Today's free analyses

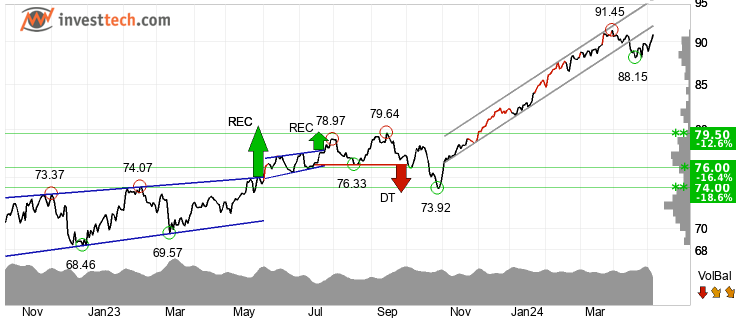

iShares Core MSCI World UCITS ETF (EUNL)

Vanguard FTSE All-World UCITS ETF - (USD) Accumulating (VWCE)

How Investtech works

Collect stock market data

Price, volume, insider information, corporate actions etc.

Perform advanced analysis

Using mathematical pattern recognition, statistical optimization and behavioural finance

Deliver actionable insights

Daily across the stocks, indices and commodities that matter most to your portfolio

Investtech's systems are built on research dating back to 1994, and have continuously received support from the Research Council of Norway.

Investtech by the numbers

Experience

21years

since 1997

Model portfolio

14.5%

average annual return

Analysis across

20+

stock exchanges

Recommendations of

30 000+

stocks, indices, currencies, cryptocurrencies and commodities

About Us

Founded in 1997, Investtech is a leading Scandinavian company within the field of research on behavioral finance and technical analysis of stocks. Investtech’s research findings have been put into practice and have resulted in a comprehensive decision support system analyzing stocks and other securities. The system is utilized daily by investors worldwide.

Investtech uses advanced mathematical models and statistical optimization techniques as a basis for the analyses, generating objective and transparent decision support. The company provides web-based subscriptions to private investors and has been a prominent provider of technical analyses to financial institutions, brokerages and media since 1999. Courses, seminars and webinars are also arranged with clients directly, or in collaboration with partners.

Partners

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices