Global stocks: US stocks - three strong candidates

Published August 14, 2019

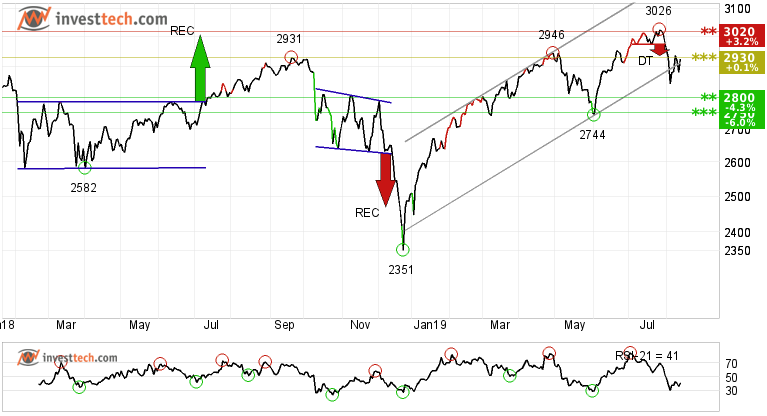

S&P 500 (SP500) developed positively on Tuesday and gained 1.50 per cent to a close of 2926.32 points. The index established a small double top formation and broke the rising trend channel earlier this month. In the past few sessions, the index gained some ground and established a temporary bottom at 2845 points to reverse back inside the trend channel, as shown in the medium term chart below. However, there is resistance at 2930 and 3020 points. Any close within these levels will take the index back in the safety zone.

Further on the downside, the index has support between 2,800 and 2,745 points. A break and close below this level may trigger panic among investors.

We mentioned Investtech's Hausse index in our previous article on global stocks. As per the numbers, the short term Hausse has improved slightly with respect to last week to close at 30 points (up by 4 points). This shows that the weight of pessimists in the market for the short term has marginally decreased. However, the bigger picture suggests that optimism among investors in the short term is still overruled. While in the long term, investors are marginally more optimistic as the Hausse index is at 56 points, unchanged from last week.

We write about three solid stocks that are listed on S&P 500. The main criteria for today using Stock Selection were stocks showing strength in a rising trend or breakout from a price formation, stocks with a technical score above 80 points (varies between +/- 100) and liquidity above 100 million dollars as 22 day average. You can set many other basic criteria in the Stock Selection tool to find your desired list of stocks based on your investment preferences.

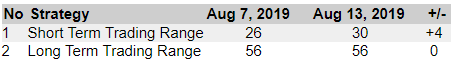

Yum Brands Inc. (YUM.US500) Close: 117.13

Yum Brands Inc. shows strong development in a rising trend and has broken above the ceiling of the rising trend channel in all time frames; short, medium and long term. This signals increasing optimism among investors who have steadily paid more to buy the stock, which indicates increasing optimism and that the price may continue to rise.

The operator of brands like Taco Bell, KFC, Pizza Hut, and WingStreet, Yum Brand, has seen its stock price go up by more than 50 per cent in the past one year. In the short term there is no clear resistance above 119 dollars which is the stock's all time high in the short term. On the downside there is support around 111-104 dollars.

Positive volume balance indicates that buyers are aggressive while sellers are passive, with high volume on days with rising prices and low volume on days with falling prices. This strengthens the stock further. The stock is overall assessed as technically positive for the medium term.

Investtech's outlook (one to six months): Positive

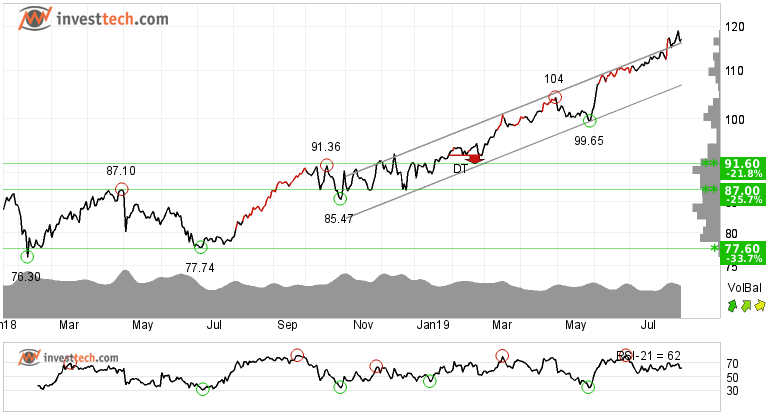

Lockheed Martin Corpor (LMT.US500) Close: 377.22

Lockheed Martin Corporation shows strong development within a rising trend channel in the medium and long term. Rising trends indicate that the company experiences positive development and that buy interest among investors is increasing.

The stock has given positive breakout from a rectangle formation by a break up through the resistance at 370. Further rise to 386 dollars or more is signaled. The stock is at its peak, hence sky is the limit. However, in case of a downside reaction, there is support between 370 and 350 dollars.

Short term volume balance and momentum indicators are positive and support the underlying strength in price. The stock is overall assessed as technically positive for the medium term.

Investtech's outlook (one to six months): Positive

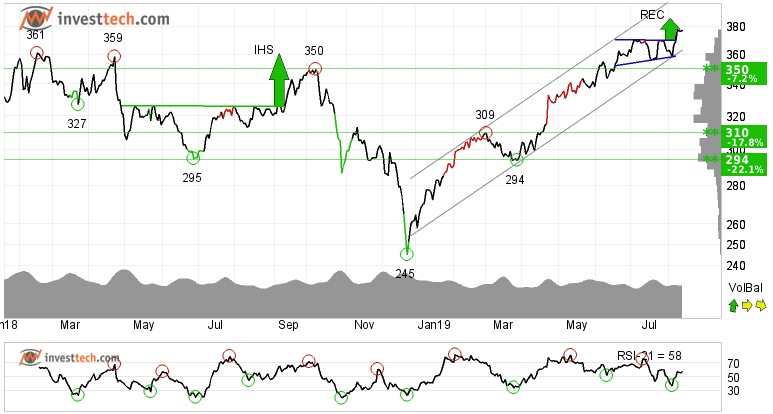

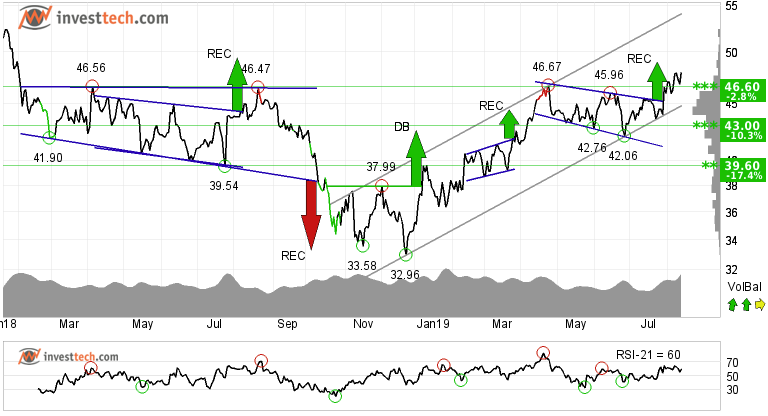

D.R. Horton Inc. (DHI.US500) Close: 47.96

D.R. Horton Inc. is in a rising trend channel in the medium and long term. This signals increasing optimism among investors and indicates continued rise in price. The stock has given positive breakout from rectangle formation on two different occasions and from a double bottom formation since the beginning of the year. Price target from the last formation is seen at 48.92 dollars. The stock has also broken above the resistance of 46.60 dollars which is now expected to work as support in case of a price correction. Further down the line there is support around 43 dollars.

As per Wikipedia, in 2017, D.R. Horton was the largest home builder in the United States based on the number of homes closed.

The volume balance indicator is positive and strengthens the stock in the short term. The RSI curve shows a rising trend, which supports the positive trend. The stock is overall assessed as technically positive for the medium long term.

Investtech's outlook (one to six months): Positive

The analyses are based on closing price as per August 13, 2019

Note: These instruments are traded in currency based on the Exchange or country they are listed on.

Skrevet av

Analytiker

i Investtech

"Investtech analyserer psykologien i markedet og gir deg konkrete tradingforslag hver dag."

Partner & Senior Advisor - Investtech

Investeringsanbefalingen(e) er utarbeidet av Investtech.com AS ("Investtech"). Investtech garanterer ikke fullstendigheten eller riktigheten av analysen. Eventuell eksponering i henhold til rådene / signalene som fremkommer i analysene står fullt og helt for investors regning og risiko. Investtech er ikke ansvarlig for noe tap, verken direkte eller indirekte, som oppstår som en følge av bruk av Investtechs analyser. Opplysninger om eventuelle interessekonflikter vil alltid fremgå av investeringsanbefalingen. Ytterligere informasjon om Investtechs analyser finnes på informasjonssiden.

Investeringsanbefalingen(e) er utarbeidet av Investtech.com AS ("Investtech"). Investtech garanterer ikke fullstendigheten eller riktigheten av analysen. Eventuell eksponering i henhold til rådene / signalene som fremkommer i analysene står fullt og helt for investors regning og risiko. Investtech er ikke ansvarlig for noe tap, verken direkte eller indirekte, som oppstår som en følge av bruk av Investtechs analyser. Opplysninger om eventuelle interessekonflikter vil alltid fremgå av investeringsanbefalingen. Ytterligere informasjon om Investtechs analyser finnes på informasjonssiden.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices