buy signal on average rose by 6.4 per cent and stocks with sell signal fell by 0.9 per cent. Average benchmark index was up 3.1 per cent.

The table below shows average annualized excess return following RSI momentum signals. The figures are based on the quarterly figures, i.e. return 66 days (3 months) after signal was triggered.

| Annualized excess return | Norway | Sweden | Denmark | Finland | Weighted average |

| Buy signal RSI21 breaks above 70 | 14.4 %p | 6.5 %p | 10.8 %p | 6.9 %p | 9.1 %p |

| Sell signal RSI21 breaks below 30 | -15.8 %p | -10.2 %p | -11.3 %p | -7.5 %p | -11.6 %p |

%p: percentage points

The combined results indicate that RSI is a well-suited momentum indicator and that investments based on buy signals from RSI momentum give statistically stronger return than average benchmark.

Please find more results and details in the full research report here.

We conducted the same study on the Indian market and the results show that buy signals from RSI momentum have given an annualized excess return of 9 percentage points in India. Read the report here.

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices