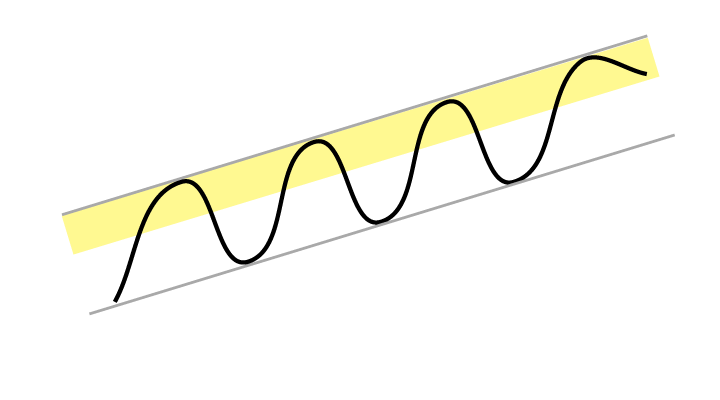

Price near ceiling of rising trend

Rising trends indicate that the company experiences positive development and increasing buy interest among investors. Stocks in rising trends signal a further increase within the trend channel.

When the price is near the resistance of the trend channel ceiling, there is a large downside to the trend channel floor. The stock may then see short term falling prices.

When the price is near the resistance of the trend channel ceiling, there is a large downside to the trend channel floor. The stock may then see short term falling prices.

However, selling near the ceiling can be a poor strategy, especially in the long term. Selling stocks for a profit too soon is one of the most common mistakes investors make. The price of a stock in a rising trend often increases for much longer than many investors think it will. Long term investors would therefore generally be wise to keep the stock, even if it is near the trend channel ceiling.

Selling near the ceiling of a rising trend can also be a poor short term strategy. When the price is close to the ceiling, there are good chances of a break upward, compared to the situation when the price is in the lower half of the trend channel. A break upward will be a buy signal and indicate a steeper rate of increase ahead. Consequently it will often be right also for short term investor to keep a stock near the trend channel ceiling.

The choice will depend on the investor’s risk analysis. Price near the trend ceiling gives a good chance for a break upward, but also a great chance for an imminent reaction downward.

In Investtech’s analyses, stocks in rising trends are counted as equally positive regardless of whether the price is near the floor, near the ceiling or in the middle of the trend channel. A stock is classified as “near trend ceiling” if it is in the upper fifth of the trend channel.

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices