Global stocks: Three leading software and digital companies across the globe

Published August 28, 2019

There are so many themes one can write about, many sectors, industries, stocks, specialized fields, etc. to choose from when it comes to writing about global stocks. Earlier today when I was browsing through the Indian stocks listed on the National Stock Exchange (NSE), I saw a pattern. Most of the big Indian IT companies are trading either close to their all-time-highs or within eight per cent range from the top, while the broader index Nifty 50 (close at 11105.00 points on Aug 27, 2019) has fallen more than eight per cent since its top close at 12089 in early June.

Suddenly a thought popped up in my head - why not search for IT/software/digital companies across the globe and see if I could find a similar pattern there. So I googled and I found two different lists on the Forbes website. So the first list I found was 'The Largest Technology Companies In 2019' (not the full title) and the other one was 'Top 100 Digital Companies' (2018 ranking). As per these lists, most of the companies are concentrated in the US, China, Japan, Taiwan, India, South Korea, Germany and others.

I am not mentioning on what basis they rank the companies, since I am not writing about all of them. Also one or two names could be outside the above mentioned lists for obvious reasons.

Hence below are the analyses for three IT/software/digital stocks from three different exchanges for which Investtech provides analysis. Also note that in this particular article I have not mentioned the big names like Apple, Microsoft, Alphabet, Facebook, etc., as we cover these stocks from time to time, and today was not the day.

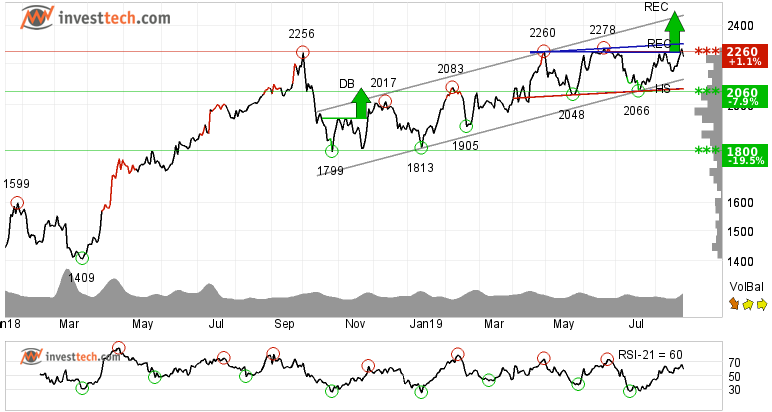

Tata Consultancy Servi (TCS.NS) Close: 2236.50

Tata Consultancy Services is the largest IT services provider in India and is widely present in the US, Europe and other parts of the world. The National Stock Exchange listed company shows strong development in a rising trend and has gained over 58 per cent since March last year. The stock is trying to break above the resistance at 2260 rupees. The stock is also trading inside a rectangle formation with the resistance around 2301 and support around 2078 rupees. A breakout through any of these levels will indicate further price development in the same direction.

The momentum indicator is positive and supports the underlying strength in price. The short term volume balance indicator is not very positive though, which indicates that the investors are a bit cautious for the time being. Hence one must maintain a stop loss at all times. The stock is overall assessed as technically positive for the medium term.

Investtech's outlook (one to six months): Positive

Sap SE (SAP.DE) Close: 108.54

IT Software & Services provider SAP SE is listed on the CDAX in Germany. Sap SE has broken through the floor of a rising trend channel in the medium long term. This indicates a slower rising rate at first, or the start of a more horizontal development. In the long term, the stock is inside a rising trend channel which indicates that the long term investors are still positive about the future of the stock.

Currently the stock is trading close to its support level of 106 euros and this is a crucial juncture. It can either go back to test its previous high or can break below the support to fall. A break below 104 euros may initiate a new sell signal in the stock and the next support is around 97 euros. The stock is facing resistance around 110 and 114 euros in the short term. A break above 114 may initiate a buy in the short term.

The momentum and volume balance indicators are not helping much in this case, as both of them are in neutral zone. Hence one must keep a close eye on the stock price. At the current levels one can enter into a buy but with a tight stop loss below the close at 104 euros. The stock is overall assessed as technically weak positive in the medium term.

Investtech's outlook (one to six months): Weak Positive

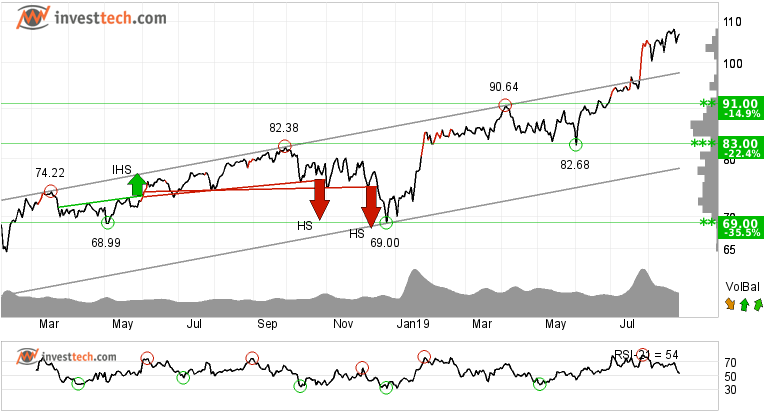

Fiserv, Inc. (FISV.US) Close: 106.98

The Nasdaq listed company showed strong development in a rising trend and broke above the ceiling of the rising trend channel in both medium and long term. This signals increasing optimism among investors who have steadily paid more to buy the stock, which indicates increasing optimism and that the price may continue to rise. The stock has been in a continuous rise since since 2014, as shown in the long term chart on Investtech's website.

There is hardly any resistance above 108 dollars in the short term for the stock. However, in case of a reaction on the downside there is support around 90 dollars, which is 15 per cent down from the current levels. Hence one must be cautious and maintain a stop loss at all times.

The volume balance indicator is positive and strengthens the stock. This indicator suggests that the volume is higher in days with stock price rising and lower on days with stock price falling. The stock is overall assessed as technically positive for all time frames; short, medium and long term.

Investtech's outlook (one to six months): Positive

Most of the medium term charts of the companies on Investtech's website suggest that either stocks are in an uptrend or have broken the uptrend channel marginally on the downside but not significantly enough to blow an alarm. Also, volume balance in many of them is neutral to red, meaning that the investors are taking a break from actively participating in the market.

** Forbes is a reliable source of information when it comes to rankings, we all know that, right!

The analyses are based on closing price as per August 27, 2019.

Note: These instruments are traded in currency based on the Exchange or country they are listed on.

Skrevet av

Analytiker

i Investtech

"Investtech analyserer psykologien i markedet og gir deg konkrete tradingforslag hver dag."

Partner & Senior Advisor - Investtech

Investeringsanbefalingen(e) er utarbeidet av Investtech.com AS ("Investtech"). Investtech garanterer ikke fullstendigheten eller riktigheten av analysen. Eventuell eksponering i henhold til rådene / signalene som fremkommer i analysene står fullt og helt for investors regning og risiko. Investtech er ikke ansvarlig for noe tap, verken direkte eller indirekte, som oppstår som en følge av bruk av Investtechs analyser. Opplysninger om eventuelle interessekonflikter vil alltid fremgå av investeringsanbefalingen. Ytterligere informasjon om Investtechs analyser finnes på informasjonssiden.

Investeringsanbefalingen(e) er utarbeidet av Investtech.com AS ("Investtech"). Investtech garanterer ikke fullstendigheten eller riktigheten av analysen. Eventuell eksponering i henhold til rådene / signalene som fremkommer i analysene står fullt og helt for investors regning og risiko. Investtech er ikke ansvarlig for noe tap, verken direkte eller indirekte, som oppstår som en følge av bruk av Investtechs analyser. Opplysninger om eventuelle interessekonflikter vil alltid fremgå av investeringsanbefalingen. Ytterligere informasjon om Investtechs analyser finnes på informasjonssiden.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices