Today's free analyses

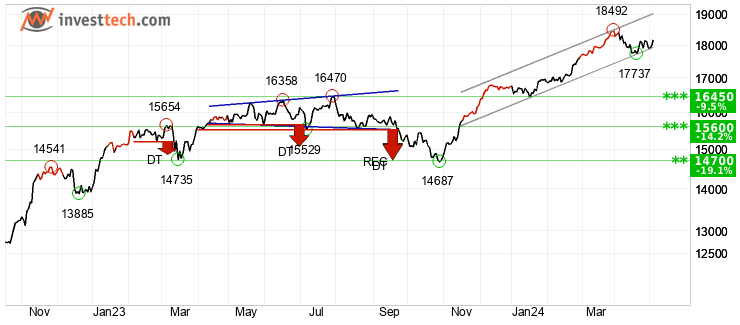

Dax (Performanceindex) (DAX)

RWE AG (RWE)

Partners

Technical analysis webinar with Investtech

Currently no scheduled webinars.| Date | Time | Title | |

|---|---|---|---|

| December 4, 2023 | 17.00 - 17.35 CET | Get started with Investtech | |

| March 2, 2022 | 19.30 - 20.15 CET | Get started with Investtech | |

| May 18, 2021 | 18.00 - 19.15 CEST | Introduction to investing and stock analysis. | |

| September 24, 2020 | 19.00 - 19.45 CEST | Introduction to Investtech by Country Manager Jan Marius van Leeuwen. | |

| August 27, 2020 | 19.00 - 19.45 CEST | Introduction to Investtech by Country Manager Jan Marius van Leeuwen. | |

| May 26, 2020 | 19.00 - 19.45 CEST | Introduction to Investtech by Country Manager Jan Marius van Leeuwen. | |

| June 26, 2019 | 10.00 - 10.30 CEST | Volume - Reality check!by Analyst Kiran Shroff. | |

| May 7, 2019 | 10.00 - 10.30 CEST | Trend is your best friend by Analyst Kiran Shroff. | |

| Dec 13, 2018 | 15.00 - 15.40 CET | Introduction to Investtech by Sales Manager Jan Marius van Leeuwen and Analyst Kiran Shroff. | |

| Nov 28, 2018 | 15.00 - 15.40 CET | Introduction to Investtech by Sales Manager Jan Marius van Leeuwen and Analyst Kiran Shroff. | |

| Nov 14, 2018 | 15.00 - 15.40 CET | Introduction to Investtech by Sales Manager Jan Marius van Leeuwen and Analyst Kiran Shroff. | |

| Oct 31, 2018 | 09.00 - 09.40 CET | Introduction to Investtech by Sales Manager Jan Marius van Leeuwen and Analyst Kiran Shroff. |

Upcoming events

Currently no scheduled events.Previously:

| Date | Location | Title | |

|---|---|---|---|

| November 22, 2023, time: 16.00 - 21.00 | Stockholm, Sweden | IG's Trading Seminar 2023 | |

| November 8, 2023, time: 17.00 - 19.30 | Oslo, Norway | Seminar: Investment Climate Opportunities and Challenges autumn 2023 | |

| September 27, 2023, 17.00 - 19.30 | Bergen, Norway | Seminar: Investment Climate Opportunities and Challenges autumn 2023 | |

| November 16, 2022, 17.00 - 19.30 | Oslo, Norway | Seminar: Investment Climate Opportunities and Challenges autumn 2022 | |

| September 29, 2022, 17.30 - 19.30 | Stavanger, Norway | Seminar with Investtech and CMC Markets |

How Investtech works

Collect stock market data

Price, volume, insider information, corporate actions etc.

Perform advanced analysis

Using mathematical pattern recognition, statistical optimization and behavioural finance

Deliver actionable insights

Daily across the stocks, indices and commodities that matter most to your portfolio

Pricing

Investor

Everything you need to start planning your investment decisions.

€

27

€

16

/ month

Billed Annually: € 199

Order- Analysis of stocks listed at Frankfurt und Xetra

- Medium and long term charts ⓘAnalyses for the medium and long term, respectively 1-6 months and 1-6 quarters investment perspective.

Medium and long term charts → - Concrete buy and sell signals ⓘSpecific buy and sell signals for each stock.

- Health Check ⓘGet a detailed portfolio health check.

- Today's Case ⓘToday's Case gives you a selected stock which is technically positive.

- Top 50 ⓘThe Top50 list provides you with a ranking of the 50 most positive/negative stocks.

Top 50 → - Price alerts ⓘYou may enter a price alert for a stock and be notified when the price reaches this level.

Price alerts → - Watchlist ⓘCreate a watchlist of stocks you are interested in.

- My portfolios ⓘGain better control of your investments with Investtech`s portfolio system.

My portfolios →

Trader

Take your investment decisions to another level with short term analyses and more advanced tools.

€

59

€

35

/ month

Billed Annually: € 429

Order- All Investor features

- +

- Short term charts and analyses ⓘAnalyses for the short term, 1-6 weeks investment perspective.

Short term charts and analyses → - Morning reports ⓘThe report consists of daily evaluations by Investtech`s automated analysis system.

- Trend signals ⓘThe Trend signals tool shows stocks that recently entered into a rising or falling trend.

Trend signals → - Pivot points ⓘPivot points are tops and bottoms in the chart.

Pivot points → - Key ratios ⓘKey financial indicators give information about a company's performance based on reported financial results for a given time period.

Key ratios → - Candlesticks ⓘCandlestick analysis is the best tool for doing a detailed short term volume analysis.

Candlesticks →

Professional

A wide range of advanced selection tools and overall analysis to scale your investments.

€

159

€

93

/ month

Billed Annually: € 1119

Order- All Trader features

- +

- Overall analysis ⓘOverall analysis for all time perspectives; long, medium and short term.

Overall analysis → - Stock selection ⓘStock selection is likely the best stock picking tool Investtech offers. The most common usage is to select liquidity and time perspective, e.g. 50 % most liquid and short term.

Stock selection → - Hausse ⓘThe Hausse indices are indicators of optimism.

Hausse → - Result Analysis ⓘHow the stock price has moved before and after the company's publication of accounting figures.

Result Analysis → - Compare stocks ⓘCompare the price development of a stock with 30,000 other stocks, commodities and indices.

Compare stocks → - Trading opportunities ⓘThe Trading opportunities table is a stock picking tool. The table shows stocks with combinations of technical indicators that strongly indicate further rise or fall.

Trading opportunities → - Ranking by signals ⓘAn overview of the latest buy and sell signals identified by Investtech`s systems. Signals from price patterns are assumed to indicate in which direction the majority of investors are moving.

Ranking by signals →

Institutional

Access to all 30,000 stocks, commodities and currencies, suited for experienced investment strategists.

- All Professional features

- +

- All 30,000 stocks, commodities and currencies ⓘAll 30,000 stocks, commodities and currencies.

- Self-defined universes ⓘDefine your own universe of stocks.

- Alarms ⓘOverview of the stocks in your universes that have triggered signals.

- Personal customer service representative for technical questions ⓘContact your personal customer service representative with any technical questions you may have.

- Flexible selection criteria ⓘWide range of flexible selection criteria.

About Us

Founded in 1997, Investtech is a leading Scandinavian company within the field of research on behavioral finance and technical analysis of stocks. Investtech’s research findings have been put into practice and have resulted in a comprehensive decision support system analyzing stocks and other securities. The system is utilized daily by investors worldwide.

Investtech uses advanced mathematical models and statistical optimization techniques as a basis for the analyses, generating objective and transparent decision support. The company provides web-based subscriptions to private investors and has been a prominent provider of technical analyses to financial institutions, brokerages and media since 1999. Courses, seminars and webinars are also arranged with clients directly, or in collaboration with partners.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices