Support and Resistance: Break upwards through resistance is a buy signal

Published 24 October 2019

Stocks that have broken upwards through resistance have continued to rise and have outperformed benchmark. These signals may be valuable input in a decision of whether to buy the stock. When monitoring a stock in terms of potential purchase, the period after a break upwards through resistance will statistically be a good time to buy. This is in agreement with classic technical analysis theory.

According to technical analysis theory, support and resistance are among the most central concepts in technical analysis and can in theory be used to find good buy and sell levels.

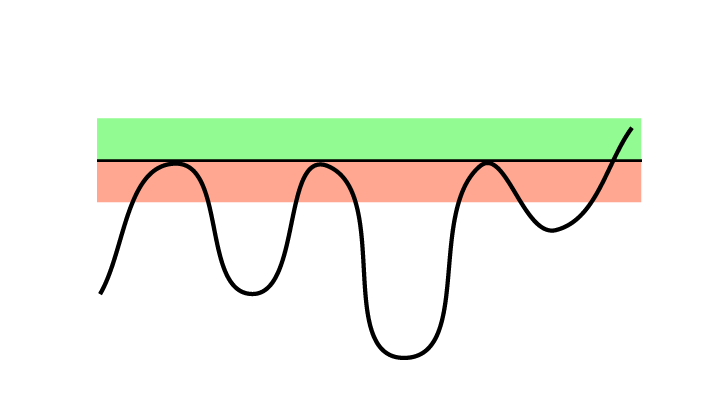

Figure 1: A break upwards through resistance is a buy signal. This is especially true if volume is also increasing. The sellers who used to be at this level are gone, but there is still buy pressure in the stock.

Figure 1: A break upwards through resistance is a buy signal. This is especially true if volume is also increasing. The sellers who used to be at this level are gone, but there is still buy pressure in the stock.

In theory, a stock that recently broke through a resistance level is expected to continue rising. Buying such stocks allows the investor to enter the stock early in a rising phase. If the stock has risen significantly since the break, a better price can be achieved by waiting for a reaction back.

Please note that stocks in falling trends often give false buy signals on breaks upwards through resistance. When buying such stocks, a long term and strong resistance level should be broken, and the break should be accompanied by increasing volume and positive volume development.

Research results

We have studied return from Norwegian, Swedish, Danish and Finnish stocks following signals triggered by stocks' movements in relation to support and resistance levels in technical price charts. We used support and resistance levels automatically identified in Investtech’s medium term price charts. We had 23 years of data, from 1996 to 2018.

The chart below shows average price development following buy signals from stocks breaking upwards through support identified in Investtech’s medium term price charts. The signals are triggered on day 0. Only days when the exchange is open are included, so 66 days equal approximately three months. The thick blue line shows the development of buy signal stocks. The shaded areas are the standard deviation of the calculations. The thin blue line shows benchmark development in the same period as the buy signal stocks.

Figure 2: Return following buy signals from stocks with break upwards through support identified in Investtech’s medium term price charts. Thick blue line is buy signals, thin blue line is benchmark, the Nordic markets, 1996-2018.

| Annualised return (based on 66-day figures) | Norway | Sweden | Denmark | Finland | Weighted average |

| Buy signal | 18.2 % | 16.8 % | 16.8 % | 9.4 % | 16.3 % |

| Benchmark in same period | 12.0 % | 12.3 % | 10.3 % | 5.3 % | 11.2 % |

| Excess return buy signal | 6.1 pp | 4.5 pp | 6.4 pp | 4.1 pp | 5.1 pp |

pp = percentage point

Stocks with buy signal following break upwards through resistance have risen in the following period. The rise in the first three months after signals was on average 4.0 per cent for 43,367 signals from the Nordic markets combined. This is an excess return of 1.2 percentage points compared to benchmark in the same period. Annualised return was 5.1 percentage points.

Statistical t-value is as high as 11.1 for the 66-day figures and suggests statistically significant positive deviation from benchmark development. An excess return of 1.2 percentage points in three months indicates that such signals can be valuable input in an active trading strategy, also when taking commission and other trading costs into account.

Article on sell signals:

Support and Resistance: Break downwards through support is a sell signal

Read the research report here.

Written by

Head of Research and Analysis

at Investtech

Research articles:

Support and Resistance: Research results cause doubt about buy signals

Support and Resistance: Profitable to buy stocks that are near resistance

Support and Resistance: Break upwards through resistance is a buy signal

Support and Resistance: Break downwards through support is a sell signal

Support and Resistance: Buy signal when stock is above support and lacks resistance

Support and Resistance: Good sell signals from stocks that are far below resistance and lack support

Please note:

Changes to Support and Resistance algorithms

Insight & Skills:

"Investtech analyses the psychology of the market and gives concrete trading suggestions every day."

Partner & Senior Advisor - Investtech

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices